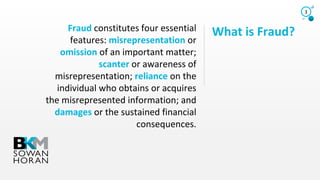

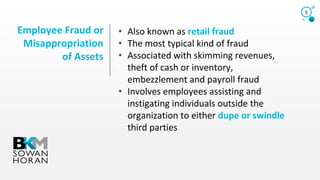

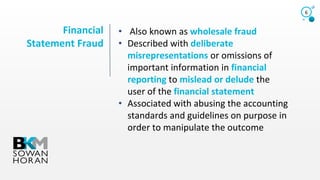

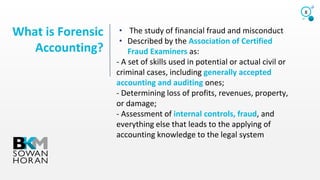

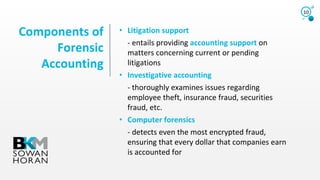

The document provides an overview of forensic accounting, defining it as the application of accounting skills in legal matters, particularly in cases of fraud. It outlines types of fraud, such as employee and financial statement fraud, and details the objectives and components of forensic accounting including litigation support, investigative accounting, and computer forensics. Forensic accountants analyze and interpret complex financial data to resolve various legal disputes and provide evidence in court.