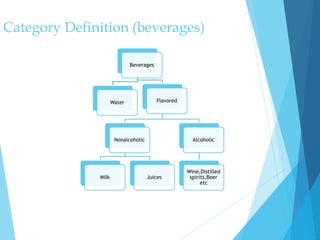

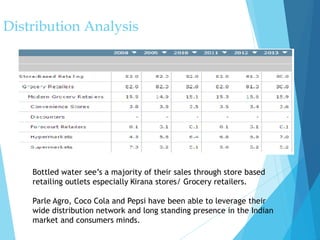

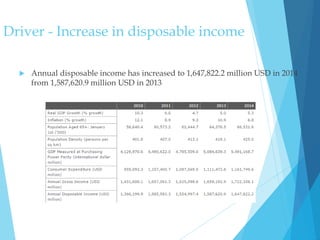

The bottled water category in India has experienced significant growth in recent years driven by factors such as rising health awareness, urbanization, and tourism. Bottled water offers convenience compared to tap water due to concerns over quality and safety. Key players dominate the market while new entrants face challenges of distribution and brand loyalty. The market is projected to continue growing substantially in the coming years given India's young population and increasing disposable incomes.

![Challenges

MYTH ONE – BOTTLEDWATER UNITS ARE MINTING MONEY

While going through various articles and news items in print / electronic

media, a general impression has been created that bottling units are minting

money as they do not pay for raw material [ bore well water ] and sell one

litre water for Rs 15.

The fact is that bottled water market is completely retailer dominated

commodity and having a lions’ share. Taking out a good margin for distributor

too , manufacturer is left with a wafer thin margin for himself. The “FREE”

water gathers considerable packaging cost till it reaches the dispatch stage.

Moreover, indirect cost includes steep marking fee charged by Bureau of

Indian Standards [ BIS ], Salaries of trained Chemist / micro biologist

and maintaining a full fledged laboratory adds huge cost to regular

processing unit expenses.

As bottled water is a very difficult commodity to transport, its delivery

charges are steep and eats up the margins. Credit sales, late realization,

competition hence makes it a difficult product to produce , distribute and

market unless scientific study is not conducted beforehand.](https://image.slidesharecdn.com/productmanagement-160407185552/85/Bottled-water-industry-analysis-India-47-320.jpg)