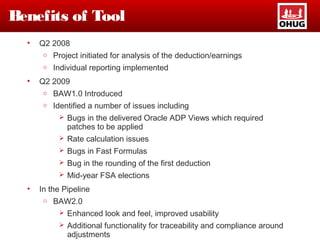

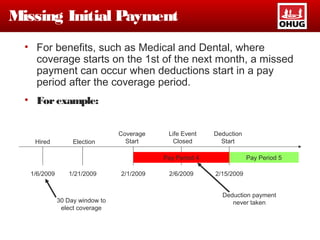

This document summarizes a presentation given by Dunkin' Brands, Inc. on benefits auditing using Oracle Advanced Benefits. It implemented Oracle HRMS applications including Advanced Benefits in November 2007. Initial challenges included being new to the Oracle HRMS suite and lack of controls. The presentation highlights the need for auditing benefits configurations, life events, vendors, backfeeds, deductions, and adjustments. It demonstrates a custom Benefits Audit Workbench tool developed by Dunkin' Brands to proactively audit deductions and earnings, increase paycheck accuracy, and reduce employee issues. The tool identifies issues like flex spending account and deduction trending anomalies and missing initial payments.