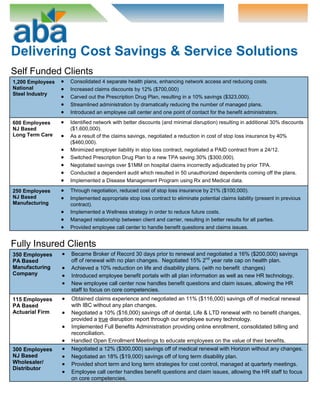

ABA provides customized benefits solutions and administration services to companies to help them reduce costs and streamline HR functions. By partnering with ABA, clients can outsource benefits management to focus on their core business while ABA handles tasks like building benefits packages, monitoring legislation, and addressing employee issues. ABA representatives meet with clients regularly and provide an employee call center and online portal for assistance. For self-funded clients, ABA has consolidated plans, increased discounts and savings, and implemented wellness programs. For fully-insured clients, ABA has negotiated substantial savings on renewals without changing benefits. ABA delivers cost savings and service solutions for both self-funded and fully-insured clients.