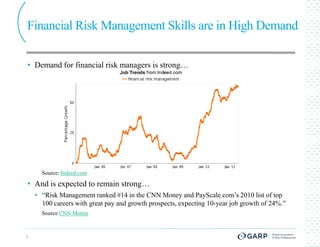

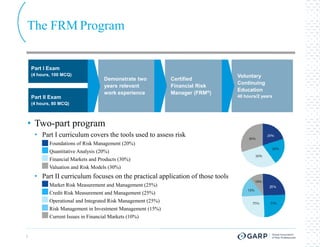

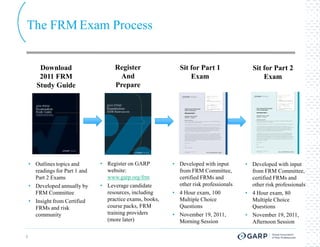

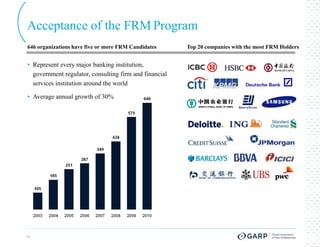

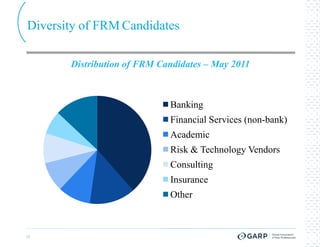

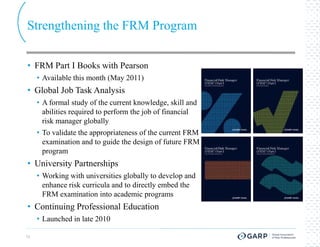

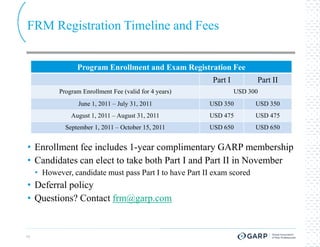

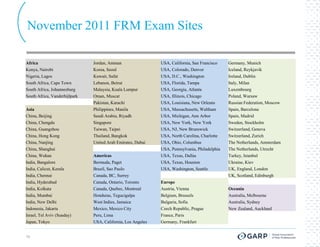

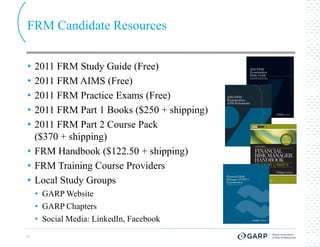

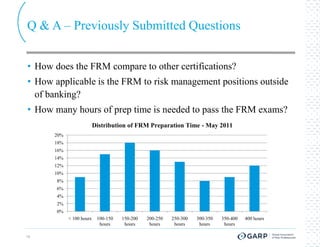

The document outlines the significance of becoming a Financial Risk Manager (FRM) and details the structure and content of the FRM certification program, which is administered by the Global Association of Risk Professionals (GARP). It highlights the high demand for risk management professionals, the growth of the FRM program, and the resources available to candidates for preparing for the examinations. Additionally, the document discusses the professional impact of obtaining the FRM designation and provides information about registration, exam schedules, and candidate resources.