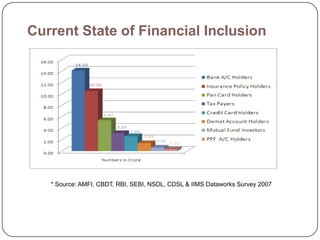

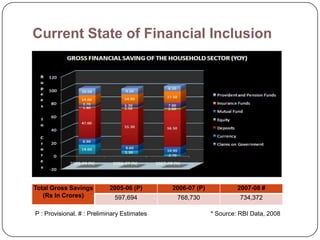

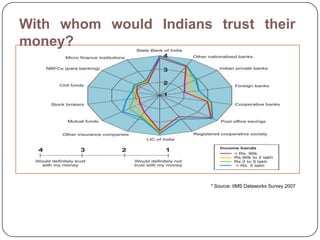

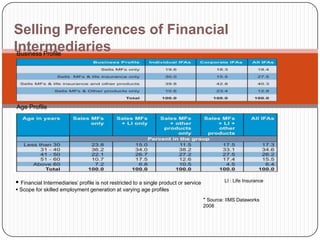

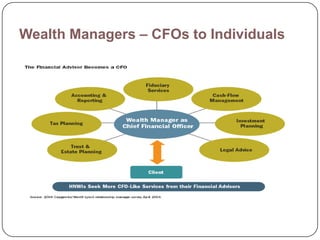

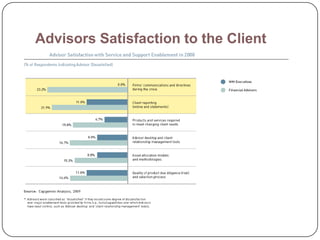

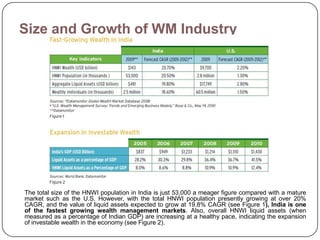

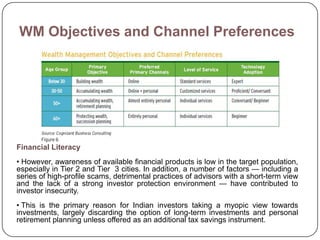

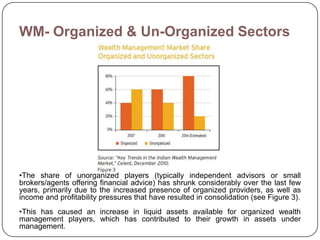

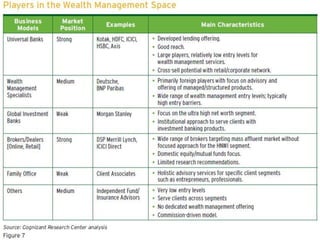

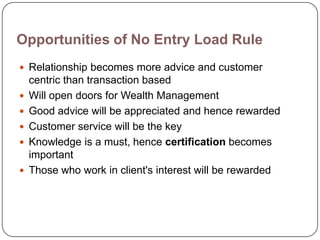

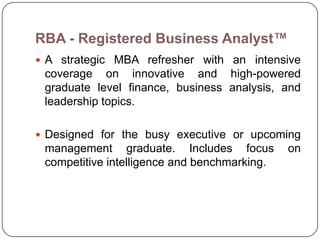

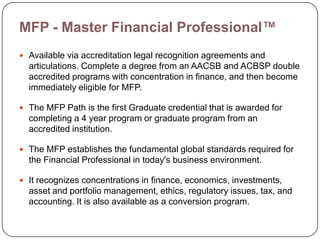

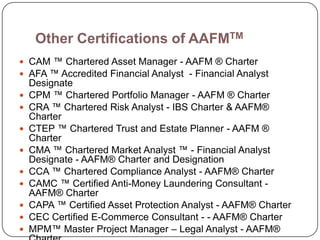

The document discusses the emerging changes in the wealth management industry in India. It notes that India's strong GDP growth is making it an attractive market for wealth management firms. However, financial inclusion and literacy remains low. Most Indians would trust banks with their money. The size of the HNWI population and wealth management industry is growing rapidly in India. There is a shift from unorganized to organized wealth management sectors. Firms are focusing on building trust and providing holistic advice through qualified advisors. New certifications from organizations like the American Academy of Financial Management can help improve the skills and qualifications of advisors in India.