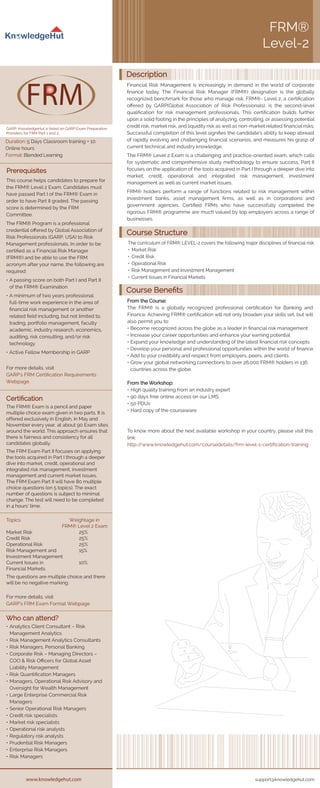

KnowledgeHut provides training for the FRM® Level 2 exam, consisting of 5 days of classroom instruction and 10 online hours, with prerequisites including passing Level 1. The exam, featuring 80 multiple-choice questions across various risk management topics, emphasizes the application of concepts learned in Level 1 and occurs twice a year in May and November. Obtaining certification recognizes professionals in risk management and enhances career opportunities and earning potential.