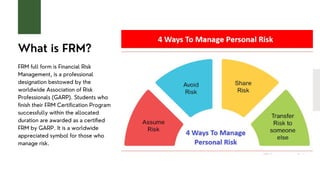

The document provides comprehensive information about the Financial Risk Management (FRM) certification, including eligibility criteria, fee structure, exam patterns, and career opportunities for FRM holders. It details the examination process, which occurs biannually in May and November, and emphasizes that there are no formal prerequisites to take the exam. Certified FRM professionals can pursue various roles in industries that require expertise in risk management.