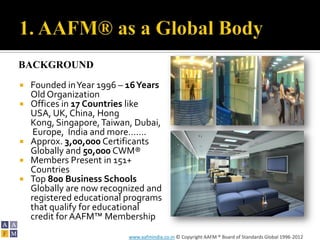

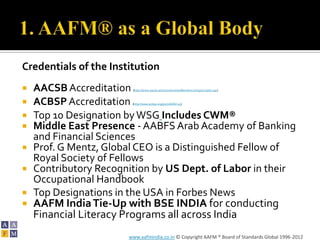

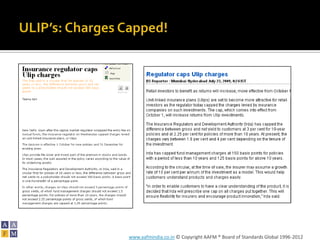

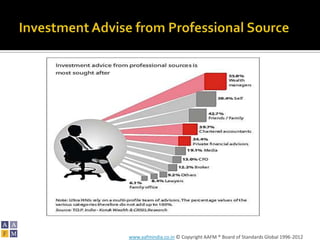

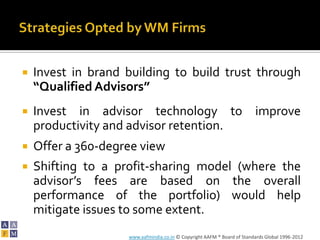

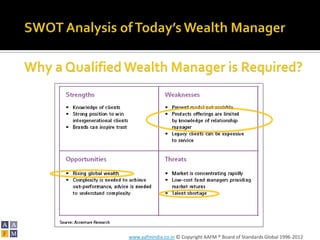

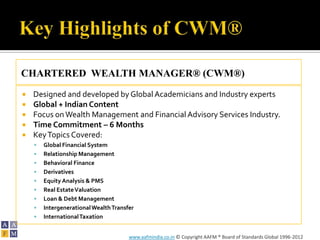

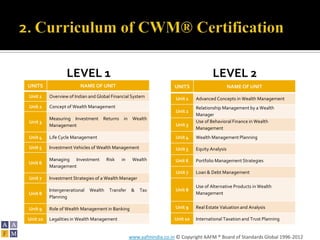

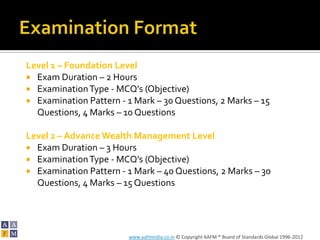

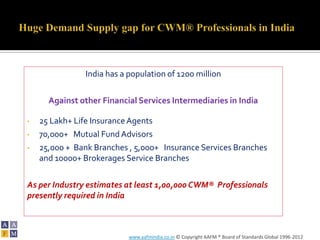

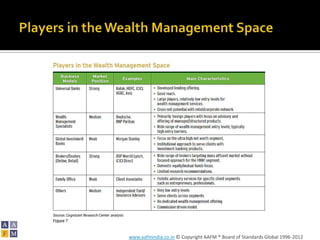

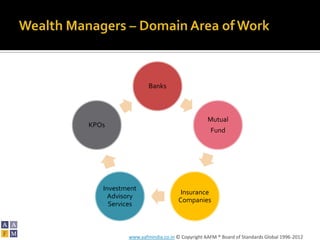

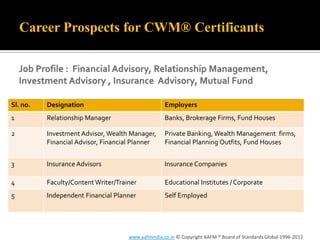

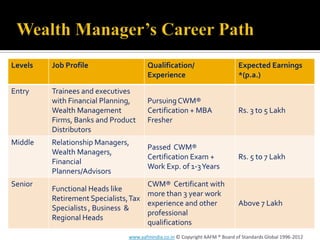

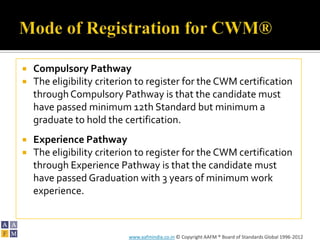

The document provides an overview of the Chartered Wealth Manager® (CWM®) certification, offered by the AAFM, emphasizing its global presence, the need for wealth management professionals, and career prospects associated with the certification. Key points include the program's curriculum, registration pathways, and the importance of qualified advisors in enhancing client trust and delivering value. It highlights the credentials of the AAFM and its collaborations with various financial institutions globally.