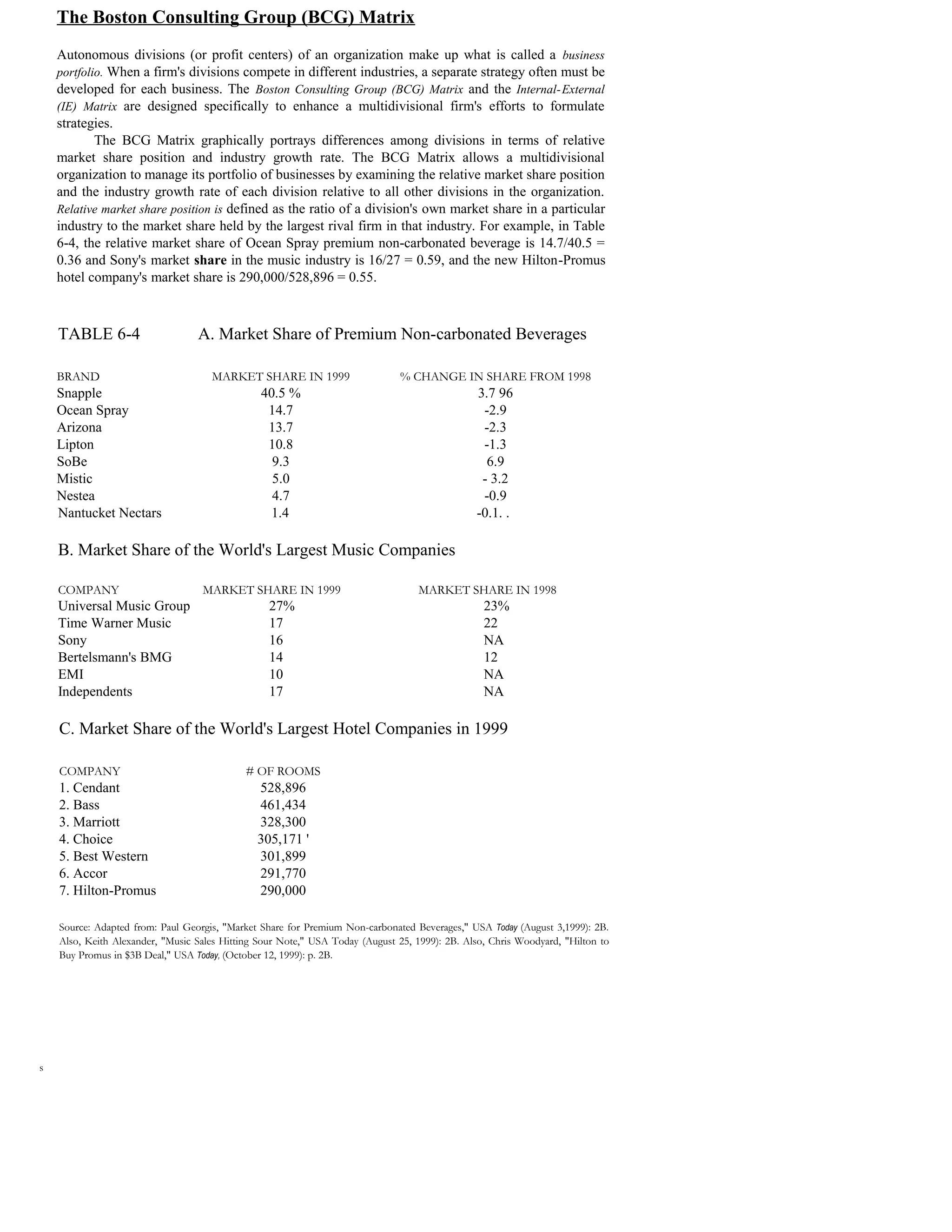

The document discusses the Boston Consulting Group (BCG) Matrix, which is used to analyze a company's portfolio of business divisions. It graphs divisions based on their relative market share on the x-axis and industry growth rate on the y-axis. Divisions fall into four categories: Stars (high share, high growth), Cash Cows (high share, low growth), Question Marks (low share, high growth), and Dogs (low share, low growth). The matrix is used to determine which divisions a company should invest in, milk for cash, consider divesting, or implement a turnaround strategy for. It provides a framework to develop customized strategies for each division based on its placement in the matrix.