The document summarizes key trends in the global retail banking industry and strategies for banks to achieve operational excellence and high levels of customer excellence. It finds that banks have faced significant financial stress due to the crisis but that the industry is recovering. It argues that to succeed, banks must streamline operations, improve processes, and focus on sales and service to customers across channels. Banks that invest in truly understanding customer needs and supporting them will strengthen relationships and drive greater profitability.

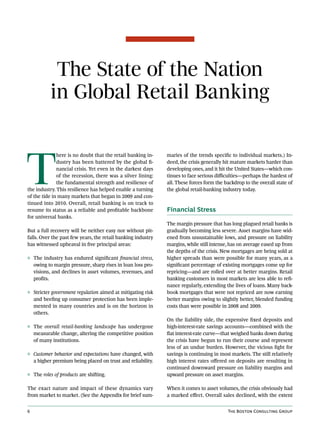

![Exhibit 1. Retail’s Share of Global Banking Revenues Grew to 52 Percent in 2009

Retail share of global revenues, 2009 [2006] (%)

52

[49]

48

[51]

Americas, Europe, Australia, Middle East, Asia,

2009 [2006] (%) 2009 [2006] (%) 2009 [2006] (%) 2009 [2006] (%) 2009 [2006] (%)

46

41 52 [70] 28

[42] 59 48 54 47

[45] [38]

[58] [55] [30] [39] 53 72

[61] [62]

Retail revenues

Other banking businesses

Retail revenues covered by database

Source: BCG Retail Banking Database.

Note: Retail shares based on segment reporting of banks in BCG’s Retail Banking Database of roughly 140 banks worldwide with retail banking

involvement.

a leverage-ratio requirement. Basel III will be adopted

worldwide, creating a level playing field internationally. In the United States, a Raft of Regulation

However, national regulators will have discretion to

strengthen Basel III’s minimum requirements as they see

fit in their local jurisdictions. For example, this is expected In the United States, the Credit Card Accountability,

Responsibility, and Disclosure Act of 2009 aims to curb

to happen in Switzerland, where the relative size of the

excessive interest-rate hikes and hidden fees. It is ex-

major Swiss banks is seen to pose substantial risk to the pected to reduce card profits by $3 billion to $5 billion

country’s economy. per year. The Durbin amendment aims to limit the in-

terchange fees that banks earn from their customers’

When it comes to new consumer-protection legislation, debit-card transactions. Its impact on profitability will

although emerging regulatory patterns are similar across amount to about $10 billion per year. Regulation E

some countries, there is considerable variation in the top- was recently modified to require customers to “opt in”

ics covered and in the strictness of the proposed controls. for debit point-of-sale and ATM overdraft protection

on their demand-deposit accounts (also known as

(See the sidebar, “In the United States, a Raft of Regula-

DDAs or checking accounts). This measure will likely

tion.”) It is safe to say, however, that the main themes are reduce profits by between $12 billion and $15 billion

the following: per year. Finally, with the establishment of the new

Consumer Financial Protection Board, the industry is

◊ Increased transparency on product design in terms of facing the prospect of additional compliance costs

the description of product details and pricing (for ex- and potential further curtailment of overdraft and oth-

ample, to avoid fine-print surprises such as up-front er fee sources. Overall, the combined effect of the new

legislation will be a sharp reduction in banks’ return

commissions, hidden fees, and penalties for actions

on equity.

like early redemptions)

8 The Boston Consulting Group](https://image.slidesharecdn.com/bcgbankingreport-13170415462618-phpapp01-110926075320-phpapp01/85/Bcg-Banking-Report-10-320.jpg)