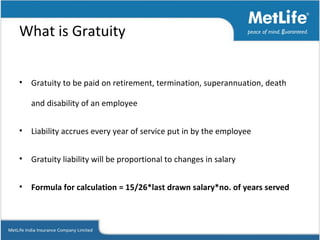

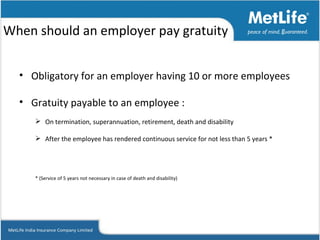

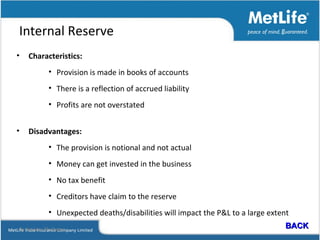

The document discusses employee benefit solutions like group term insurance and group gratuity offered in the Indian market. It provides details on group life insurance benefits for employers and employees. It also explains the concept of gratuity, statutory requirements for paying gratuity, and options available to meet gratuity liability such as creating an internal reserve fund, gratuity liability insurance, or a managed gratuity plan. Finally, it outlines MetLife's gratuity solution product features and process.