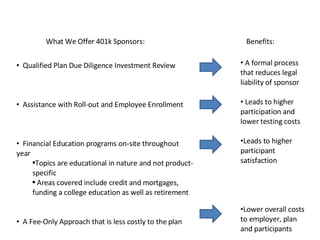

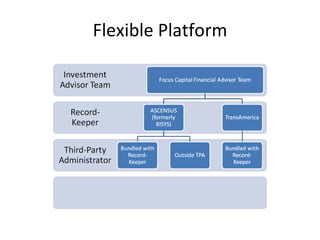

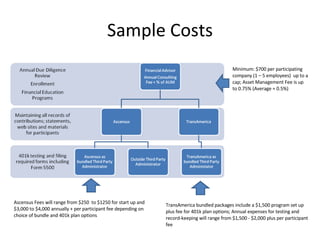

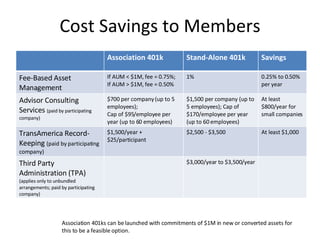

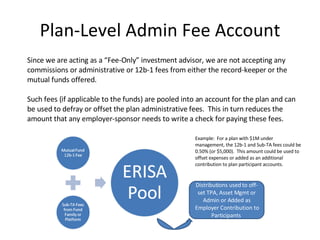

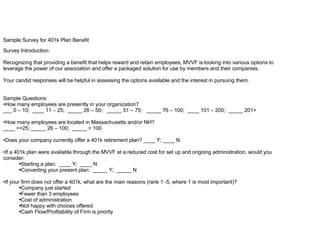

The document outlines a 401k program designed for sponsors, providing fiduciary management, investment reviews, and financial education services. It highlights the benefits of a fee-only approach, including reduced legal liability, higher participation rates, and lower costs for employers and participants. Additionally, the document details various costs associated with the program, options for investment, and services available to participants.