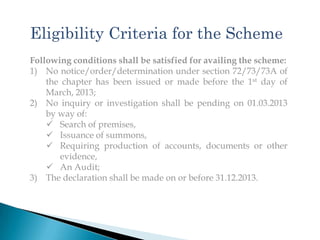

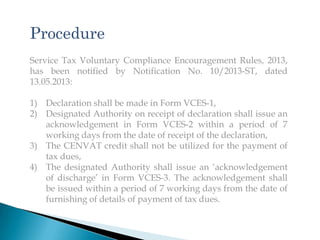

The Voluntary Compliance Encouragement Scheme, 2013 (VCES) allows service providers to settle outstanding service tax liabilities for the period from October 2007 to December 2012 without penalties. Eligible taxpayers must have no pending inquiries or orders and must file a declaration by December 2013. Taxpayers must pay declared taxes using Form VCES-1 and will receive an acknowledgement of discharge within 7 days of payment using Form VCES-3. While the acknowledgement is generally conclusive, the tax authority can reopen the case within 1 year if the declaration was substantially false. The scheme aims to encourage voluntary compliance in the service tax sector.