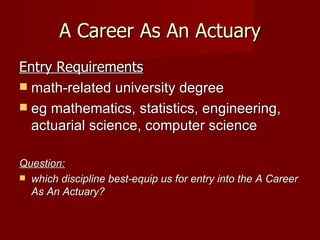

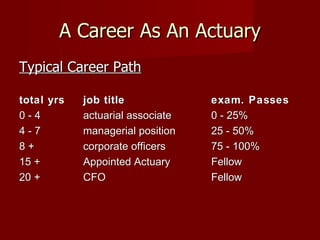

This document discusses careers as an actuary. It notes that actuarial work involves statistical techniques, product design, investments, underwriting, and medical knowledge. Those interested can qualify through exam bodies in various countries. Career paths include life insurance companies, general insurance companies, and consultancies. The responsibilities of an appointed actuary include ensuring long-term solvency and balancing objectives of shareholders and policyholders. Employers seek graduates with strong analytical skills, an understanding of actuarial concepts, initiative, and a range of interests.