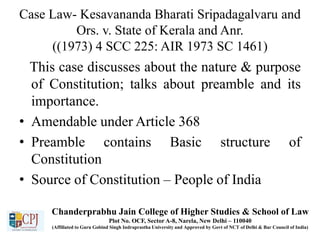

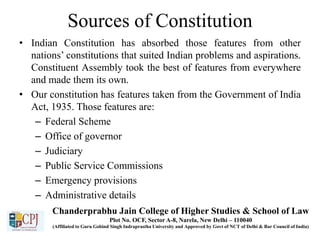

The document outlines the definition, classification, sources, and salient features of the Indian Constitution, detailing its written nature, rigidity and flexibility, and incorporation of elements from various other nations' constitutions. It highlights the Constitution's democratic, secular, and socialist elements, as well as its unique characteristics that reflect India's historical context and diverse society. Through discussing cases and the preamble, it emphasizes the Constitution's role as a foundational legal document guiding India since its enactment on January 26, 1950.

![Article 246 - Subject-Matter Of Laws Made By Parliament

And By The Legislatures Of States

(1) Notwithstanding anything in clauses (2) and (3), Parliament has exclusive power to

make laws with respect to any of the matters enumerated in List I in the Seventh

Schedule in this Constitution referred to as the “Union List”.

(2) Notwithstanding anything in clause (3), Parliament, and, subject to clause (1), the

Legislature of any State also, have power to make laws with respect to any of the

matters enumerated in List III in the Seventh Schedule (in this Constitution referred

to as the “Concurrent List”.

(3) Subject to clauses (1) and (2), the Legislature of any State has exclusive power to

make laws for such State or any part thereof with respect to any of the matters

enumerated in List II in the Seventh Schedule in this Constitution referred to as the

“State List”.

(4) Parliament has power to make laws with respect to any matter for any part of the

territory of India not included 2 [in a State] notwithstanding that such matter is a

matter enumerated in the State List.

Chanderprabhu Jain College of Higher Studies & School of Law

Plot No. OCF, Sector A-8, Narela, New Delhi – 110040

(Affiliated to Guru Gobind Singh Indraprastha University and Approved by Govt of NCT of Delhi & Bar Council of India)](https://image.slidesharecdn.com/pptconstitutionallaw-i-201107190322/85/Constitutional-Law-I-LLB-203-83-320.jpg)

![Article 270- Taxes Levied And Distributed Between The

Union And The States

(1) All taxes and duties referred to in the Union List, except the duties and taxes

referred to in articles 2 [268, 269 and 269A], respectively, surcharge on taxes and

duties referred to in article 271 and any cess levied for specific purposes under any

law made by Parliament shall be levied and collected by the Government of India

and shall be distributed between the Union and the States in the manner provided

in clause (2).

(2) Such percentage, as may be prescribed, of the net proceeds of any such tax or

duty in any financial year shall not form part of the Consolidated Fund of India, but

shall be assigned to the States within which that tax or duty is leviable in that year,

and shall be distributed among those States in such manner and from such time as

may be prescribed in the manner provided in clause (3).

(3) In this article, “prescribed” means,—

(i) until a Finance Commission has been constituted, prescribed by the President by

order, and

(ii) (ii) after a Finance Commission has been constituted, prescribed by the President

by order after considering the recommendations of the Finance Commission.

Chanderprabhu Jain College of Higher Studies & School of Law

Plot No. OCF, Sector A-8, Narela, New Delhi – 110040

(Affiliated to Guru Gobind Singh Indraprastha University and Approved by Govt of NCT of Delhi & Bar Council of India)](https://image.slidesharecdn.com/pptconstitutionallaw-i-201107190322/85/Constitutional-Law-I-LLB-203-124-320.jpg)

![Article 273 – Grants In Lieu Of Export Duty On Jute And

Jute Products

(1) There shall be charged on the Consolidated Fund of India in each year as grants-in-

aid of the revenues of the States of Assam, Bihar, 5 [Odisha] and West Bengal, in

lieu of assignment of any share of the net proceeds in each year of export duty on

jute and jute products to those States, such sums as may be prescribed.

(2) The sums so prescribed shall continue to be charged on the Consolidated Fund of

India so long as any export duty on jute or jute products continues to be levied by

the Government of India or until the expiration of ten years from the

commencement of this Constitution whichever is earlier.

(3) In this article, the expression “prescribed” has the same meaning as in article 270

Chanderprabhu Jain College of Higher Studies & School of Law

Plot No. OCF, Sector A-8, Narela, New Delhi – 110040

(Affiliated to Guru Gobind Singh Indraprastha University and Approved by Govt of NCT of Delhi & Bar Council of India)](https://image.slidesharecdn.com/pptconstitutionallaw-i-201107190322/85/Constitutional-Law-I-LLB-203-126-320.jpg)

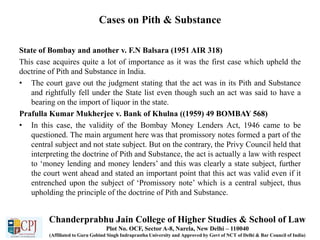

![Cases of Harmonious Construction

• In M.S.M. Sharma v. Krishna Sinha (1958 AIR 395), the doctrine was applied to

resolve the conflict between Articles 19(1)(a) and Article 194(3) of the Constitution

and it was held that the right to freedom of speech as guaranteed under Article

19(1)(a) is to be read as subjects of powers and privileges of the House of the

Legislature which is similar to those of the House of Commons of the United

Kingdom as declared under Article 194(3).

• in the case of Venkataramana Devaru v. the State of Mysore (1958 AIR 255),

the Supreme Court applied the doctrine in resolving a conflict between Articles

25(2)(b) and 26(b) of the Constitution and it was held that the right of every

religious denomination or any section thereof to manage its own affairs in matters

of religion [Article 26(b)] is subject to provisions made by the State providing for

social welfare and reform or opening of Hindu religious institutions of a public

character to all classes and sections of Hindus [Article 25(2)(b)].

• The principle of ‘Harmonious Construction’ is also applicable in the case of

construction of provisions relating to subordinate legislation.

•

Chanderprabhu Jain College of Higher Studies & School of Law

Plot No. OCF, Sector A-8, Narela, New Delhi – 110040

(Affiliated to Guru Gobind Singh Indraprastha University and Approved by Govt of NCT of Delhi & Bar Council of India)](https://image.slidesharecdn.com/pptconstitutionallaw-i-201107190322/85/Constitutional-Law-I-LLB-203-137-320.jpg)

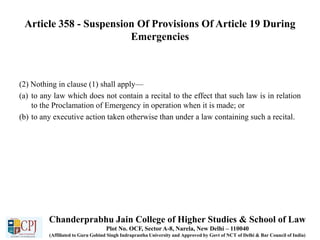

![Article 358 - Suspension Of Provisions Of Article 19 During

Emergencies

(1) While a Proclamation of Emergency declaring that the security of India or any part

of the territory thereof is threatened by war or by external aggression is in

operation], nothing in article 19 shall restrict the power of the State as defined in

Part III to make any law or to take any executive action which the State would but

for the provisions contained in that Part be competent to make or to take, but any

law so made shall, to the extent of the incompetency, cease to have effect as soon as

the Proclamation ceases to operate, except as respects things done or omitted to be

done before the law so ceases to have effect:

Provided that where such Proclamation of Emergency is in operation only in any part

of the territory of India, any such law may be made, or any such executive action may

be taken, under this article in relation to or in any State or Union territory in which or in

any part of which the Proclamation of Emergency is not in operation, if and in so far as

the security of India or any part of the territory thereof is threatened by activities in or

in relation to the part of the territory of India in which the Proclamation of Emergency

is in operation.

Chanderprabhu Jain College of Higher Studies & School of Law

Plot No. OCF, Sector A-8, Narela, New Delhi – 110040

(Affiliated to Guru Gobind Singh Indraprastha University and Approved by Govt of NCT of Delhi & Bar Council of India)](https://image.slidesharecdn.com/pptconstitutionallaw-i-201107190322/85/Constitutional-Law-I-LLB-203-160-320.jpg)

![Article 359 - Suspension Of The Enforcement Of The Rights

Conferred By Part III During Emergencies

(1) Where a Proclamation of Emergency is in operation, the President may by order

declare that the right to move any court for the enforcement of such of 6 [the rights

conferred by Part III (except articles 20 and 21)] as may be mentioned in the order

and all proceedings pending in any court for the enforcement of the rights so

mentioned shall remain suspended for the period during which the Proclamation is

in force or for such shorter period as may be specified in the order.

(1A) While an order made under clause (1) mentioning any of the rights conferred by

Part III (except articles 20 and 21) is in operation, nothing in that Part conferring those

rights shall restrict the power of the State as defined in the said Part to make any law or

to take any executive action which the State would but for the provisions contained in

that Part be competent to make or to take, but any law so made shall, to the extent of

the incompetency, cease to have effect as soon as the order aforesaid ceases to operate,

except as respects things done or omitted to be done before the law so ceases to have

effect:

Chanderprabhu Jain College of Higher Studies & School of Law

Plot No. OCF, Sector A-8, Narela, New Delhi – 110040

(Affiliated to Guru Gobind Singh Indraprastha University and Approved by Govt of NCT of Delhi & Bar Council of India)](https://image.slidesharecdn.com/pptconstitutionallaw-i-201107190322/85/Constitutional-Law-I-LLB-203-162-320.jpg)