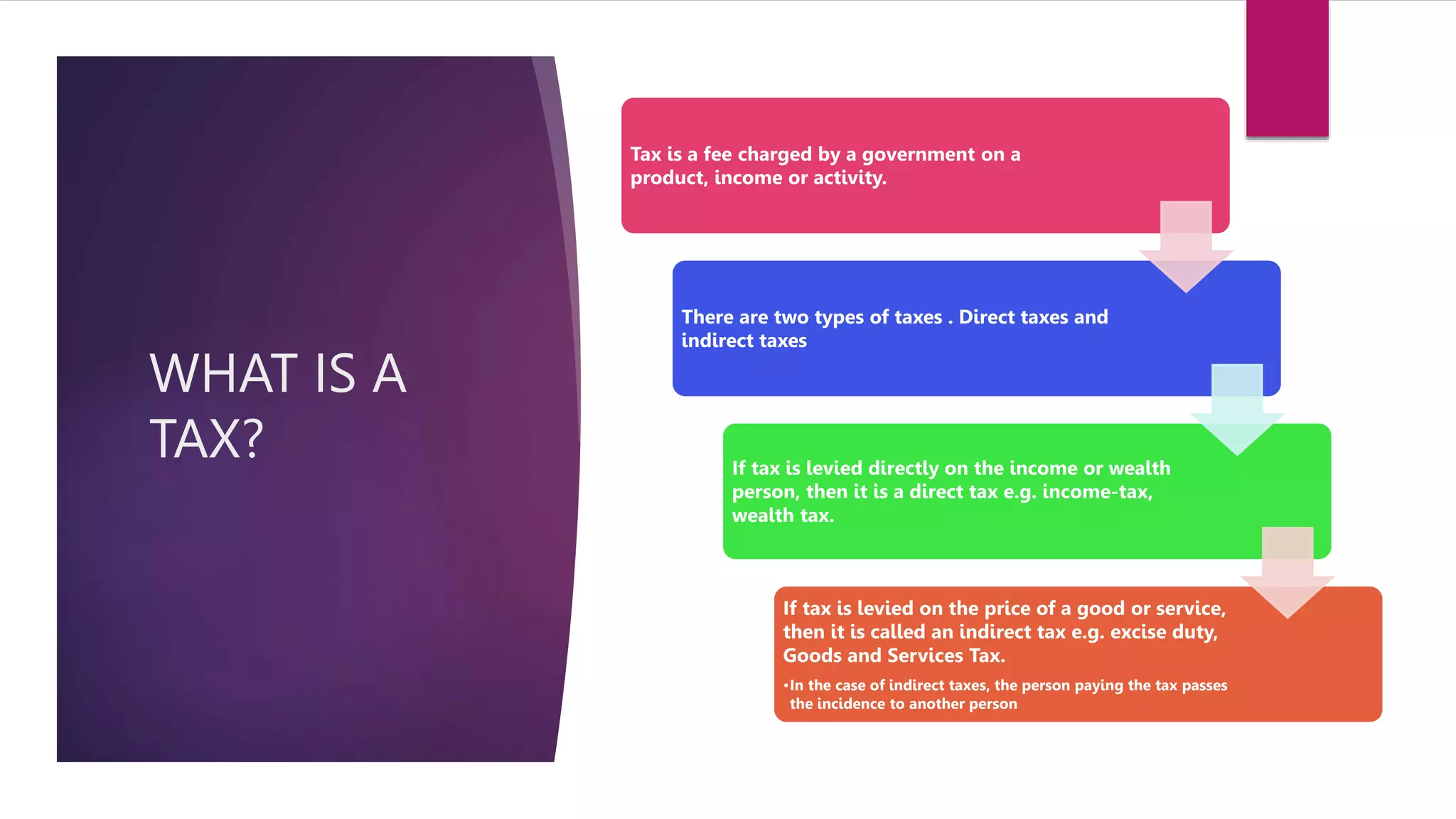

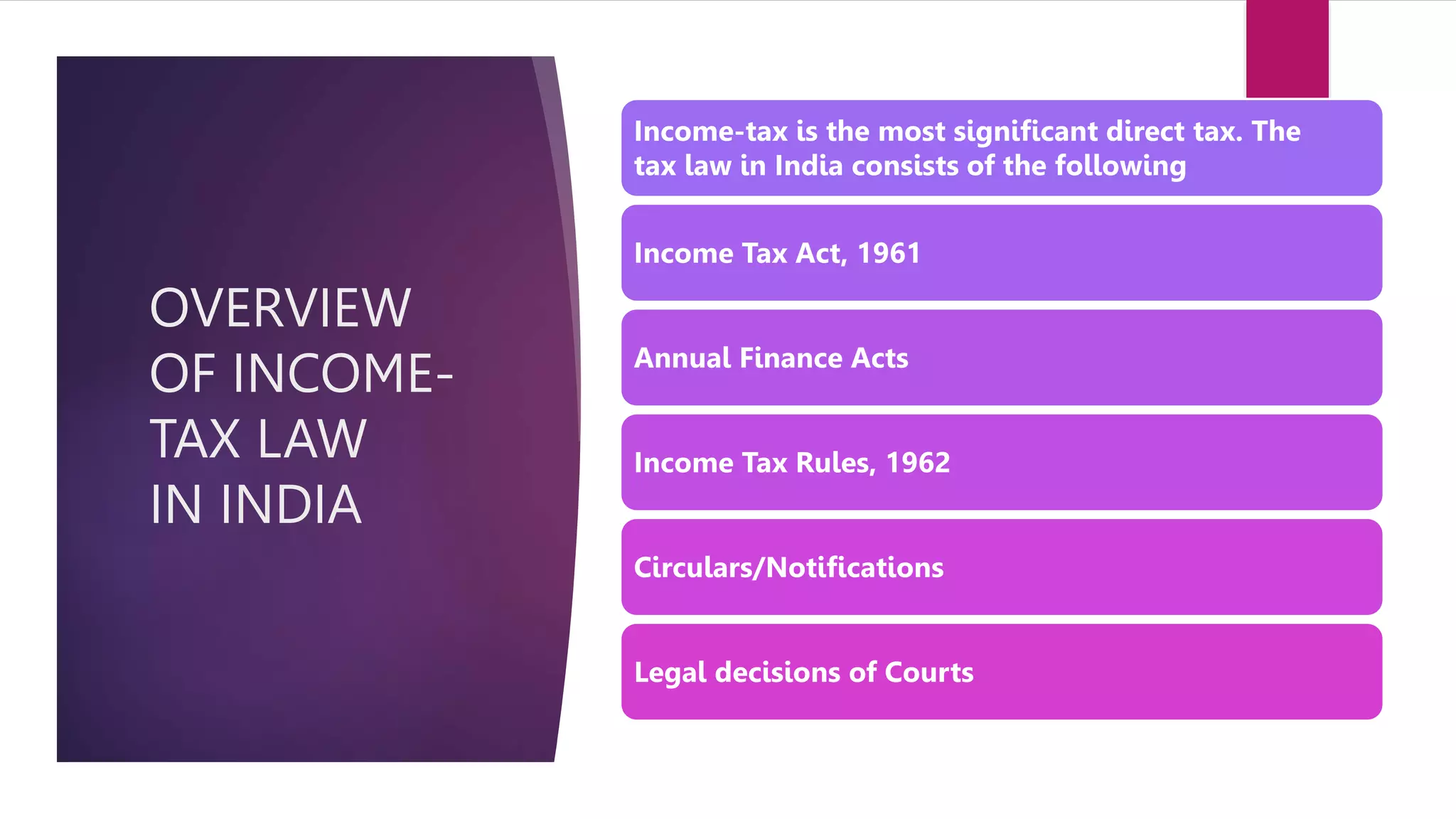

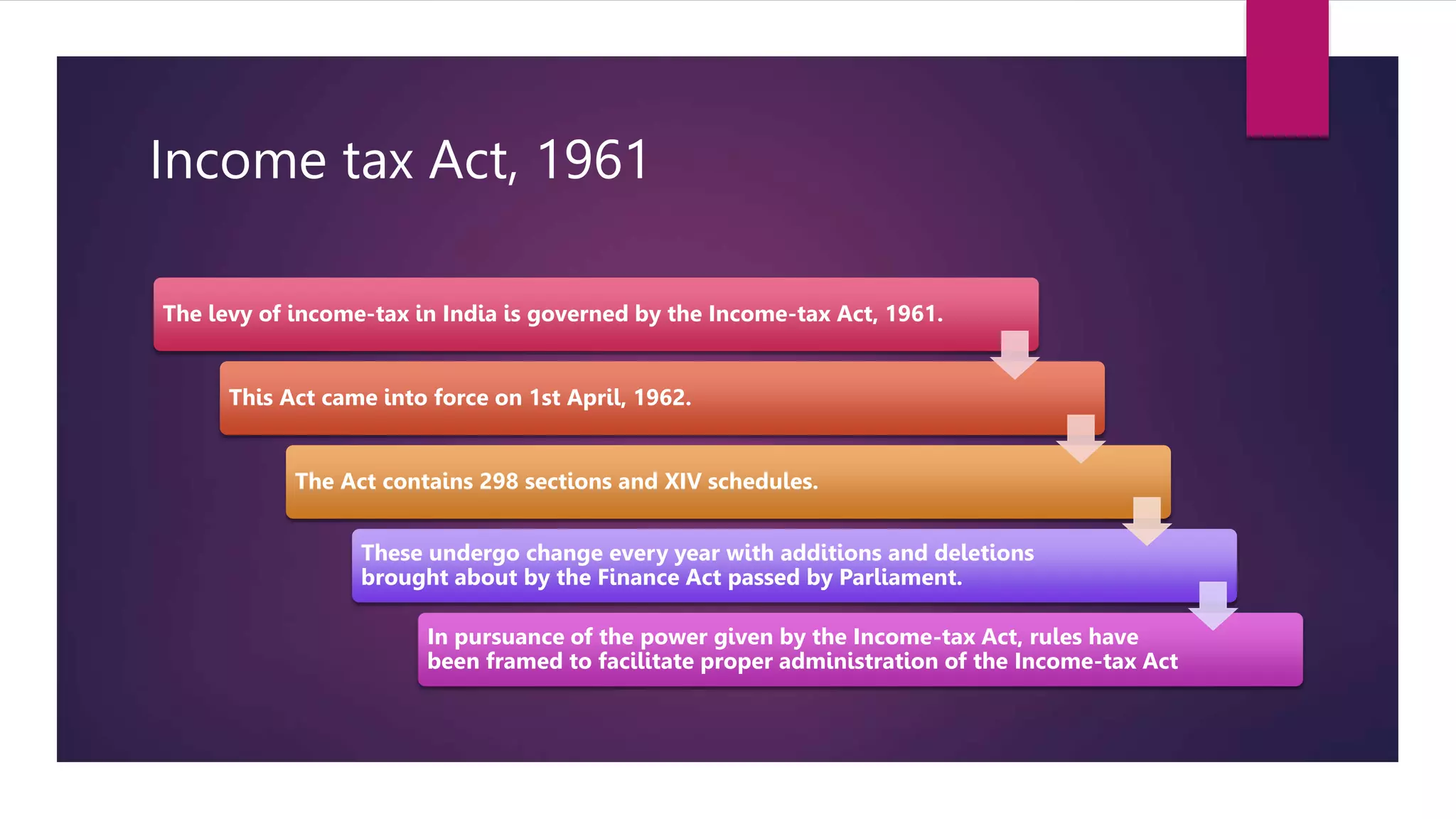

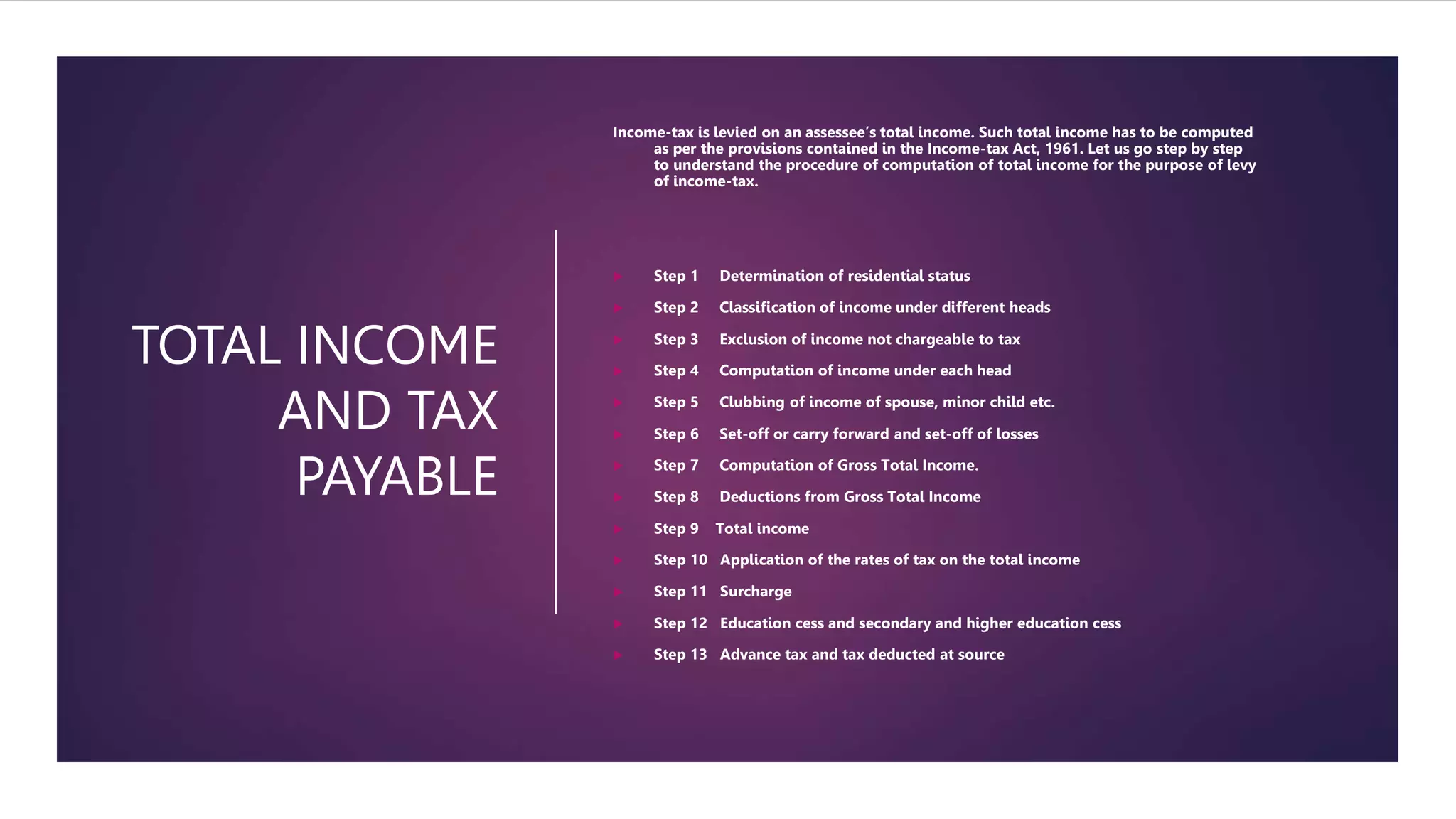

This document provides an overview of direct tax laws and practices in India. It defines what a tax is, describing direct and indirect taxes. Income tax is identified as the most significant direct tax in India. The key laws and rules governing income tax are outlined, including the Income Tax Act of 1961, annual Finance Acts, Income Tax Rules of 1962, circulars and notifications, and legal decisions from courts. Total income is computed in several steps, including determining residential status, classifying and computing income under different heads, making adjustments, and applying tax rates along with surcharges and cesses to determine the final tax payable.