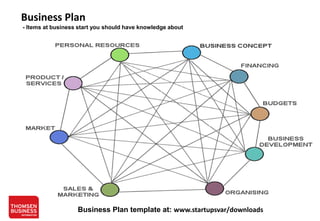

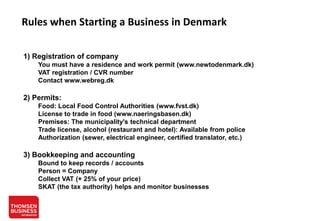

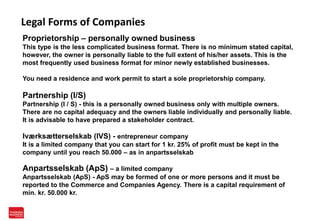

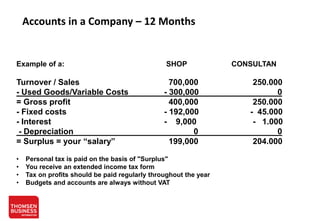

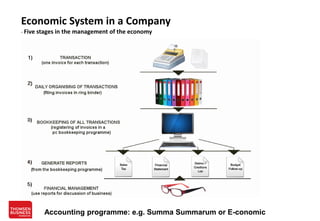

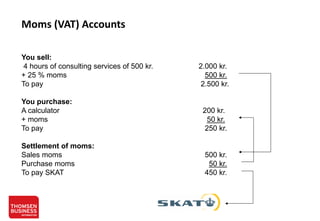

This document provides guidance on writing a business plan and starting a business in Denmark. It outlines important initial steps like exploring business ideas, finding value in potential opportunities, and registering a company. The document reviews different legal forms of businesses in Denmark like sole proprietorships, partnerships, entrepreneur companies, and limited companies. It also discusses key considerations for accounting, taxes, permits, insurance, and economic management for a new Danish business. Resources for further information on starting and running a business in Denmark are provided.