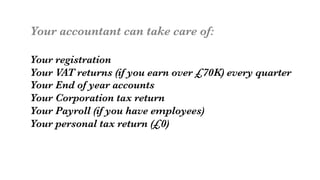

This document provides advice and information for starting a creative business, including how to register a company, get business banking and tax accounts, manage VAT payments, apply for funding, sell internationally, and eventually shut down the business. It recommends enlisting an accountant to handle tax filings, using bookkeeping and accounting software to stay organized, and considering insurance for your business. The author shares their experience owning multiple creative businesses in the UK, US, and Estonia.