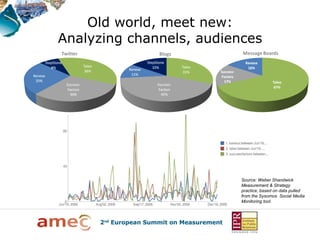

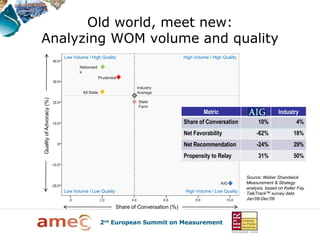

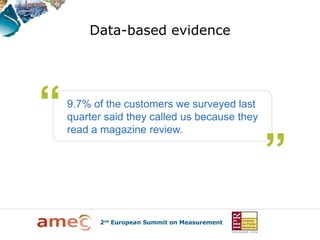

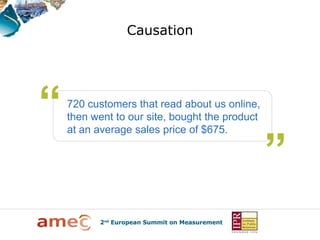

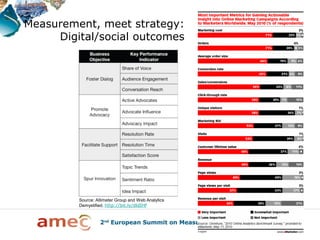

The document discusses the integration of social media measurement with traditional PR and marketing strategies, emphasizing the importance of clear goals and effective measurement metrics. It highlights the need to analyze various types of measurements, such as content engagement, conversation sentiment, and advocacy impact, to demonstrate PR's value in business outcomes. Additionally, it addresses challenges in comparing the effectiveness of different media channels and the necessity of understanding both quantitative and qualitative results in measuring success.