For updated information, please visit www.ibef.org June 2018

This document provides an overview of the Indian banking sector. It discusses the following key points in 3 sentences:

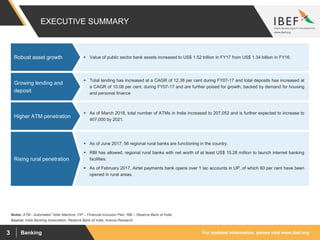

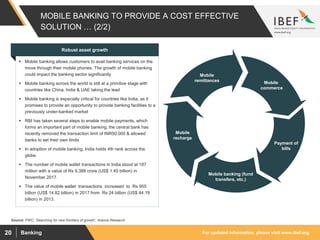

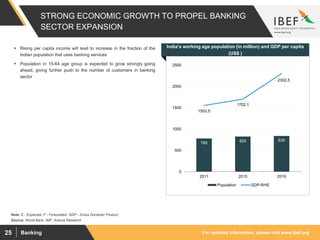

1) The value of public sector bank assets increased to US$ 1.52 trillion in FY17 from US$ 1.34 billion in FY16, demonstrating robust asset growth. Total lending and deposits have also increased at a healthy pace, backed by demand for housing and personal finance.

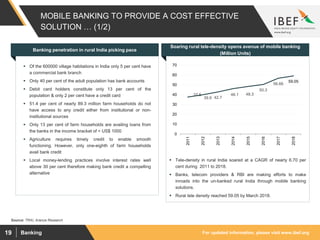

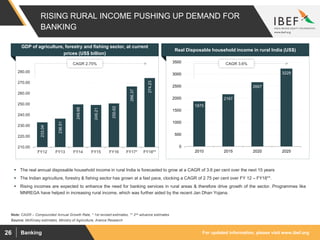

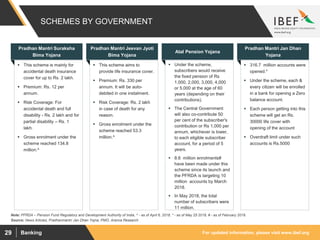

2) Rural and financial inclusion initiatives like regional rural banks, internet banking access, and accounts opened through payments banks are helping to increase rural penetration of banking services.

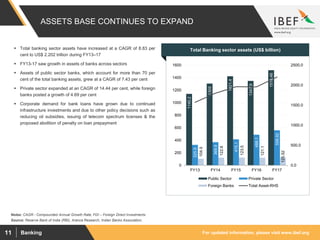

3) The banking sector has seen steady growth in key metrics like