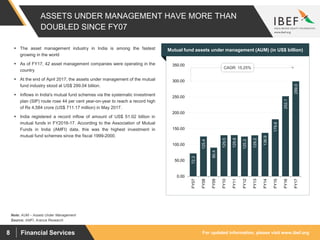

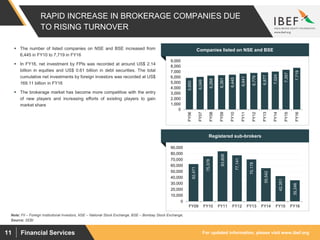

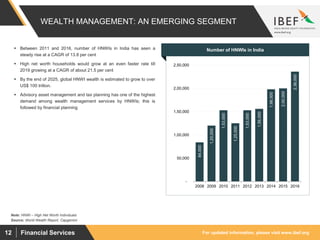

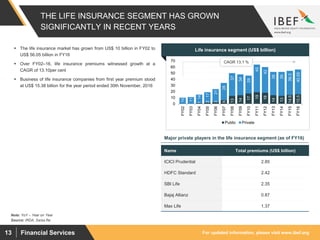

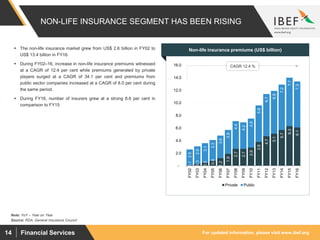

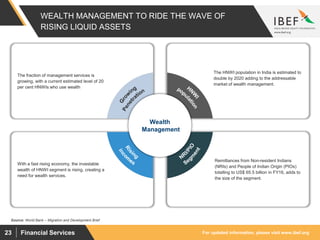

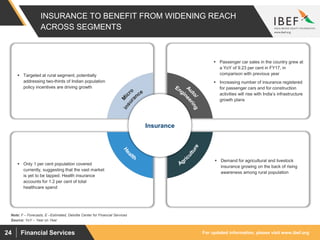

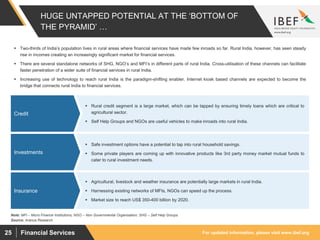

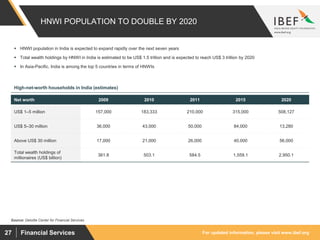

The financial services sector in India has grown significantly in recent years. Assets under management by the mutual fund industry have more than doubled since FY07 to US$299 billion in FY17. The life insurance market has grown from US$10 billion in FY02 to US$56 billion in FY16. Non-life insurance premiums have increased from US$2.6 billion to US$13.4 billion over the same period. The number of high net worth individuals in India has also risen steadily in recent years. Overall, various segments of the financial services sector in India such as insurance, mutual funds, brokerage and wealth management have demonstrated robust growth, supported by favorable regulations and increasing demand.