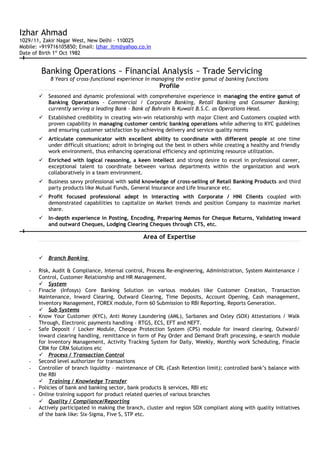

Izhar Ahmad has over 8 years of experience in banking operations including commercial banking, retail banking, and consumer banking. He is currently the Operations Head at Bank of Bahrain & Kuwait B.S.C. Previously he has worked at ICICI Bank Ltd and Axis Bank Ltd in roles with increasing responsibility over branch operations, trade finance operations, administration, and financial control. He has expertise in various banking software systems including Finacle core banking and has experience in areas like risk management, auditing, customer service, and training.