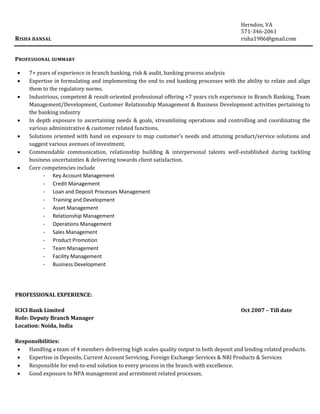

Risha Bansal has over 7 years of experience in branch banking, risk management, and audit. She currently works as a Deputy Branch Manager for ICICI Bank in Noida, India, where she manages a team of 4 and is responsible for all deposit, lending, foreign exchange, and account management processes. She has received several awards for her performance in preventing fraud, achieving high service quality, revenue generation, and sales of insurance products. Risha holds a Post Graduate Diploma in Banking Operations and a Bachelor of Technology degree.