Banking Payment Systems Guide

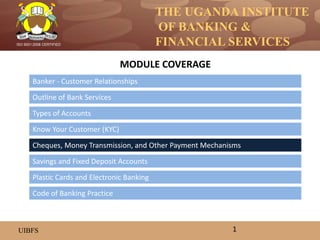

- 1. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Banker - Customer Relationships Outline of Bank Services Types of Accounts Know Your Customer (KYC) Savings and Fixed Deposit Accounts Cheques, Money Transmission, and Other Payment Mechanisms MODULE COVERAGE 1 Code of Banking Practice Plastic Cards and Electronic Banking

- 2. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED What is a Cheque? A Cheque is an unconditional order in writing, addressed to a banker, signed by the drawer(account-holder), requiring him to pay on demand a certain sum of money to or to the order of certain person(payee) or to the bearer There are three main parties to the cheque – the drawer, the drawee and the payee i. Drawer is the account holder who issues the cheque instructing the bank to pay ii. Drawee – is the bank that has been instructed to pay iii. Payee – is person who is the beneficiary who will receive the money Features of a cheque • A cheque must be in writing- It can be written in ink pen, ball point pen, typed or even printed. Oral orders are not considered as cheques. • A cheque is an unconditional order - issued by the customer to his bank. It is not a request for payment and will therefore be paid on presentation as long as it is signed in accordance with customer’s mandate he account. • A cheque must be signed by customer (Account holder) - Unsigned cheques or signed by persons other than customers are not regarded as cheque. 2

- 3. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED In 1999 a cheque standard was adopted to improve on the cheque processing and minimize on frauds involving cheques. One of the requirements was that all cheques should contain at the bottom a magnetic code line. i. A code line is a machine readable area on the bottom face of a cheque that is encoded with the cheque details: ii. Serial Number (6 digits) iii. Check digit no. (2 digits) iv. Bank (2), Branch (2) & Clearinghouse (2) v. Account number vi. Transaction/Voucher type (2 digits) vii. Amount. viii. The first 5 digits are pre-coded while the amount is coded at the time of issue 3

- 4. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Different types & classifications of cheques • Bearer Cheque - When the words "or bearer" appearing on the face of the cheque are not cancelled, the cheque is called a bearer cheque. The bearer cheque is payable to the person specified therein or to any other else who presents it to the bank for payment. However, such cheques are risky; this is because if such cheques are lost, the finder of the cheque can collect payment from the bank. • Order Cheque -When the word "bearer" appearing on the face of a cheque is cancelled and when in its place the word "or order" is written on the face of the cheque, the cheque is called an order cheque. Such a cheque is payable to the person specified therein as the payee, or to any one else to whom it is endorsed (transferred). • Open Cheque -When a cheque is not crossed, it is known as an "Open Cheque" or an "Uncrossed Cheque". The payment of such a cheque can be obtained at the counter of the bank. An open cheque may be a bearer cheque or an order one. 4

- 5. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED • Crossed Cheque-Crossing of cheque means drawing two parallel lines on the face of the cheque with or without additional words like "& CO." or "Account Payee" or "Not Negotiable". • Anti-Dated Cheque -If a cheque bears a date earlier than the date on which it is presented to the bank, it is called as "anti-dated cheque". Such a cheque is valid up to six months from the date of the cheque. • Post-Dated Cheque -If a cheque bears a date which is yet to come (future date) then it is known as post-dated cheque. • Stale Cheque - If a cheque is presented for payment after six months from the date of issue it is called a stale cheque. 5

- 6. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Advantages and disadvantages of cheques Advantages: • No need to carry cash all the time • Convenience of making future payments through post-dating cheques • Subject to less risk of third-party fraud than some other methods of payments. Disadvantages: • Risk of loss or theft of the cheque • Signatures can be forged on the cheque • Payments generally take longer to mature or be received 6

- 7. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED What is money transmission? • Money Transmission is one of the services that are offered by banks to customers although organizations such as Money Gram and Western Union are also in the same business. Money can also be transferred from one country to another using the banking system through SWIFT. • Money transmission therefore simply means transferring money from one location to another within the same bank, between banks in the country and internationally between banks and their correspondents. • Customers generally use money transmission to send money abroad to family or to settle business indebtedness and pay for services rendered. 7

- 8. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED What are payment mechanisms? A payment mechanism (also called payment system) is a financial system supporting transfer of funds from suppliers to the users (borrowers), and from payers to the payees, usually through exchange of debits and credits among financial institutions.. Types of payment systems Typical types of payment mechanisms are: • Real Time Gross Settlement (RTGS) - Basically, this is a system for large-value interbank funds transfers. This system lessens settlement risk because interbank settlement happens throughout the day, rather than just at the end of the day. • Clearing - is the periodic settling of bankers' claims against each other, for which local banks establish clearinghouse associations. Such an institution involves frequent meetings of local bank representatives to settle the balances among member banks. The balance (debit or credit) for each bank at the close of a meeting is forwarded to the Central bank, which adjusts the individual accounts accordingly. 8

- 9. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED E-commerce payment systems – • An e-commerce payment system facilitates the acceptance of electronic payment for online transactions. Also known as a sample of Electronic Data Interchange (EDI), e-commerce payment systems have become increasingly popular due to the widespread use of the internet-based shopping and banking. • SWIFT-Society for World Wide Interbank financial Telecommunications is an organization that facilitates the exchange of payment messages between Financial Institutions around the world in an efficient manner between correspondent banks. SWIFT provides the framework for an international communication system between financial institutions. 9

- 10. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Interbank Network(ATM,EFT,EFTPOS – • This is an interbank network that allows a customer of one bank to withdraw funds from another bank’s ATM also known as an Automated Teller Machine (ATM). For example a customer of Bank of Baroda will be able to draw from say Stanbic Bank ATMs anywhere in the country as long as they are members of the interbank network consortium or ATM network. • Electronic Funds Transfer (EFT) – is the transfer of funds between accounts by electronic means rather than conventional paper-based payment methods, such as Cheque writing. EFT is any financial transaction originating from a telephone, electronic terminal, computer, or magnetic tape. 10

- 11. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Advantages and disadvantages of Electronic Payments Advantages of E-payments • Convenience - Individuals can pay their bills and make purchases at unconventional locations 24 hours a day, 7 days a week, 365 days a year. • Saving time. It takes a matter of seconds or minutes to transact and therefore saves time. • Lower cost – Most banks have no charges for ATM transactions or charge a nominal fee • Secure – As long as one is not careless with the secret personal identification number (PIN), electronic transactions have proved to be more secure than say writing cheques, mailing them, forging signatures etc. Encryption technology allows an individual’s personal financial data to be scrambled before it is sent electronically. It also lowers the risk of human error by reducing the number of people touching the payment once it leaves the payer. 11

- 12. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Disadvantages of E-payments • Lack of authentication - There is no way to authenticate or verify that the individual entering the information online is who they say they are. There is no request for picture identification or even a signature. Therefore, an unauthorized user may carry out transactions in your name before you have time to alert authorities the information has been taken. • Most sites require a customer to open an online account with them - You need to register with the institution in order to be authorized to perform money transactions with them. While the overall payment process is efficient, the initial registration to a given site can be time-consuming. It also involves a username and a password, which implies the need of password protection, to maintain an e-payment account at each organization. 12

- 13. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Banker - Customer Relationships Outline of Bank Services Types of Accounts Know Your Customer (KYC) Savings and Fixed Deposit Accounts Cheques, Money Transmission, and Other Payment Mechanisms MODULE COVERAGE 13 Code of Banking Practice Plastic Cards and Electronic Banking

- 14. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Savings accounts • A savings account is an account where funds are available on demand but subject to certain conditions. • Under normal circumstances credit interest will be paid provided credit balances are maintained above certain minimum limits. • Interest rates can fluctuate with market conditions and credit interest is normally capitalized on a monthly basis. • Transactions that can take place on these accounts include deposits, withdrawals, ATM usage and inter-account transfers. • Because of competition, Uganda financial institutions offer a very big variety of branded savings products and different incentives are offered to attract savers. 14

- 15. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Fixed deposit accounts • A fixed deposit account is a type of account where a customer agrees to deposit a specific amount of money for a specific period and in return gets a higher interest rate compared to what he earns on an ordinary savings account. • Fixed deposits are normally fixed for three, six, and twelve months respectively although this is normally a subject of negotiation between the institution and the customer. • The customer is not expected to withdraw the funds before maturity as he will otherwise forfeit interest earned. 15

- 16. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Banker - Customer Relationships Outline of Bank Services Types of Accounts Know Your Customer (KYC) Savings and Fixed Deposit Accounts Cheques, Money Transmission, and Other Payment Mechanisms MODULE COVERAGE 16 Code of Banking Practice Plastic Cards and Electronic Banking

- 17. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED What are plastic cards in banking? • Plastic cards, commonly known as ATM cards in Uganda, are electronic cards issued by banks to enable bank clients have 24 hour access to their accounts. These cards have the ability to store account information and to facilitate automatic transactions between the client and the bank without the presence of any bank staff. • Two types of common electronic plastic cards are the debit and credit cards. Debit cards – This is an electronic card issued by a bank which allows bank clients access to their accounts 24 hours a day. The main feature of a debit card is that you will have access only to your credit balance and no more. • The major benefits to this type of card are convenience and security. Along with the convenience of accessing account funds at anytime, it also removes the hassles associated with going to the bank, writing cheques etc 17

- 18. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Credit Cards - Allow the customer to draw money in excess of his credit balance on his account up to agreed limits. The credit limit, in most cases, is a revolving limit and the customer may use the available credit as long as the minimum payment due is paid each month by the due date. There are four major players in the international field of Plastic card business. These are: • Visa International • MasterCard international • Diners club • American Express 18

- 19. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED What is electronic banking? Electronic banking is a form of banking where funds are transferred through an exchange of electronic signals between financial institutions, rather than an exchange of cash, cheques, or other negotiable instruments. The ownership and transfers of funds between financial institutions are recorded on computer systems connected by telephone lines or other electronic communication media. Customers using electronic banking services can among other services use it to: • Withdraw Money • Check account balance • Deposit money • Exchange money • Pay bills and Loans • Generate bank statement • Transfer money 19

- 20. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Advantages and disadvantages of plastic cards and e-banking Advantages • Convenience of withdrawing from anywhere in the world -There are over a million VISA ATMs worldwide • The convenience of shopping and paying for services anywhere in the world using the cards. • Convenience of not having to carry hard cash – affording the customers peace of mind • Convenience of cash access 24 hrs a day- Most ATMs operate 24 hours in all major towns all over the country. Online banking sites never close; they're available all- day, seven days a week. • Convenience of simplified money management- You can keep track of how much you spend and on what. You can access detailed monthly statements that show all your cash transactions including withdrawals. • Worldwide, regardless of location - If you're out of your country when a money problem arises, you can log on instantly to your online bank and take care of business at any time • Transaction speed - Online bank sites generally execute and confirm transactions at or quicker than ATM processing speeds. 20

- 21. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED • Efficiency - You can access and manage all of your bank accounts, including securities, from one secure site. • Effectiveness - Many online banking sites now offer sophisticated tools, including account aggregation, stock quotes, rate alerts and portfolio managing programs to help you manage all of your assets more effectively. Most are also compatible with money managing programs such as Quicken and Microsoft Money. Disadvantages • Start-up may take time and formalities: In order to register for your bank's online program, you will probably have to provide ID and sign a form at a bank branch. If you and your spouse wish to view and manage your assets together online, one of you may have to sign a durable power of attorney before the bank will display all of your holdings together. • Learning curve: Banking sites can be difficult to navigate at first. Plan to invest some time and/or read the tutorials in order to become comfortable in your virtual lobby. For busy executives who do not have spare time, this can be a challenge 21

- 22. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Disadvantages… • Difficulties posed by bank site changes: Even the largest banks periodically upgrade their online programs, adding new features in unfamiliar places. In some cases, you may have to re-enter account information. • Proneness to internet and other electronic fraud – this is perhaps the greatest threat to electronic banking. There are increasing numbers of international internet criminals who target theft of bank customers’ electronic identity to defraud them • Internet breakdowns and system malfunctions, causing inconveniences to electronic banking customers 22

- 23. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Banker - Customer Relationships Outline of Bank Services Types of Accounts Know Your Customer (KYC) Savings and Fixed Deposit Accounts Cheques, Money Transmission, and Other Payment Mechanisms MODULE COVERAGE 23 Code of Banking Practice Plastic Cards and Electronic Banking

- 24. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED What is a Code of Banking Practice? The code is a voluntary standard of acceptable conduct which sets standards for its members to observe. The Code of Banking Practice stipulates the practice for banks to follow when dealing with customers. Although it is voluntary, once adopted by a bank, it becomes contractually enforceable. Useful information on a range of banking matters in the Code of Banking Practice normally includes: • Banker and customer relationships in business • Disclosure of costs, product features, legal and other implications of using the bank’s products • Conduct of the bank towards customers • Provision of documents and other information in a timely way to customers • Contractual enforceability of statutory obligations • Debt collection provisions, including the related fairness to customers • Complaint handling procedures • Dispute resolution • Financial hardship handling 24

- 25. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Uganda Code of Good Banking Practice The Uganda Code of Good banking Practice covers the relationship between Banks and their Customers in respect of services offered by UBA (Uganda Bankers Association) member commercial banks. They include, but may not be limited to maintenance of current, savings and other deposit accounts, overdrafts and loans and other services as from time to time individual member banks may choose to offer. Code of Good Banking Practice in Uganda • The code of Good Banking Practice has been drawn up by the Uganda Bankers’ Association (UBA) to guide all member Banks of the UBA in their relationship with their customers where appropriate. • It is a voluntary code that allows competition and market forces to operate to encourage higher standards for the benefit of customers. The code will be reviewed from time to time as may be found necessary. • All institutions subscribing to this code will ensure that their staff are aware of it and will make it available to their customers upon request. Any member Bank may observe a higher standard if it so wishes. 25

- 26. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Objectives of the Code of good Banking Practice The objectives of the code are: i. To set out the standards of good banking practice which member banks of the UBA will follow in their dealings with their customers. ii. To ensure that Banks will act fairly and reasonably in all their dealings with their customers. iii. To enable Banks to help their customers understand how their accounts operate and give them a good understanding of Banking services. iv. To promote confidence in the integrity and security of the Banking system. v. To promote and maintain high standards of professional and moral conduct recognized within the banking industry. Banks will conduct their business with uncompromising integrity and fairness so as to promote complete trust and confidence in the Banking industry. In meeting this fundamental objective, banks will conduct their relationships with the authorities, their clients, competitors and the community at large, in the manner described below. 26

- 27. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED AUTHORITIES: Banks will comply with all relevant Laws and Regulations that will be in force from time to time in the Republic of Uganda. FUNDAMENTAL PRINCIPLES: Banks will observe the following fundamental principles in dealing with their customers. i) Avoid conflicts of interest ii) Offer their services irrespective of race, religion or gender iii) Safeguard deposits iv) Act fairly and reasonably in all their dealings with their customers v) Respect confidentiality vi) Recognize the need to ensure the reliability of their systems and technology. 27

- 28. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED OPENING AND CLOSING OF ACCOUNTS: To assist in protecting their customers, members of the public and themselves against fraud and other misuse of the banking system, banks, when opening accounts, will reasonably satisfy themselves as to the identity of the applicants, through the production of relevant Identification (ID) documents and acceptable references, or the seeking of information from another bank, Credit Reference Bureau (CRB) when and if applicable. When opening A/Cs, all banks are to observe the minimum guidelines Subject to contractual and other legal obligations: • Banks may close accounts or discontinue service at any time, although reasonable notice will be given unless there are exceptional circumstances; • Customers may close accounts at any time subject to settlement of any obligations to the Bank. 28

- 29. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED TERMS AND CONDITIONS: Banks should ensure that current terms and conditions governing their banking services, which may vary from time to time at their discretion, are available to their customers on request. The said terms and conditions should be expressed in plain language to enable the prospective customer understand fairly the relationship he/she is entering into with the Bank. Banks will encourage their customers to acquaint themselves with and abide by the current terms, conditions and obligations relating to their financial dealings with their banks. INTEREST AND CHARGES: Banks will advise their customers through an appropriate medium of the following information when accounts are opened, when requested or, with due notice when required, when changes are made to the information regarding among others: i) the rates of interest payable to or by them; ii) any service/administration fees and other applicable charges; 29

- 30. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED iii) the method of calculation of interest and charges and the frequency at which these are debited and/or credited to customers’ accounts. iv) Charges for services not specified at the time of opening the Account in the published tariffs will be advised on request or at the time the service is offered. v) Any changes in the tariffs given to the customer i.e. details of any charges will be made known to the customer in an appropriate manner. vi) A customer intending to borrow money will be advised in clear terms the level and type of interest rates applicable. vii) Banks shall advise borrowing customers on all other charges. 30

- 31. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED STATEMENTS: Banks will provide customers with or customers may obtain periodic written statements which will contain: (i) the dates, amounts and brief details of all transactions, (ii) interest debited or credited. CHEQUES ACCOUNTS To assist in protecting their customers, members of the public and themselves against fraud and other misuse of the banking system, Banks will take care in issuing cheque books and will encourage customers to: i) Exercise care and safety precautions in the keeping of their cheque books and in the issuing of cheques; ii) Acquaint themselves with the guidelines printed in cheque books regarding the drawing and crossing- of cheques; and iii) Ensure that the correct number of leaves are contained in the cheque books when collected. CREDIT FACILITIES: When considering applications for credit, banks will have regard to purpose for borrowing, the applicants’ character and credit worthiness, their ability to repay borrowing and to pay interest and charges, and any security offered. 31

- 32. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED DEBT COLLECTION PRACTICES: When dealing with customers in default, banks will ensure that fair debt collection practices are observed. CONFIDENTIALITY: With the following exceptions, banks will at all times observe a strict duty of confidentiality regarding customer information: i) Where the customer requests or consents to disclosure. ii) Where the bank is compelled to disclose information by Law. iii) Where, in protecting the interest of Banks, or where there is a duty to the public to do so, information is given, for example: a. in response to status enquiries from other banks; b. to surety, guarantor or cessionary; and c. when taking steps to recover debts. iv) Where information is given within a banking group in order to maintain existing, and establishing future relationships with customers. 32

- 33. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED COMPLAINTS BY CUSTOMERS: (i) Every Bank will establish adequate procedures’- for handling of customers’ complaints (ii) At the time of opening an, account, customers should be made aware of the complaints handling procedure. (iii) Should a customer or any, aggrieved party have any cause to complain about Bank services, details in the first instance should be made in writing to the Chief Executive of the bank concerned. Should this procedure not satisfy the matter, the complainant/ aggrieved party has a right to forward the complaint in writing to the Uganda Bankers’ Association through the current Chairman, c/o the Executive Secretary who in turn will refer it to a UBA Sub select Committee. (iv) The Sub Committee will be composed of UBA representatives not normally exceeding three but excluding the bank(s) concerned plus one member from either a legal profession or a recognized Auditor or both as may be appropriate at the ‘Sole option of UBA. The Committee will sit from time to time and work out a fair assessment, which will be made known to all the parties concerned. 33

- 34. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED SAFETY AT BANK PREMISES Banks will take all reasonable steps to protect their customers and the public whilst in bank premises. MARKETING OF BANKING SERVICES Banks will compete for business based entirely on merit and, in marketing their services, will act responsibly and prudently and ensure that advertisements are fair and reasonable, do not contain misleading information and do not make negative inference or reference to other banks in their promotional campaigns. COMMUNITIES Banks will play a role of fostering social and environmental needs. UBA STATEMENT AGAINST MONEY LAUNDERING Uganda Bankers’ Association is committed to fighting money laundering and complying fully with the letter and spirit of money laundering laws in all parts of the world and guiding regulations as established by regulatory authorities from time to time. All Bank employees will accept accountability and responsibility for observing these laws and policies. Any instances of suspicious transactions will be reported to the appropriate authorities. Any instances of suspicious transactions will be reported to the appropriate authorities 34

- 35. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED END 35

Editor's Notes

- By the end of this module, the students should be able to: Define a cheque; understand what a cheques means and its features. Understand the advantages and disadvantages of cheques Conversant with the different types of Cheques Explain what Money Transmission is and what it does. Explain what a payment mechanism is; with examples of payment systems. State the advantages and disadvantages of Electronic Payments

- A crossed cheque cannot be cashed at the bank counters but can only be credited to the payee's account and put through the clearing system A post dated cheque when presented will be returned marked ‘Post Dated Cheque’. A stale cheque when presented for payment at the bank will be returned unpaid marked ‘Cheque Stale’.

- Banks will, on the instructions of their customers, transfer money from one customer’s account to another within the same bank(inter-bank transfer), or transfer money from a customer of one bank to a customer of another using EFT(Electronic Funds Transfer)or using RTGS(Real Time Gross Settlement). Alternatively, a customer of one bank will issue a cheque in favour of a customer of another bank and send it through the clearing system.

- A payment mechanism consists of a paper-based mechanism for handling checks and drafts, and a paperless mechanism (such as electronic funds transfer) for handling electronic commerce transactions. Electronic payment systems include debit cards, credit cards, electronic funds transfers, direct credits, direct debits, internet banking and e-commerce payment systems. Payment systems may be physical or electronic and each has their own procedures and protocols. Standardization has allowed some of these systems and networks to grow to a global scale. The term electronic payment can refer narrowly to e-commerce - a payment for buying and selling goods or services offered through the Internet, or broadly to any type of electronic funds transfer. Payment systems are used for tendering cash and payments in domestic and international transactions by banks and other financial institutions Clearing involves the exchange among banks of checks, drafts, and notes and the settlement of consequent differences. Clearing represents the total of claims presented daily at a clearing-house. In Uganda the Clearing House is at bank of Uganda.

- Because no identifying information is provided at the time of the online payment, an individual may have an extremely hard time disputing a charge later.

- INTRODUCTION The code is prepared by the Uganda Bankers’ Association in light of the need to harmonize the Banker Customer Relationship, following requests from the member banks, The Bank of Uganda, the Government, Consumer Organization and members of the public’. It is written to promote good banking practice and specific services may have their own terms and conditions, which will comply with the principles contained in the code. The code covers the relationship between Banks and their Customers in respect of services offered by ‘member commercial banks, which include but may not be limited to maintenance of current, savings and other deposits accounts, overdrafts and loans and other services as from time to time individual member banks may choose to offer.

- Banks will encourage customers to satisfy themselves as to the accuracy of their statements and to notify their bank immediately of any perceived errors.