Banking operations unit4

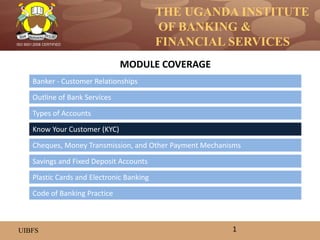

- 1. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Banker - Customer Relationships Outline of Bank Services Types of Accounts Know Your Customer (KYC) Savings and Fixed Deposit Accounts Cheques, Money Transmission, and Other Payment Mechanisms MODULE COVERAGE 1 Code of Banking Practice Plastic Cards and Electronic Banking

- 2. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Money laundering and Know Your Customer (KYC) Introduction Banks have always made efforts to know who their customers are before opening an account by insisting on references mainly to avoid being accused of negligence and suffer damages. However, as competition heated up, banks became a bit lax and started opening accounts without insisting on proof of identity. With the advent of money laundering laws, increase in drug trafficking and terrorism, it has become absolutely necessary for banks to know who they are dealing with, the nature of his business and sources of his income because as not to do so might spell danger not only for the banking institutions but also for management. It is with this background and the desire for banks to deepen their target marketing that ‘Know Your Customer’ has gained prominence. 2

- 3. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Money laundering – This is the practice of disguising the origins of illegally- obtained money. It is the process by which the proceeds of crime are made to appear legitimate. The money involved can be generated by any number of criminal acts, including drug dealing, corruption, accounting fraud and other types of fraud, and tax evasion. The methods by which money may be laundered are varied and can range in sophistication from simple to complex although it usually consists of three steps: • Placement • Layering • Integration Placement - This is the depositing of funds in financial institutions or the conversion of cash into negotiable instruments. The easiest way to begin laundering large amounts of cash is to deposit them into a financial institution. But it is also the most dangerous for the money launderer because of suspicions once large amounts of cash are deposited 3

- 4. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Layering – This is the transfer of funds through a series of accounts in an attempt to hide the funds' true origins. Once money has been placed in the banking system a launderer will start transferring it to different accounts in small amounts not arouse suspicion. Integration – Integration involves the movement of layered funds, which are no longer traceable to their criminal origin, into the financial world, where they are mixed with funds of legitimate origin. This dirty money as it is known once it enters the banking system may be invested in real estate, stock exchange to buy shares, invested in legitimate businesses and in the end emerges clean and almost un traceable. 4

- 5. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED What is money laundering & anti money laundering (AML)? The anti money laundering law is in the offing. However, Bank of Uganda has spelt out strict guidelines for banks to follow to minimize money laundering and if not adhered to, banks risk heavy penalties and in the extreme, possibility of closure of the banking business. Be that as it may, Uganda is considered to be a conduit for money laundering mainly because of our porous borders, weak legislation and rampant corruption 5

- 6. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED What is KYC? Know your customer (KYC) is) is a process of due diligence that requires banks to obtain detailed information about their customers both existing and new. This information includes proof of identity, physical address, the nature of his business, where it is located so that you are able to tell whether his banking operations are compatible with a business of that type. Rationale for KYC • The objective of KYC guidelines is to prevent banks from being used, intentionally or unintentionally by criminal elements for money laundering activities, financing of terrorist or criminal activities or transacting with banned/ ineligible entities. • Regulators internationally are becoming increasingly strict about financial institutions having sufficient knowledge about their customers to ensure that they can properly identify them and know where their monies originate from. 6

- 7. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED When to do KYC KYC needs to be done on a customer at the time of opening an account and in the following cases: i. Prior to entering a business relation with a customer (including permanent and on-off business relationships). ii. When periodically updating customer information like when a customer has applied to access a product or service such as a loan or overdraft iii. Where time has passed since the initial KYC information was collected iv. Where there is a change in the customer’s transactional levels or v. Where regulatory or supervisory developments dictate so. 7

- 8. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED KYC Process There are three stages of KYC, that is, identification, verification and profiling. • Identification - Identification is a process through which sufficient information regarding the customer’s identity is obtained (identity document and address information). • Verification - This involves the steps taken by the bank to ensure that the information, which has been accumulated, is valid and reliable. • Profiling - This is a process through which information regarding the source of income and funds is obtained from the customer. In this process, the bank can also obtain information regarding the activity that can be expected on the customer’s account. 8

- 9. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Implications of non adherence to KYC Bank of Uganda established The Bank of Uganda Anti Money Laundering Guidelines in 2002 which among others requires banks to conduct proper KYC and to monitor accounts so as to control money laundering. Non-compliance with KYC requirements could result into:- a. Fines & penalties to the bank - The Financial Institutional Act in Uganda provides for a penalty of UGX 5 million for KYC non compliance. b. Suspension of the bank’s business c. Imprisonment of bank executives d. Irreparable reputational risk to the bank e. Financial risk to the bank (fraud) f. In severe cases, closure of the bank 9

Editor's Notes

- This can be done within the same bank, same country and to countries with weak or no anti money- laundering laws or those with strict bank-secrecy laws. Such countries include the Cayman Islands, the Bahamas, Switzerland and Panama. Once deposited in a foreign bank, the funds can be moved through accounts of "shell" corporations, which exist solely for laundering purposes. The high daily volume of electronic funds transfers makes it difficult for law enforcement agencies and bank staff to trace these transactions.

- KYC, although an important tool for compliance, can be a double edged sword and the banks can use it to their advantage. Because of close monitoring of transactions and deeper understanding of customer’s business, it is better placed to understand their requirements and can therefore design products tailored to match their requirements