Banking and insurance chapters

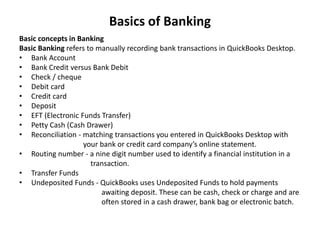

- 1. Basics of Banking Basic concepts in Banking Basic Banking refers to manually recording bank transactions in QuickBooks Desktop. • Bank Account • Bank Credit versus Bank Debit • Check / cheque • Debit card • Credit card • Deposit • EFT (Electronic Funds Transfer) • Petty Cash (Cash Drawer) • Reconciliation - matching transactions you entered in QuickBooks Desktop with your bank or credit card company’s online statement. • Routing number - a nine digit number used to identify a financial institution in a transaction. • Transfer Funds • Undeposited Funds - QuickBooks uses Undeposited Funds to hold payments awaiting deposit. These can be cash, check or charge and are often stored in a cash drawer, bank bag or electronic batch.

- 2. Bank - Customer relationship

- 3. Know your customer Know Your Customer is the process of verifying the identity of customer. The objective of KYC guidelines is to prevent banks from being used, by criminal elements for money laundering activities. It also enables banks to understand its customers and their financial dealings to serve them better and manage its risks prudently. Importance of KYC KYC is the means of identifying and verifying the identity of the customer through independent and reliance source of documents, data or information. For the purpose of verifying the identity of: - Individual customers, bank will obtain the customer’s identity information, address and recent photograph. Similar information will also have to be provided for joint holders and mandate holders. - - Non-Individual customers – banks will obtain identification data to verify the legal status of the entity, operating address, the authorized signatories and beneficial owners. - Information is also required on the nature of employment/business that the customer does or expects to undertake and the purpose of opening of the account with the bank.

- 4. Anti Money Laundering Anti-money laundering refers to a set of laws, regulations, and procedures intended to prevent criminals from disguising illegally obtained funds as legitimate income. Though anti-money-laundering (AML) laws cover a relatively limited range of transactions and criminal behaviours, their implications are far-reaching. Methods and Stages of Money Laundering 1.Placement –This is the movement of cash from its source. On occasion the source can be easily disguised or misrepresented. This is followed by placing it into circulation through financial institutions, casinos, shops, bureau de change and other businesses, both local and abroad. The process of placement can be carried out through many processes including: • Currency Smuggling • Bank Complicity • Currency Exchanges • Blending of Funds • Asset Purchase

- 5. Anti Money Laundering 2.Layering – The purpose of this stage is to make it more difficult to detect and uncover a laundering activity. It is meant to make the trailing of illegal proceeds difficult for the law enforcement agencies. The known methods are: • Cash converted into Monetary Instruments • Material assets bought with cash then sold 3.Integration – This is the movement of previously laundered money into the economy mainly through the banking system and thus such monies appear to be normal business earnings. This is dissimilar to layering, for in the integration process detection and identification of laundered funds is provided through informants. The known methods used are: • Property Dealing • Front Companies and False Loans • Foreign Bank Complicity • False Import/Export Invoices

- 6. Negotiable Instruments A negotiable instrument is a document guaranteeing the payment of a specific amount of money, either on demand, or at a set time, with the payer usually named on the document. • Promissory notes. • Bill of exchange. • Check / Cheque. • Government promissory notes. • Delivery orders. • Customs Receipts. Duties and responsibilities of a banker Duties A banker is an individual who advises their clients with regard to financial matters. Duties concerning savings, loans, taxes, investments, and securities are all within the job realm of a banker. The banker will provide financial assistance to the client in accordance with their required needs. Some bankers may also sell financial instruments such as stocks and bonds from time to time.

- 7. General Responsibilities of a Banker A banker has numerous general responsibilities which go along with their daily job duties. • The banker is responsible for assessing the client’s financial standing and offering bank programs in accordance with that financial standing. • The banker will review the finances of a client, introduce financial programs which may be needed by the client and answer to their needs each step of the way. • The banker is also an individual who is responsible for the smooth daily operation of the financial institution. • This individual must ensure that they comply with institution rules and regulations as well as pertinent federal and state laws.

- 8. DICGC Deposit Insurance and Credit Guarantee Corporation (DICGC) It is a subsidiary of Reserve Bank of India. It was established on 15 July 1978 under Deposit Insurance and Credit Guarantee Corporation Act, 1961 for the purpose of providing insurance of deposits and guaranteeing of credit facilities. DICGC insures all bank deposits, such as saving, fixed, current, Recurring deposit for up to the limit of Rs. 100,000 of each deposits in a bank. Types of customers • Potential customer • New customer • Impulsive Customer • Discount customer • Loyal customer Types of Bank Accounts • Regular Savings. • Current Account. • Recurring Deposit Account. • Fixed Deposit Account. • DEMAT Account. • NRI Accounts. • Types of deposit products • Basic Checking Accounts. • Money Market Accounts. • IRAs (investment retirement accounts) • Brokerage Accounts.

- 9. DICGC Types of Bank deposit customers • Individuals. • Joint Hindu Families. • Partnership Firms. • Limited Liability Companies. • Clubs and Associations. • Trusts. Services rendered by banks • Checking and Savings Accounts. • Retirement Accounts. • Mortgages. • Credit Cards. • Alternative Investments – such as mutual funds and other securities. • Financial Management. • Safe Deposit (a box inside a vault in a bank to keep important papers or valuables) services. • Various types of consumer loans.

- 10. DICGC Principle of lending • The borrower should be able to repay the loan and interest in time at regular intervals without default. • • The repayment of the loan depend upon the nature of the security, character of the borrower, his capacity to repay and his financial standing. • 1. Liquidity • 2. Safety • 3. Diversity • 4. Stability • 5. Profitability Steps in the lending process • Finding prospective loan customers, • Evaluating a prospective customer’s character and sincerity of purpose, • Making site visits and evaluating a prospective customer’s credit record, • Evaluating a prospective customer’s financial condition, • Assessing possible loan collateral and signing the loan agreement, • Monitoring compliance with the loan agreement and other customer service needs.

- 11. DICGC Credit control and monitoring Often referred as Loan Review Mechanism (L R M), plays an important role in the following aspects: (1) To ensure that the funds provided by the bank are put to the intended use and continue to be used properly. (2) To ascertain that the business continues to run on the projected lines. (3) If the deterioration of the business continues despite appropriate action, the bank should decide if any harsh action like, recalling the advance or seizing the security, etc. is necessary. Credit Monitoring Ensure end use, performance, warning signals and action to be taken Available Tools for Credit Monitoring (1)Conduct of the Accounts with the Bank (2) Periodic Information Submitted as per the Terms of the Advance (3) Audit of Stocks and Receivables Conducted by the Bank (4) Financial Statements of the Business, Auditors’ Report (5) Periodic Visits and Inspection (6) Interaction (7) Periodic Scrutiny (8) Market Reports about the, Borrower and the Business Segment (9) Appointing Bank’s Nominee on Company’s Board (10) Credit Audit

- 12. DICGC Priority Sector Lending • It is an important role given by the Reserve Bank of India (RBI) to the banks for providing a specified portion of the bank lending to few specific sectors like agriculture and allied activities, micro and small enterprises, poor people for housing, students for education and other low income. Lending to agriculture Agricultural finance refers to financial services ranging from short-, medium- and long-term loans, to leasing, to crop and livestock insurance, covering the entire agricultural value chain - input supply, production and distribution, wholesaling, processing and marketing. • Running day to day operations. • Buying farm machinery such as tractors, harvesters, et cetera. • Purchasing land. • Storage purposes. • Product marketing loans. • Expansion.

- 13. DICGC • Microfinance, It also known as microcredit, is a financial service that offers loans, savings and insurance to entrepreneurs and small business owners who don't have access to traditional sources of capital, like banks or investors • Joint Liability Group (JLG) . • Self Help Group (SHG) . • The Grameen Bank Model. • Rural Cooperatives. • A small business is defined as one which is privately owned, has only a few employees and low sales volumes. • Term loans. • Business lines of credit. • Equipment loans. • Invoice factoring. • Invoice financing. • Merchant cash advances. • Business credit cards. • Microloans.

- 14. DICGC • Medium-sized businesses are defined within the Companies Act 2006 as a business with up to 250 employees. Medium term loan, hire- purchase, leasing • Recovery is different from one loan to another. • In short term loans recovery is less than 36months. • In medium term loans recovery is from 36 months to 84 months. • In long term loans recovery is normally 84 months or longer. • Risk management in Indian banks is a relatively newer practice, but has already shown to increase efficiency in governing of these banks as such procedures tend to increase the corporate governance of a financial institution. • Market risk. . • Operational risk. • Liquidity risk. • Reputational risk • Credit risk • Business risk • Systematic risk

- 15. Management of non performing assets With effect from 31-03-2004, a non-performing asset means a loan or advance where: (i) Interest and/or instalment of principal remains overdue for a period of more than 90 days in respect of term loan; (ii) The account remains ‘out of order’ for a period of more than 90 days in respect of an overdraft/cash credit; (iii) Interest and/or instalment of principal remains overdue for two harvest seasons but for a period not exceeding two half years in case of an advance granted for agriculture purposes. Prudential Norms for Managing Non-Performing Assets 1. Asset Classification i. Standard Assets – Such assets don’t disclose any problem and don’t carry more than normal risk attached to the business. Such an asset is not a non-performing asset. ii. Sub Standard Assets – It is classified as non-performing asset for a period not exceeding 12 months. Such an asset will have well defined credit weaknesses that jeopardize liquidation of the debt and are characterized by distinct possibility that the bank will sustain some loss.

- 16. Management of non performing assets iii. Doubtful Assets – Assets, which have remained NPAs for a period exceeding 12 months. It means any NPA would migrate from sub-standard to doubtful category after 12 months. iv. Loss Assets – A loss asset is one where loss has been identified by the bank or internal/external auditors or RBI inspectors but the amount has not been written off, wholly or partially Any NPA would get classified as loss asset if it were irrecoverable or only marginally collectible and cannot be classified as bankable asset. 2. Income Recognition If an asset is performing, income can be recognized on accrual basis but if the asset is non-performing, income should not be recognized on accrual basis but should be booked only when it is actually received (cash basis). 3. Provisioning Requirements