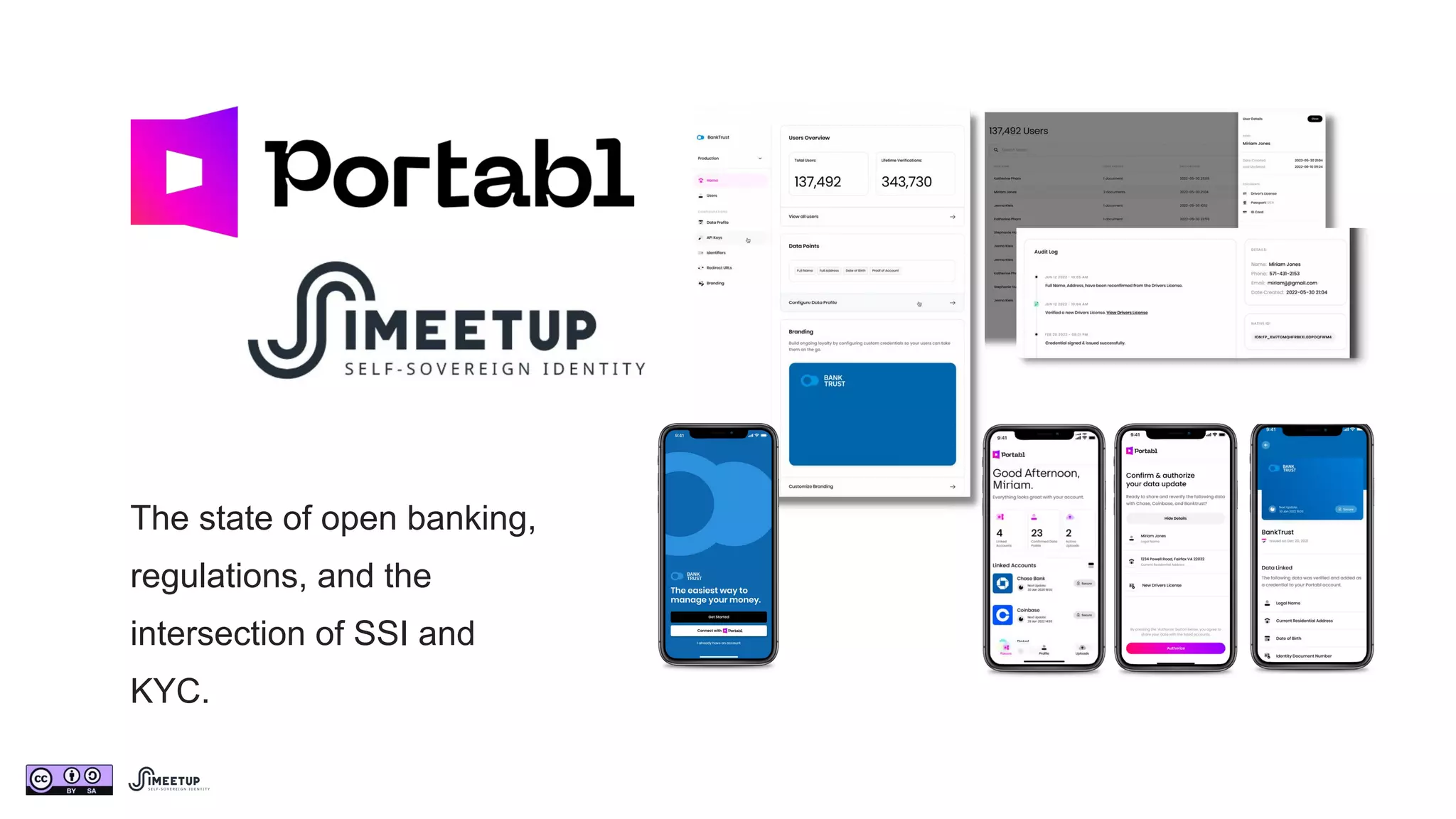

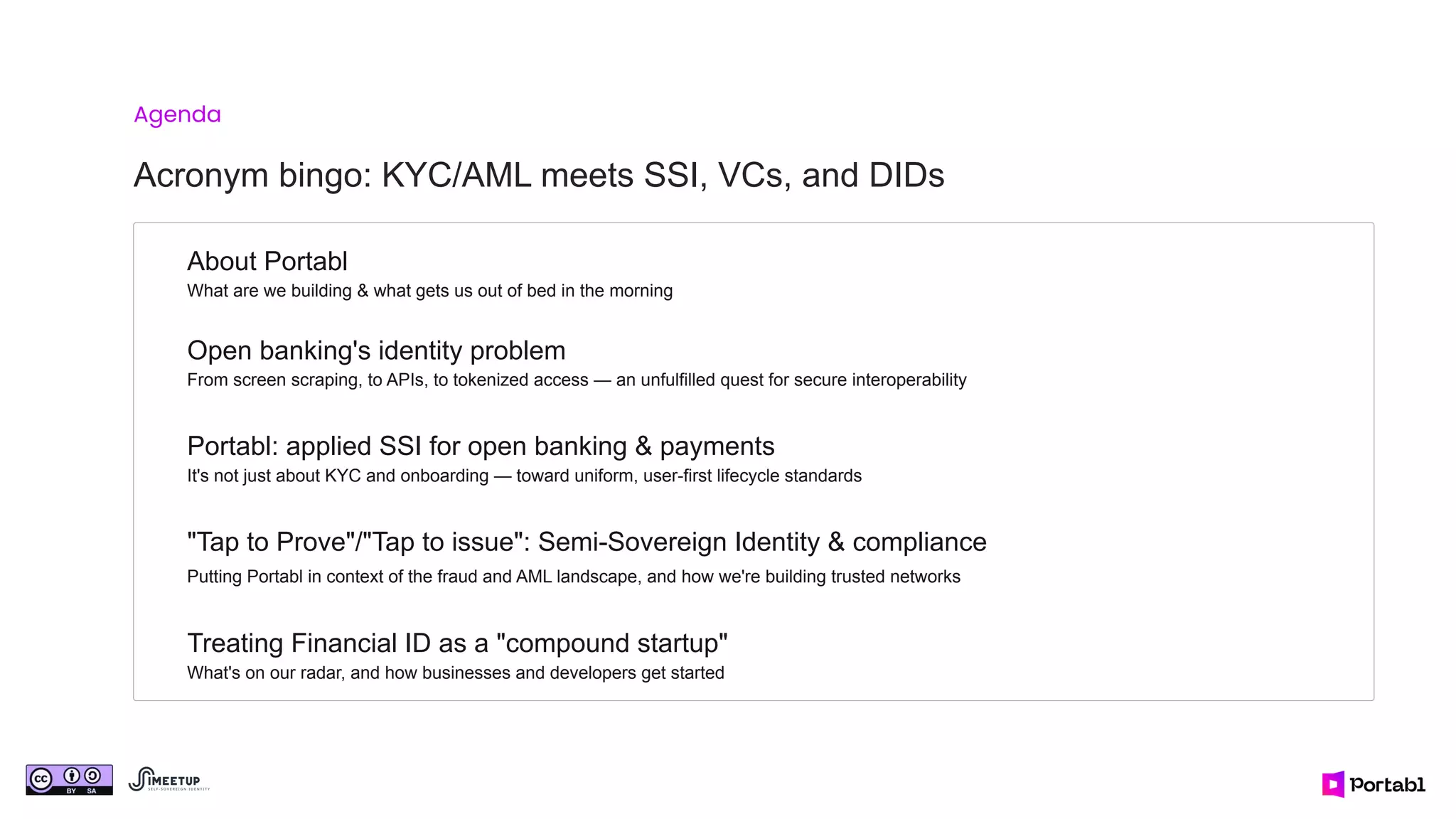

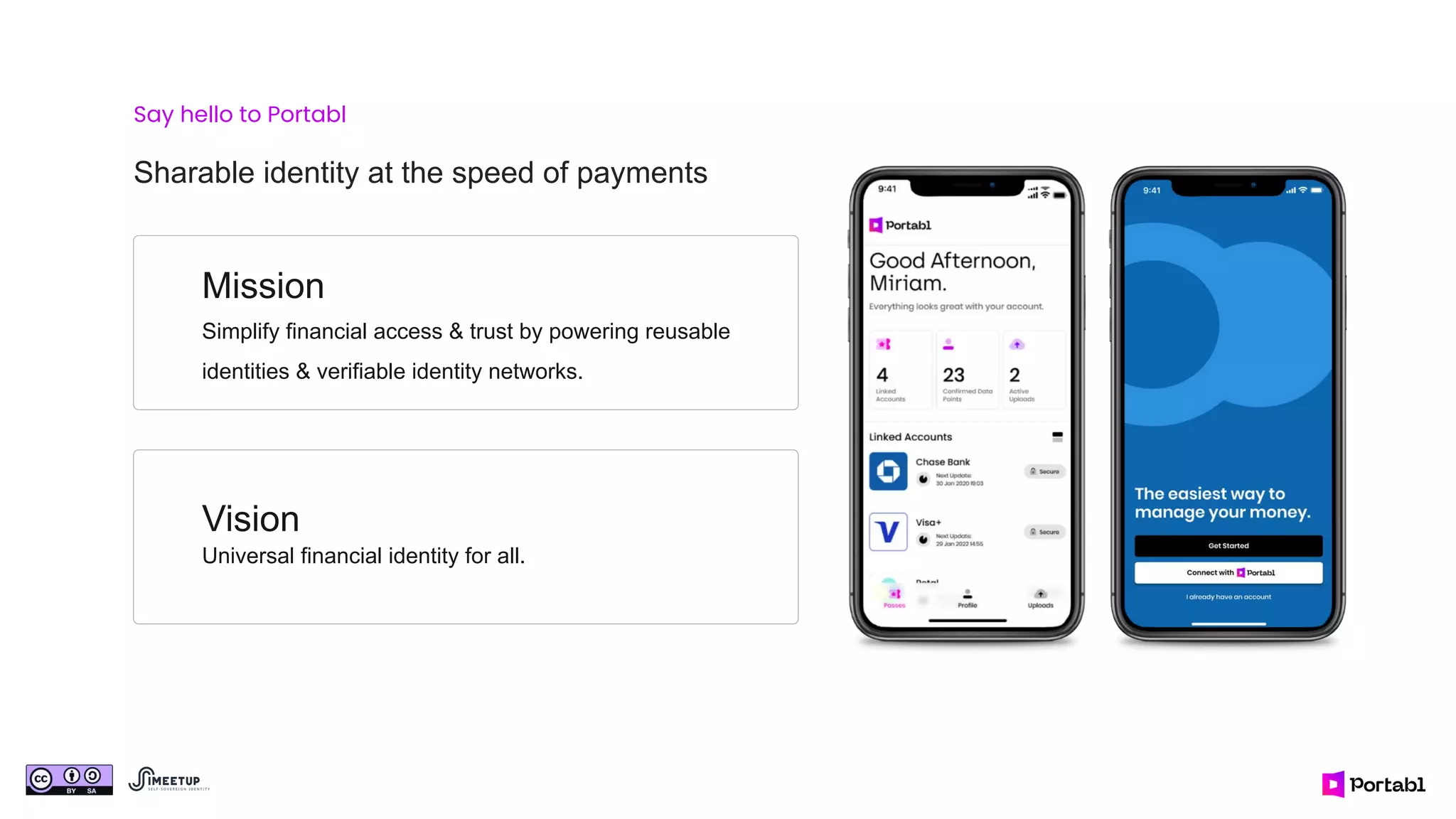

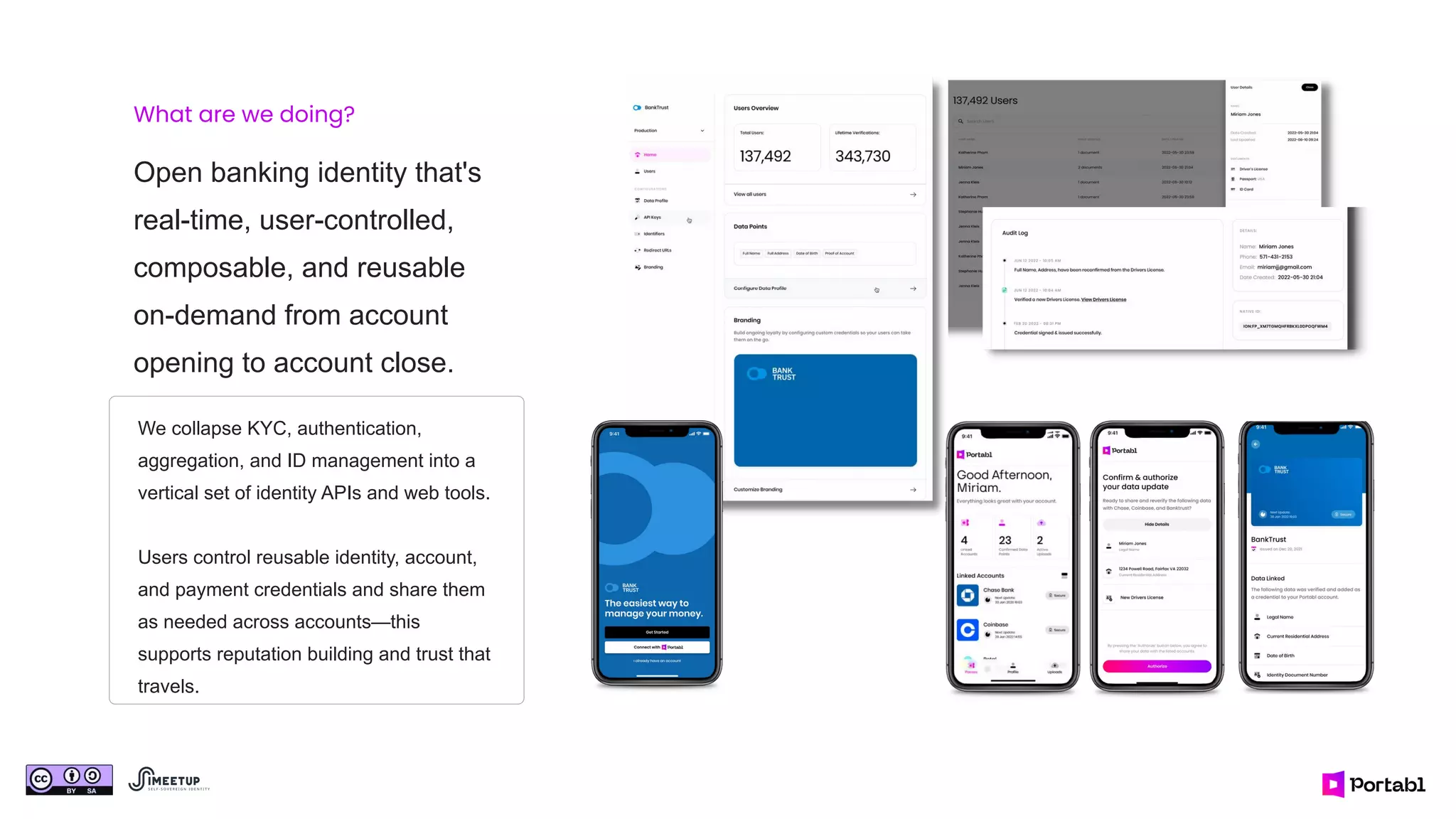

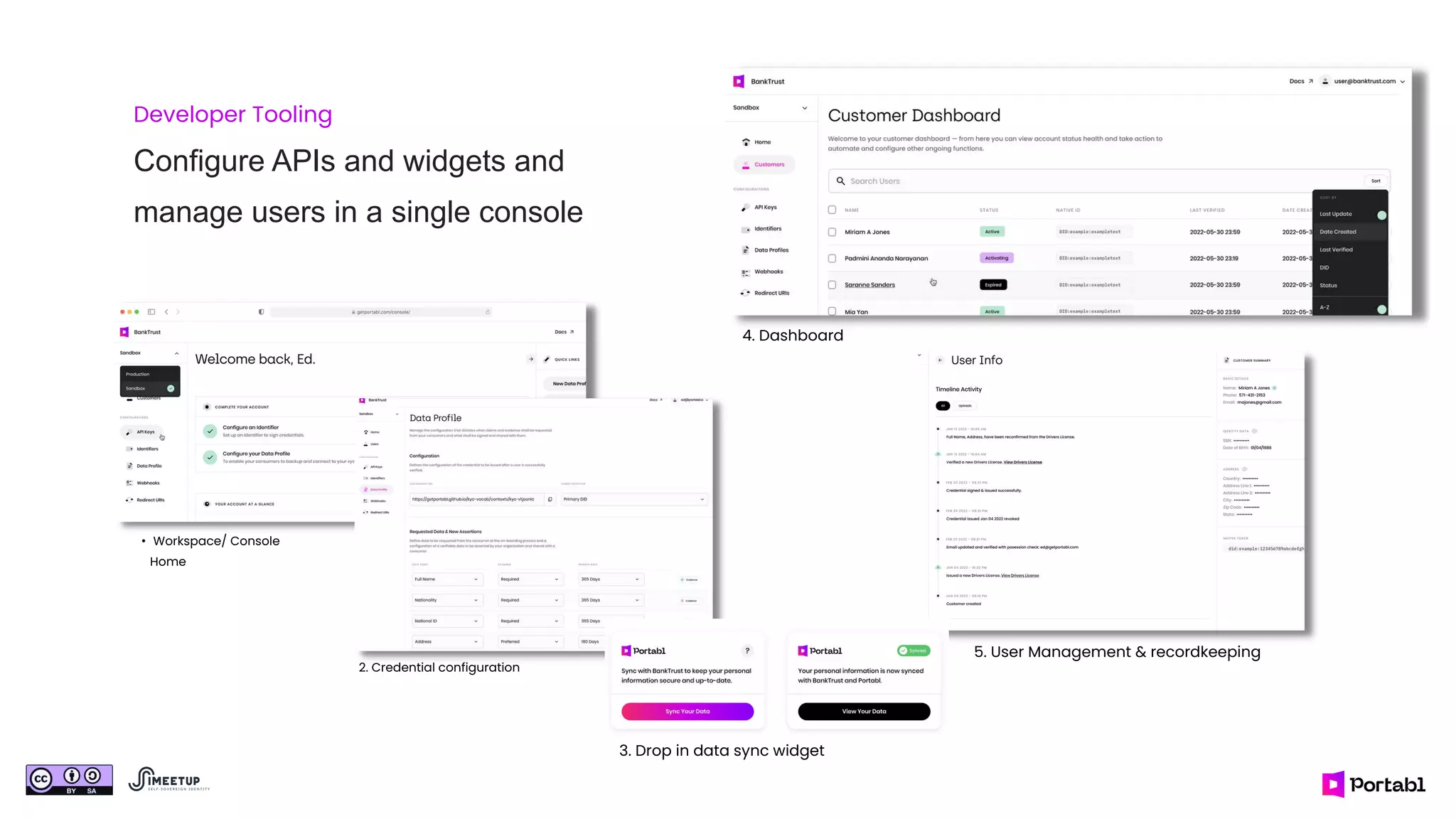

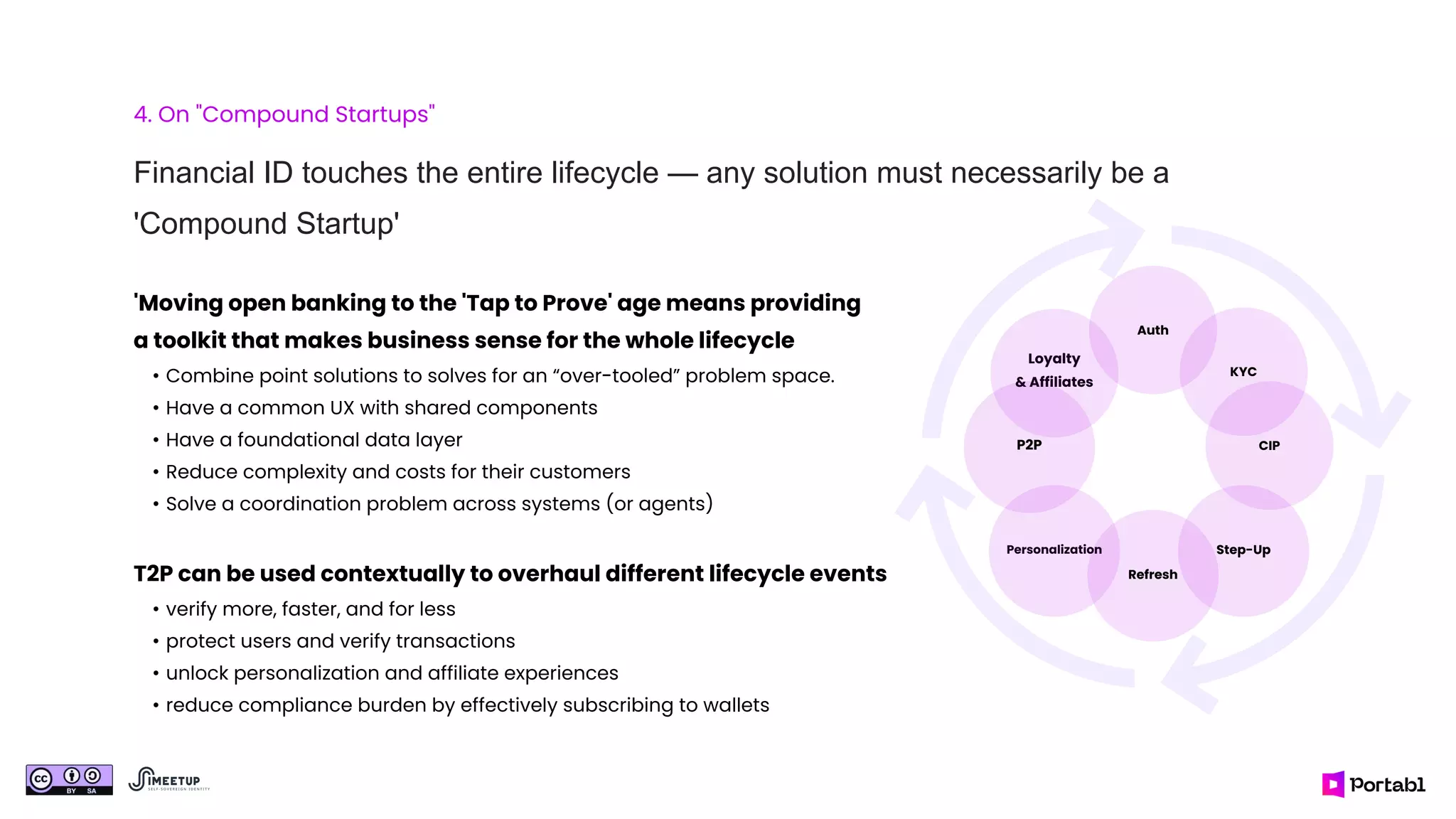

The document discusses the state of open banking, emphasizing the integration of self-sovereign identity (SSI) and know your customer (KYC) regulations. It highlights the challenges of trust, security, and user control in financial identity management, advocating for a user-first approach that simplifies access and enhances overall lifecycle standards. The vision includes creating a universal financial identity that enables reusable credentials while addressing compliance, privacy, and fraud concerns.