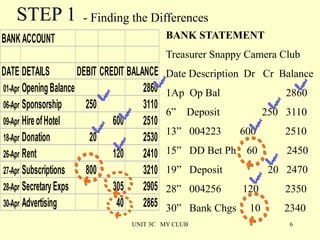

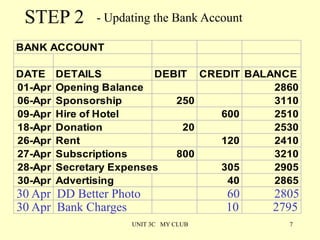

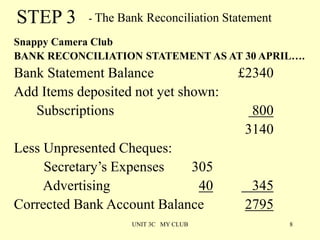

This document discusses bank reconciliation and the reasons why an organization's bank balance may differ from its bank statement balance. It explains that cheques paid and deposits made near the statement date may not be reflected. It also outlines things the bank and organization each may not be aware of like direct debits. The document provides steps to reconcile the two balances by identifying differences, updating the bank account, and preparing a reconciliation statement with any outstanding items. Key terms related to bank reconciliation like standing orders and direct debits are also defined.