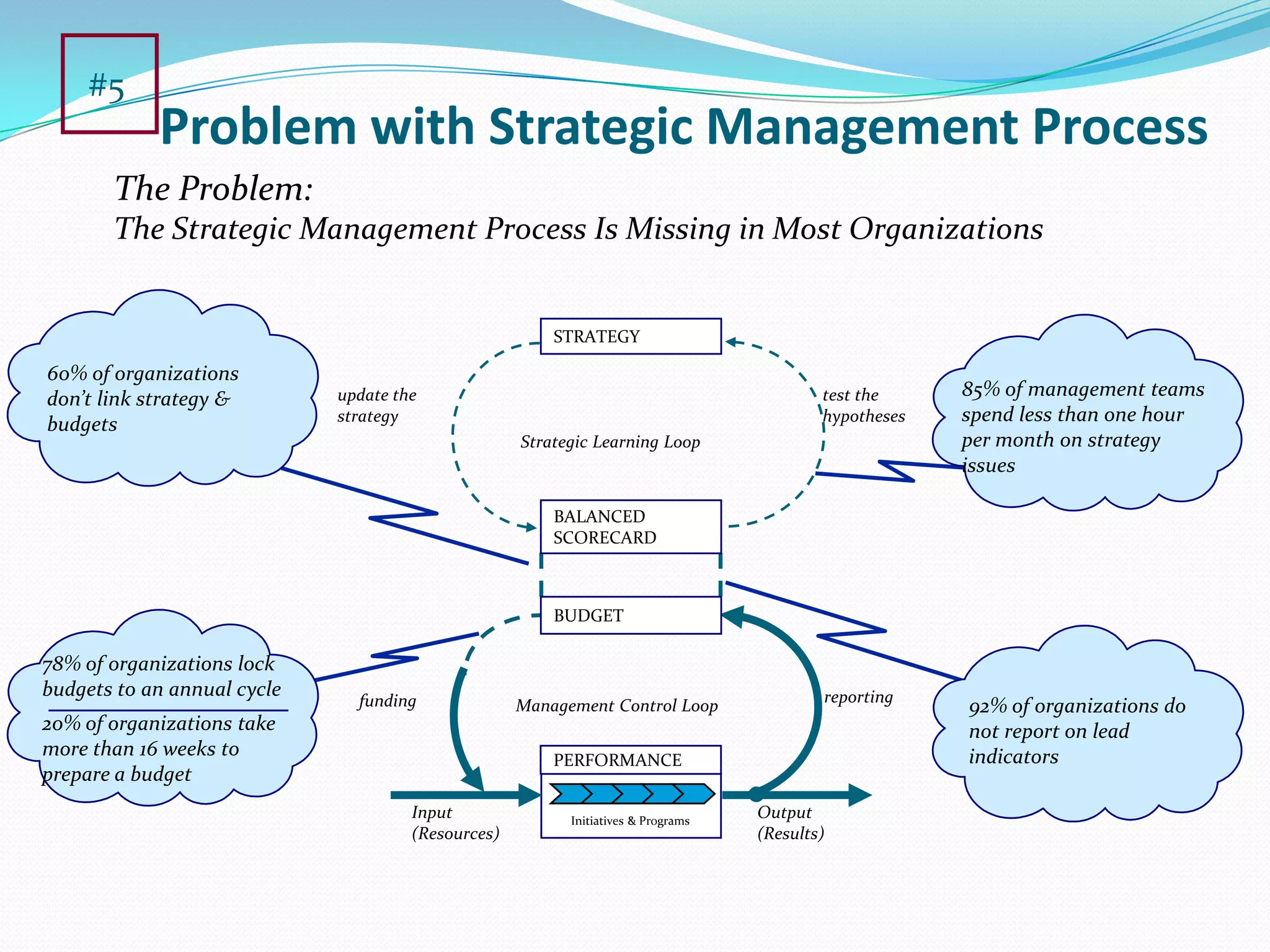

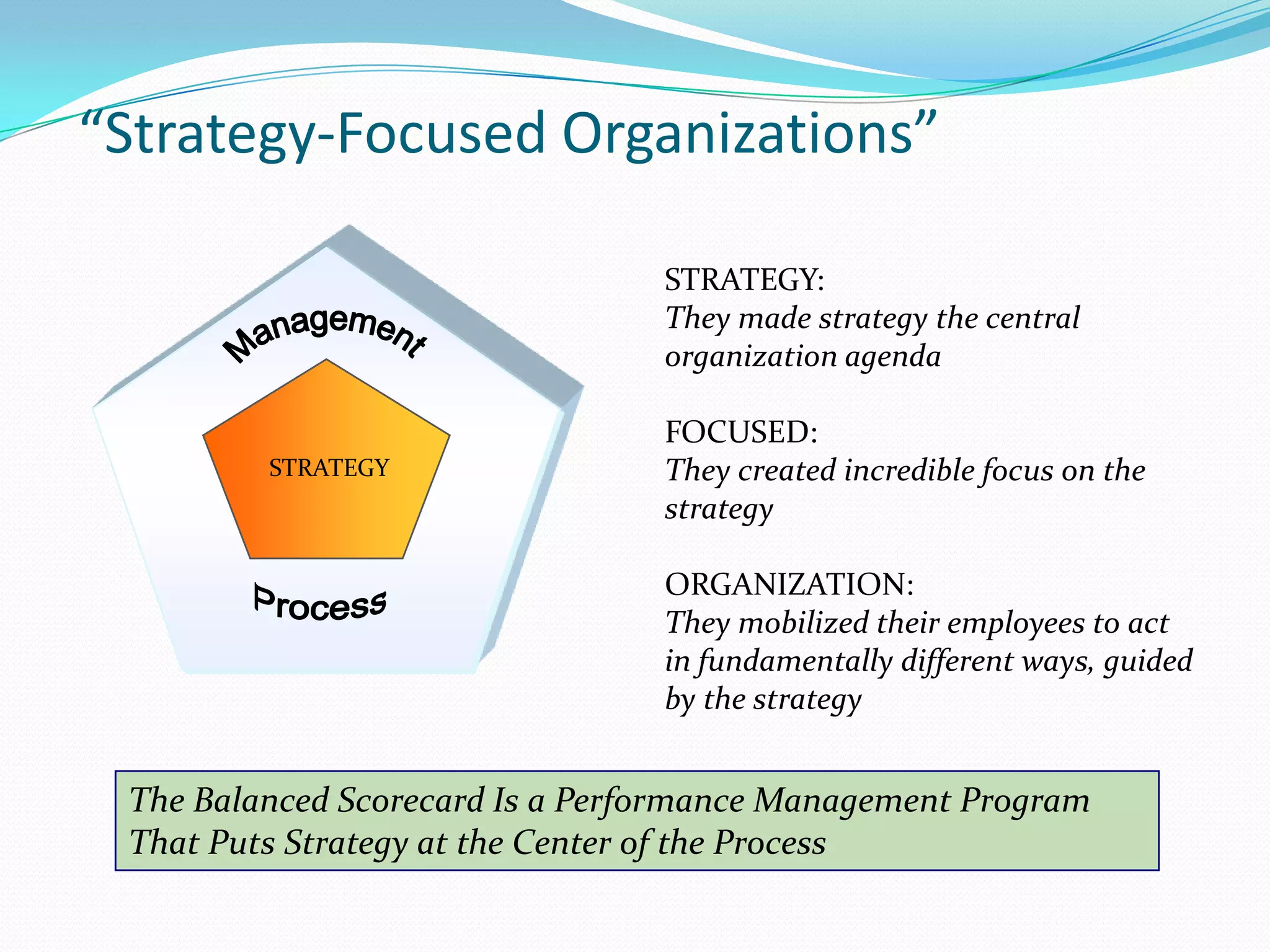

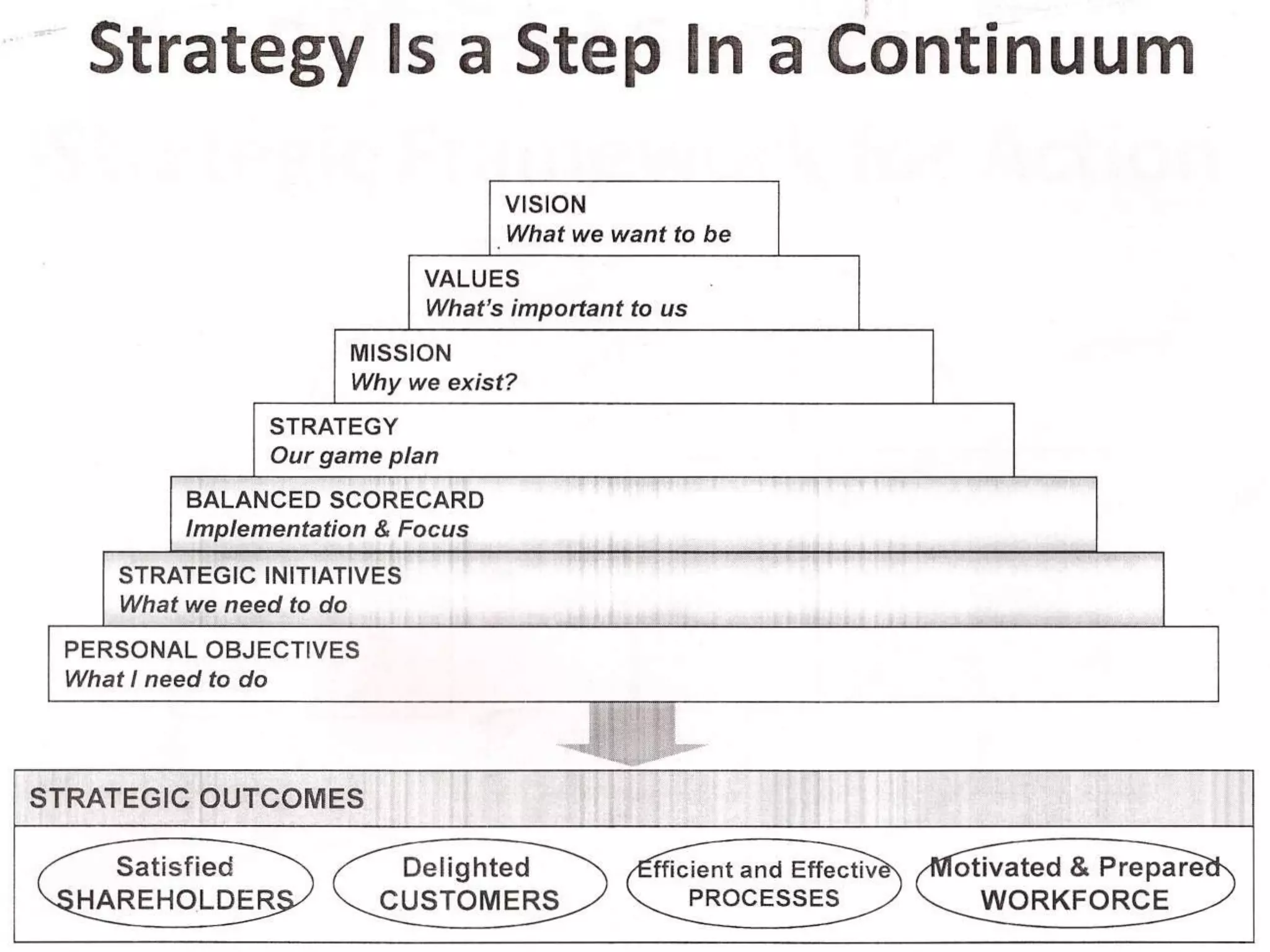

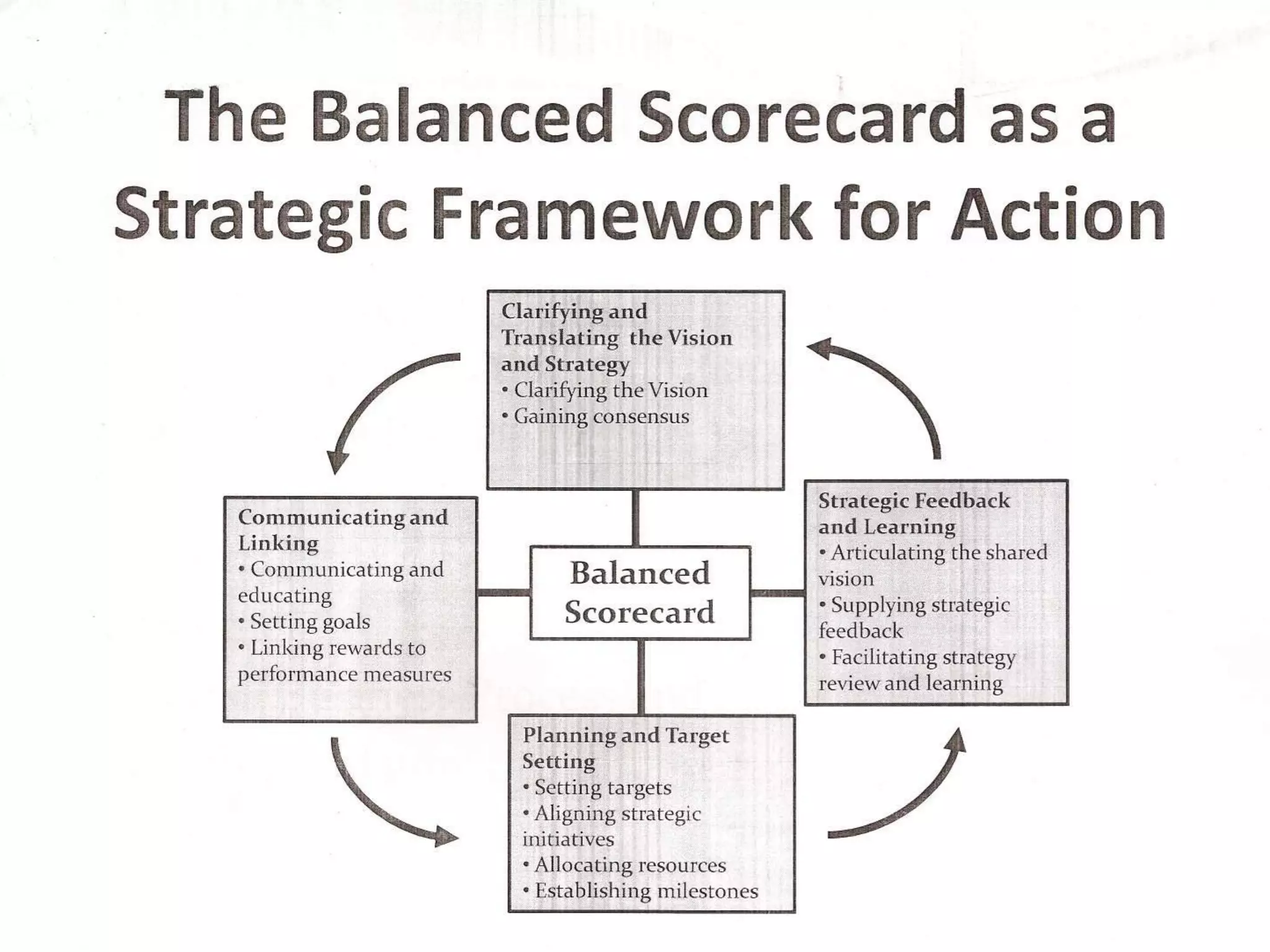

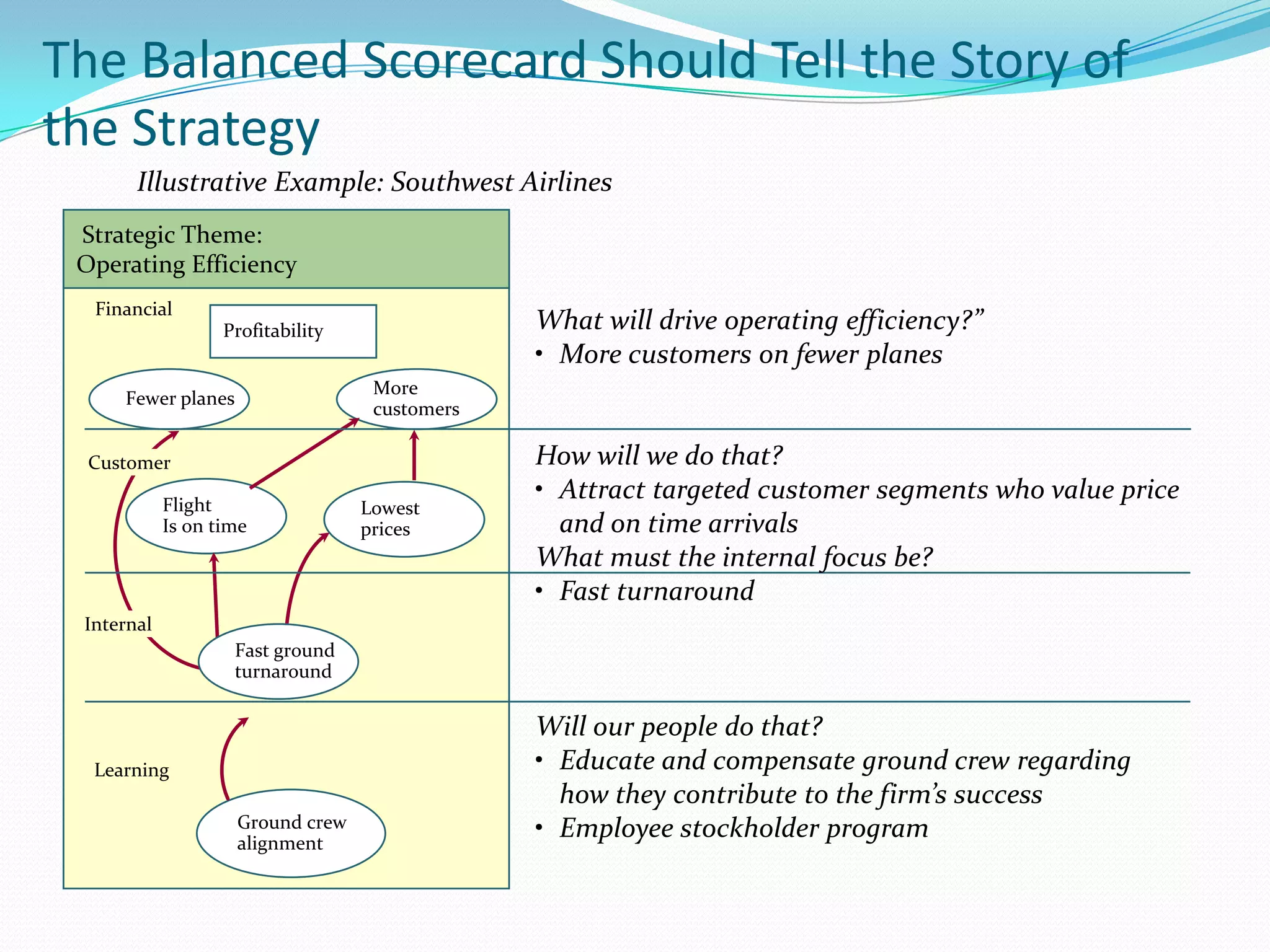

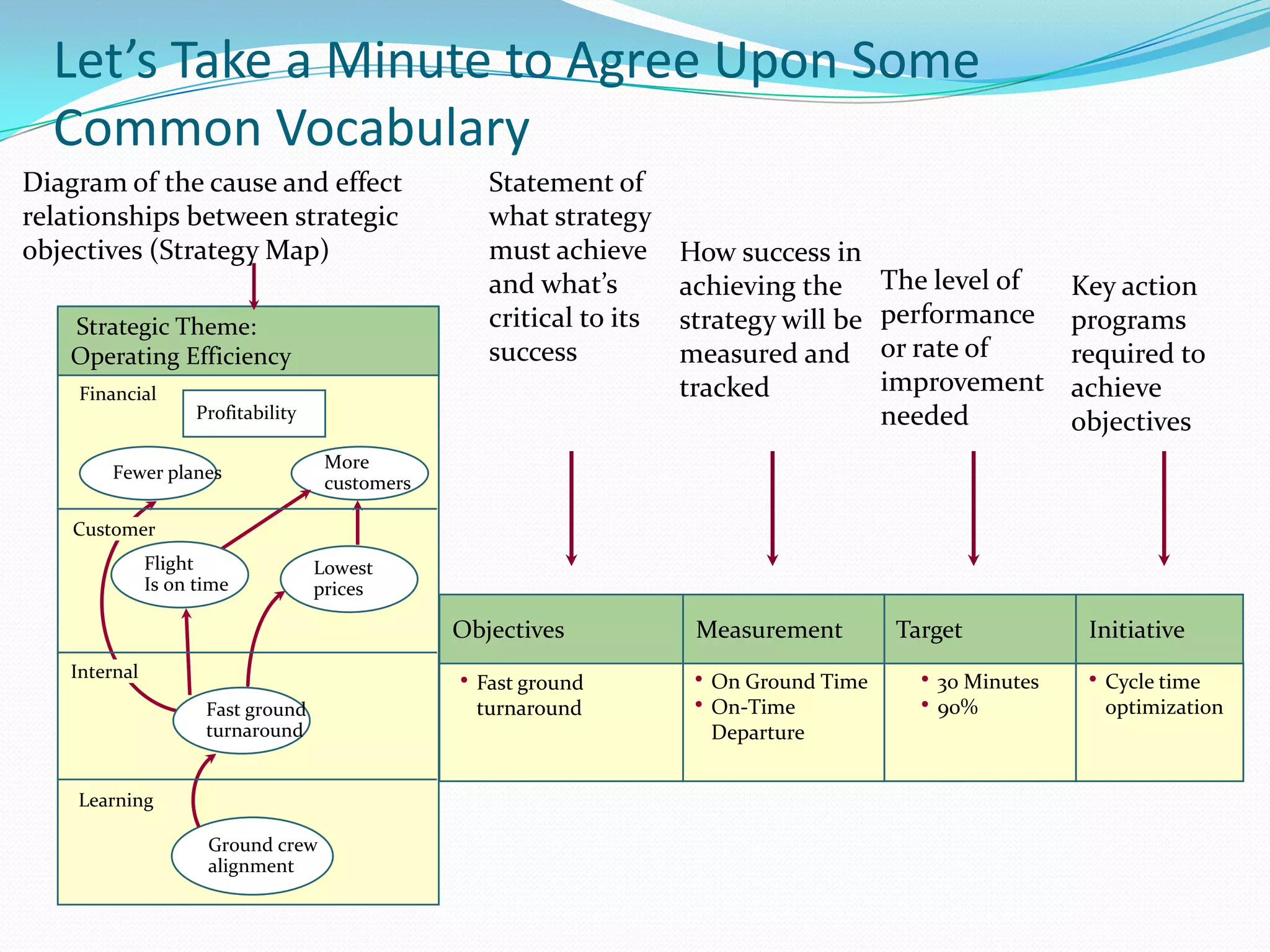

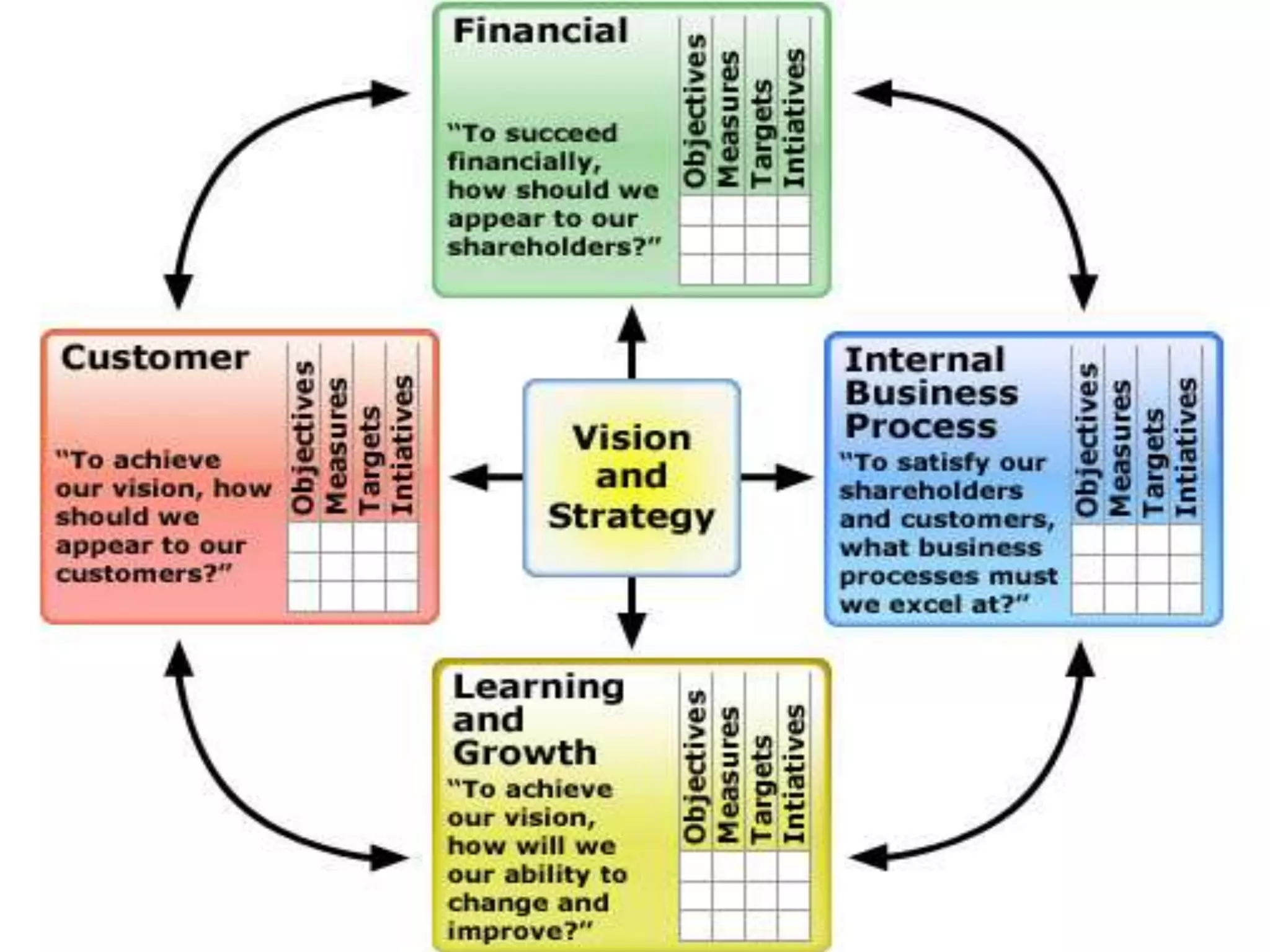

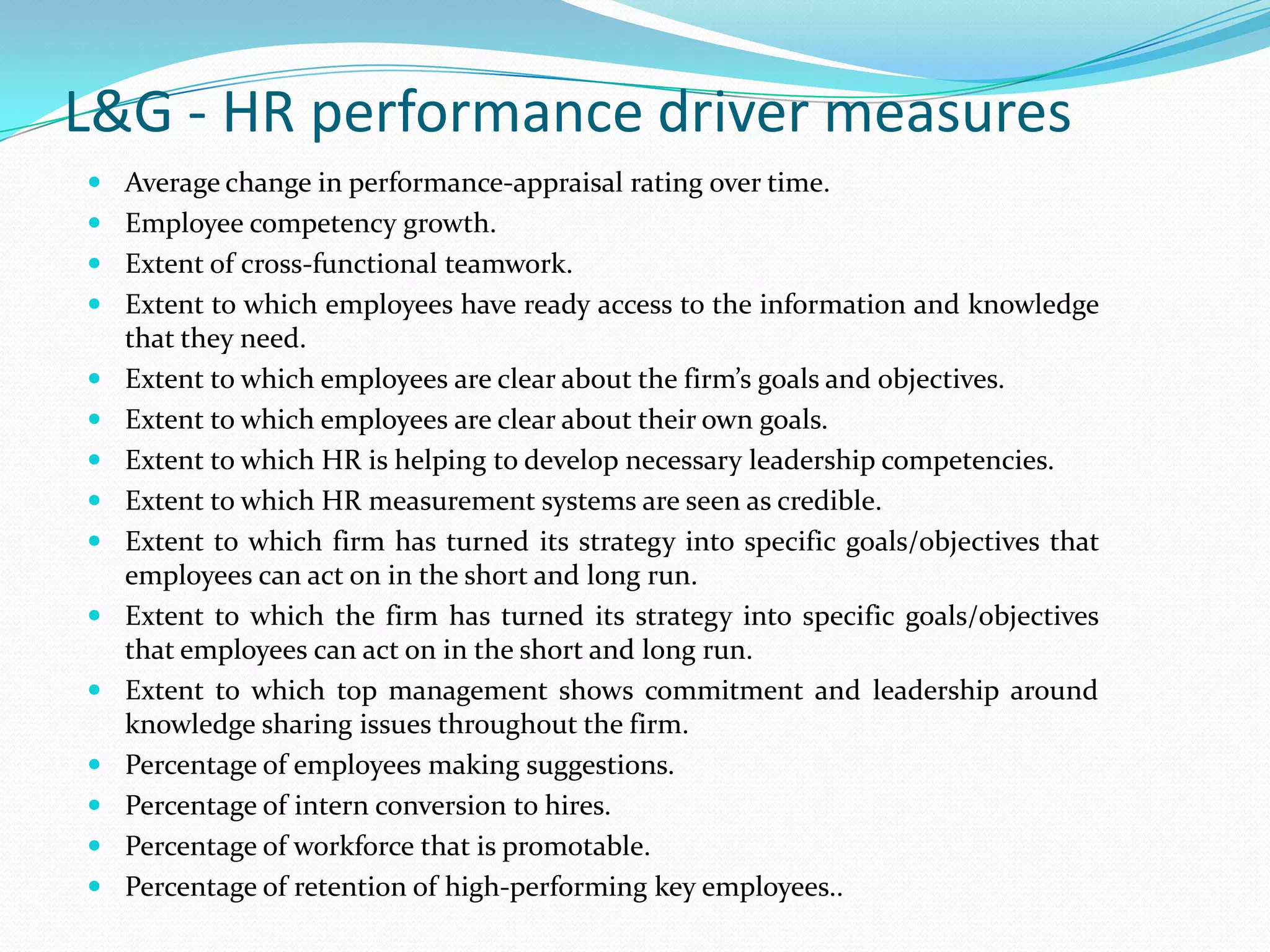

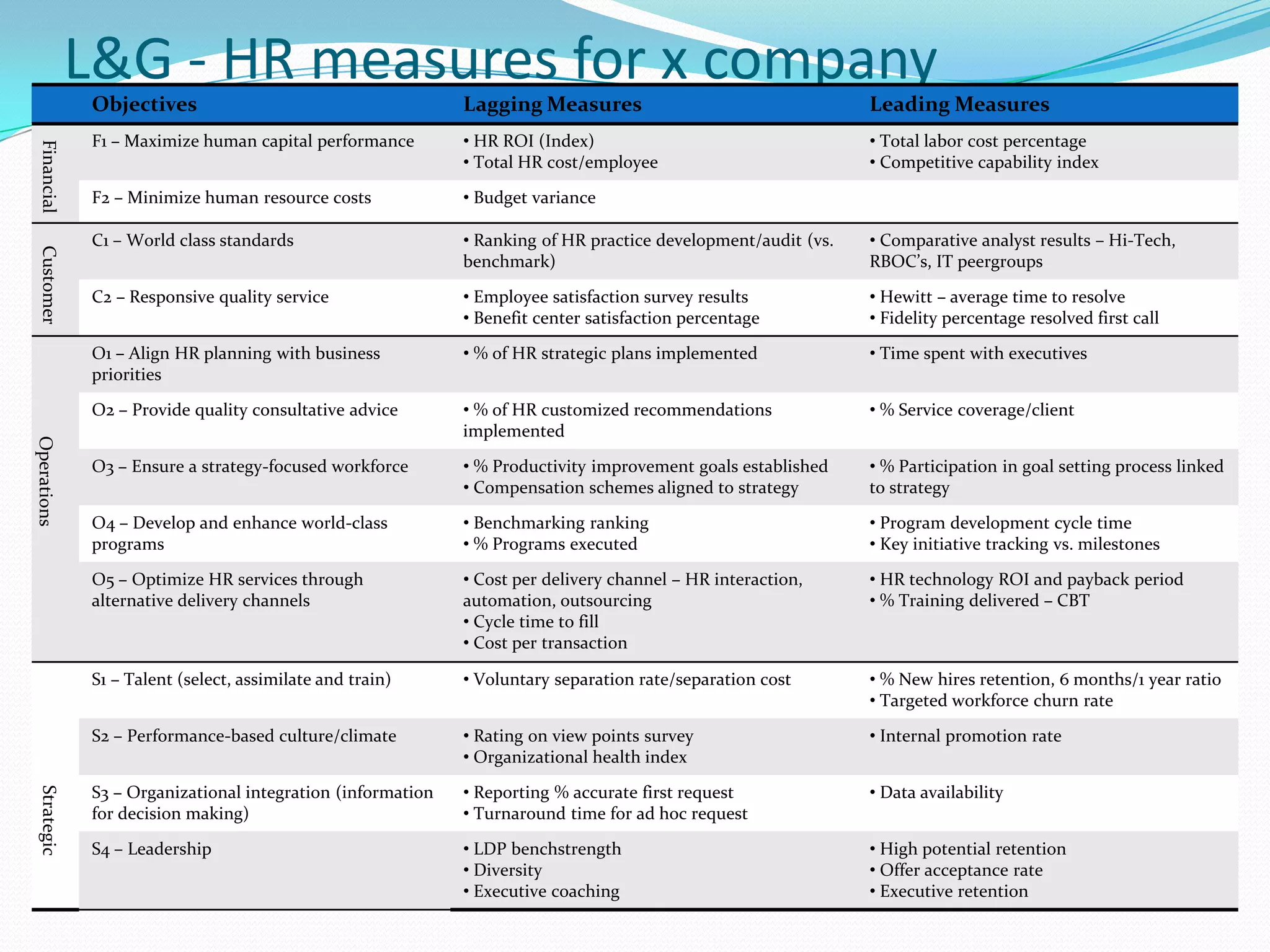

The document discusses the Balanced Scorecard framework. It provides background on why organizations struggle with strategy execution and the development of the Balanced Scorecard as a performance management tool. The Balanced Scorecard translates an organization's strategy into objectives and measures across four perspectives: financial, customer, internal processes, and learning and growth. It allows organizations to link strategic objectives, measure performance, and track initiatives.