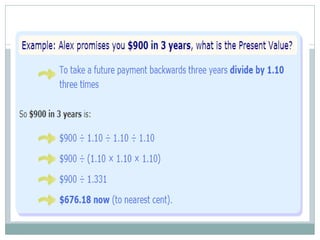

This document provides an overview of the BA4 - Basic Finance course. It defines basic finance as the management of assets and money with the primary goals of increasing profit and minimizing risks. The document discusses different sources of capital for businesses, including owners' savings and loans from banks or creditors. It also outlines key goals of business finance such as maximizing profit, profitability, and present net worth while maintaining adequate cash flow and balancing risks and returns. Net present value is defined as the value now of all future cash flows from an investment discounted at a given interest rate.