This presentation provides an overview of Axis Bank, the third largest private sector bank in India. Some key points:

- Axis Bank was founded in 1993 as UTI Bank and renamed in 2005. It is headquartered in Mumbai with over 2,900 branches and 12,700 ATMs.

- The bank's vision is to pursue global benchmarks in profitability, efficiency, and risk management while excelling in customer service.

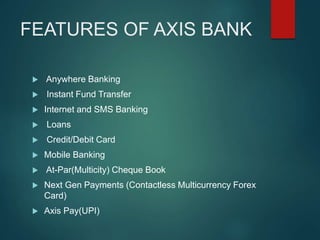

- Products and services include savings and credit cards, loans, mobile and internet banking. Innovations include lifestyle banking apps and youth accounts.

- An analysis of the bank's strengths, weaknesses, opportunities, and threats is provided.

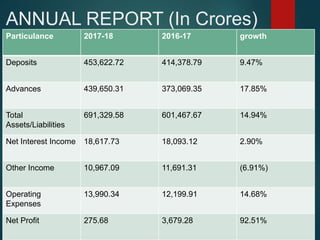

- Annual report figures for 2017-18 show deposits