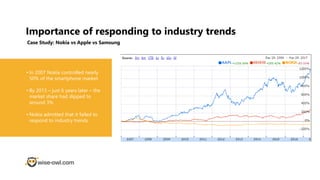

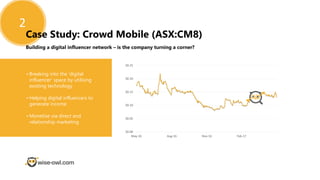

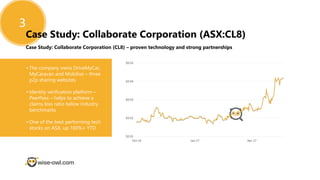

This document discusses industry trends in technology and retail and provides examples of how companies can benefit or be disrupted by responding to trends. It identifies three key trends: 1) mobile payments are growing rapidly, benefiting payment processors, retailers, and banks, 2) social commerce is expanding online shopping through social media and influencers, and 3) collaborative consumption through platforms like Airbnb and Uber is unlocking value from underutilized assets. Case studies show how Trade Me, Crowd Mobile, and Collaborate Corporation have leveraged these trends. The conclusion emphasizes that companies must adapt to remain competitive.