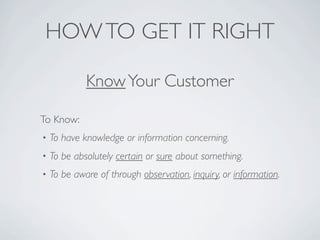

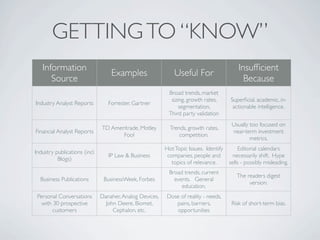

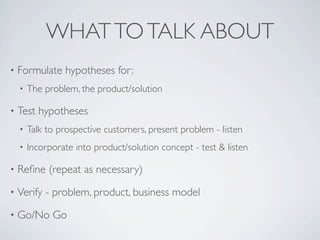

The document provides guidance for marketing in startups. It discusses the current economic environment which favors proven revenue streams and fast payback periods. It distinguishes strategic from tactical marketing and emphasizes the importance of understanding customers through conversations to develop and refine product concepts. The document advises marketing a solution to a well-defined customer problem and testing hypotheses directly with prospective customers.