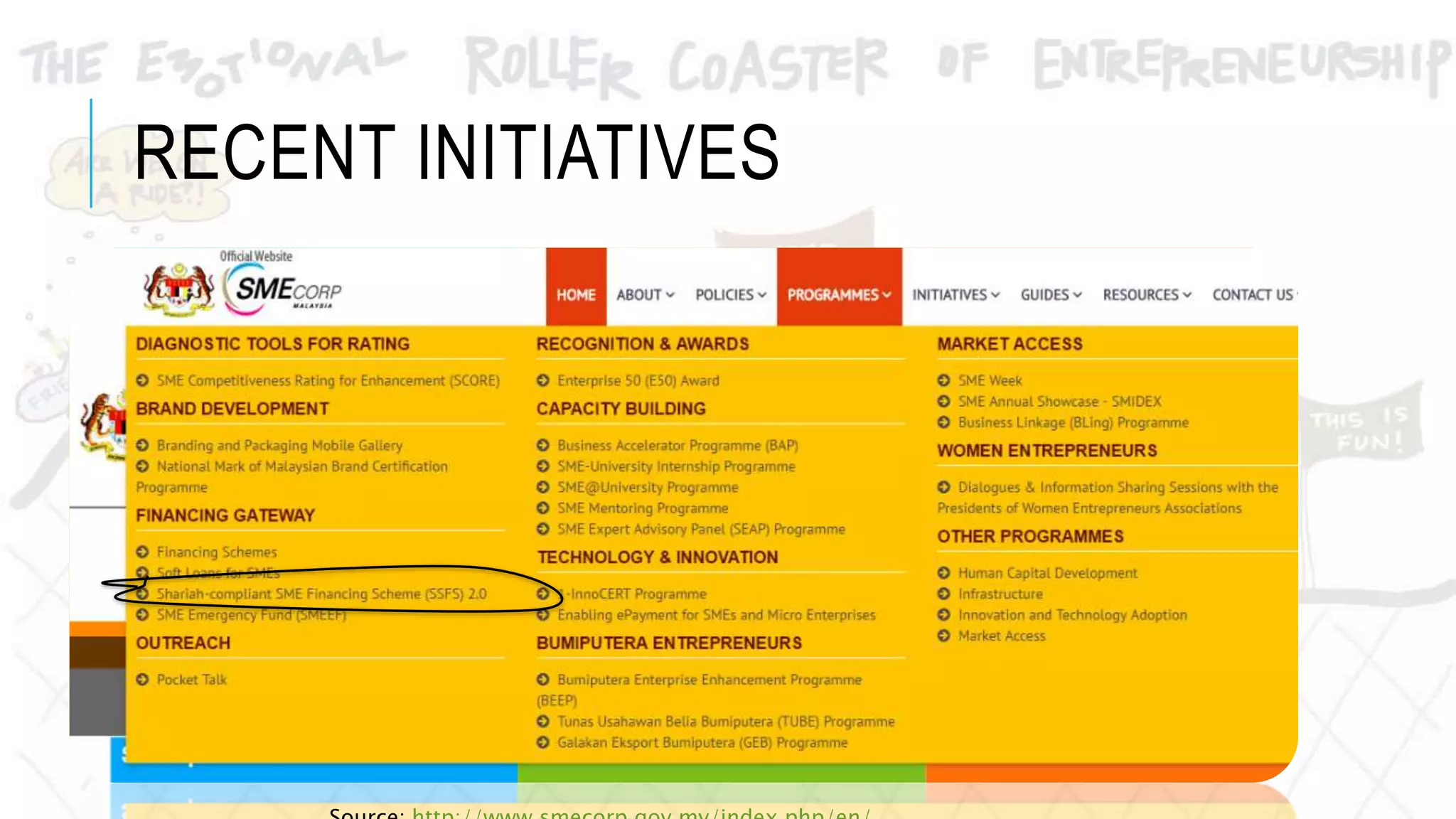

The document discusses entrepreneurship within the context of fintech and Islamic finance, focusing on the Malaysian startup landscape and global trends. It highlights the role of various organizations, initiatives, and regulatory measures like the fintech sandbox in fostering innovation and supporting entrepreneurship. It also touches on the importance of startups for job creation, attracting investment, and building an ecosystem for growth.