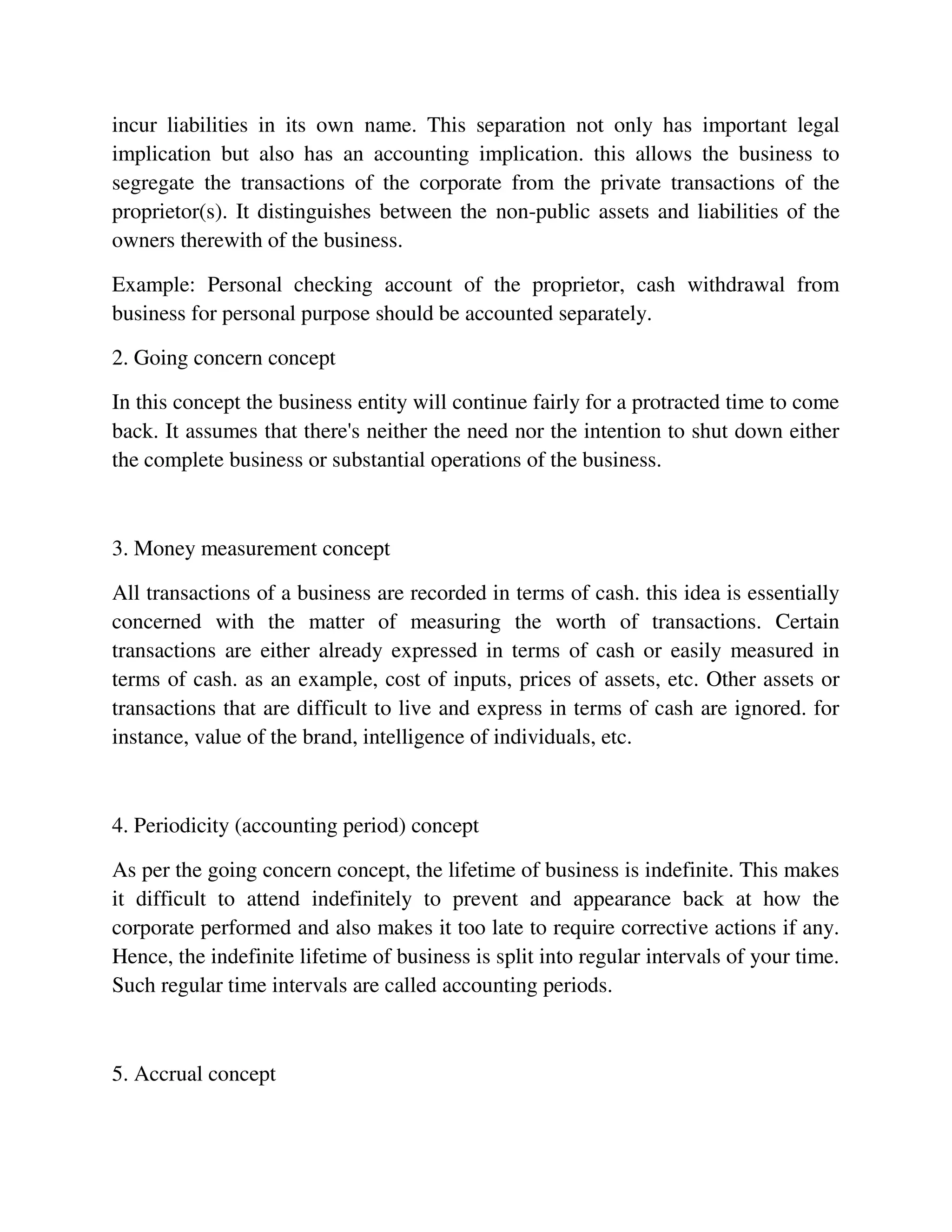

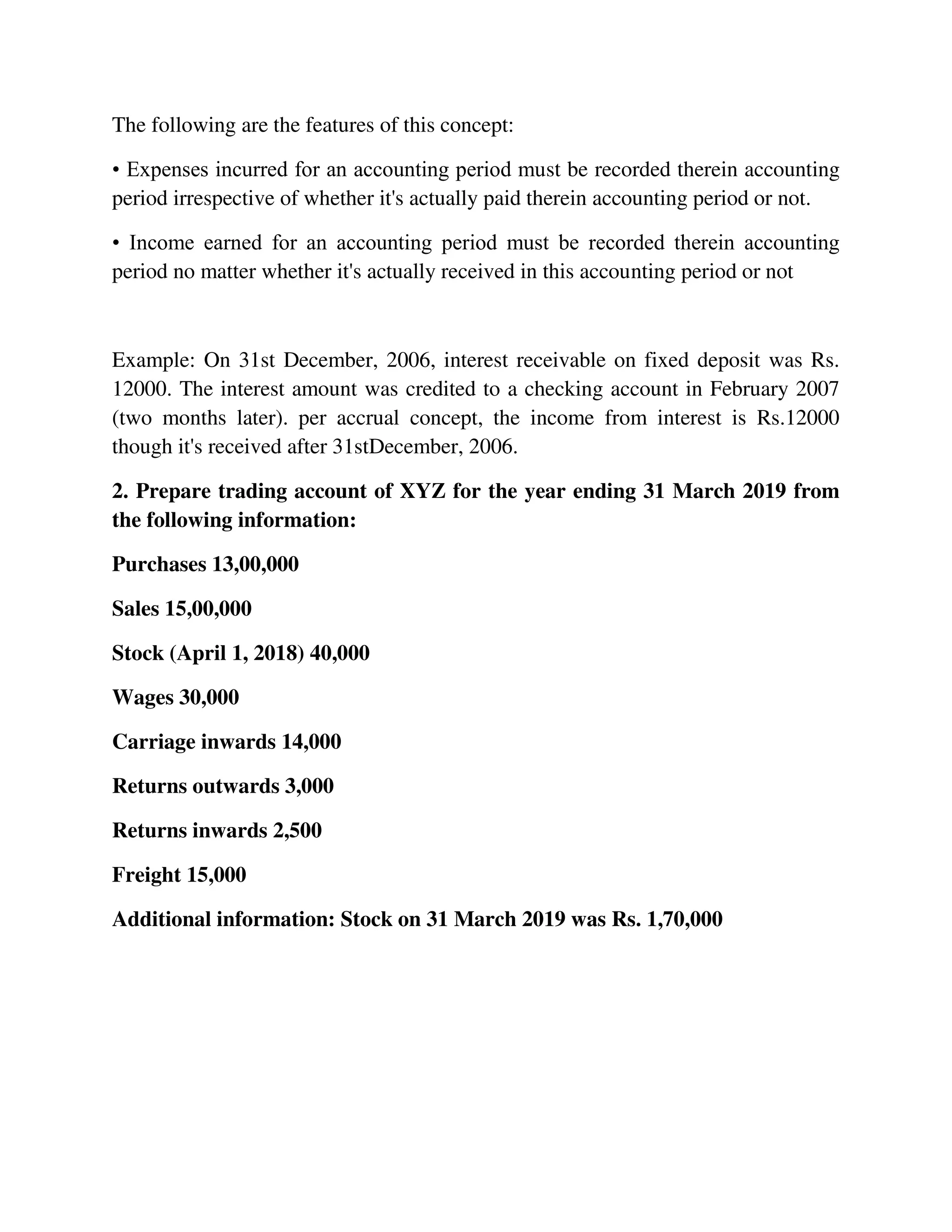

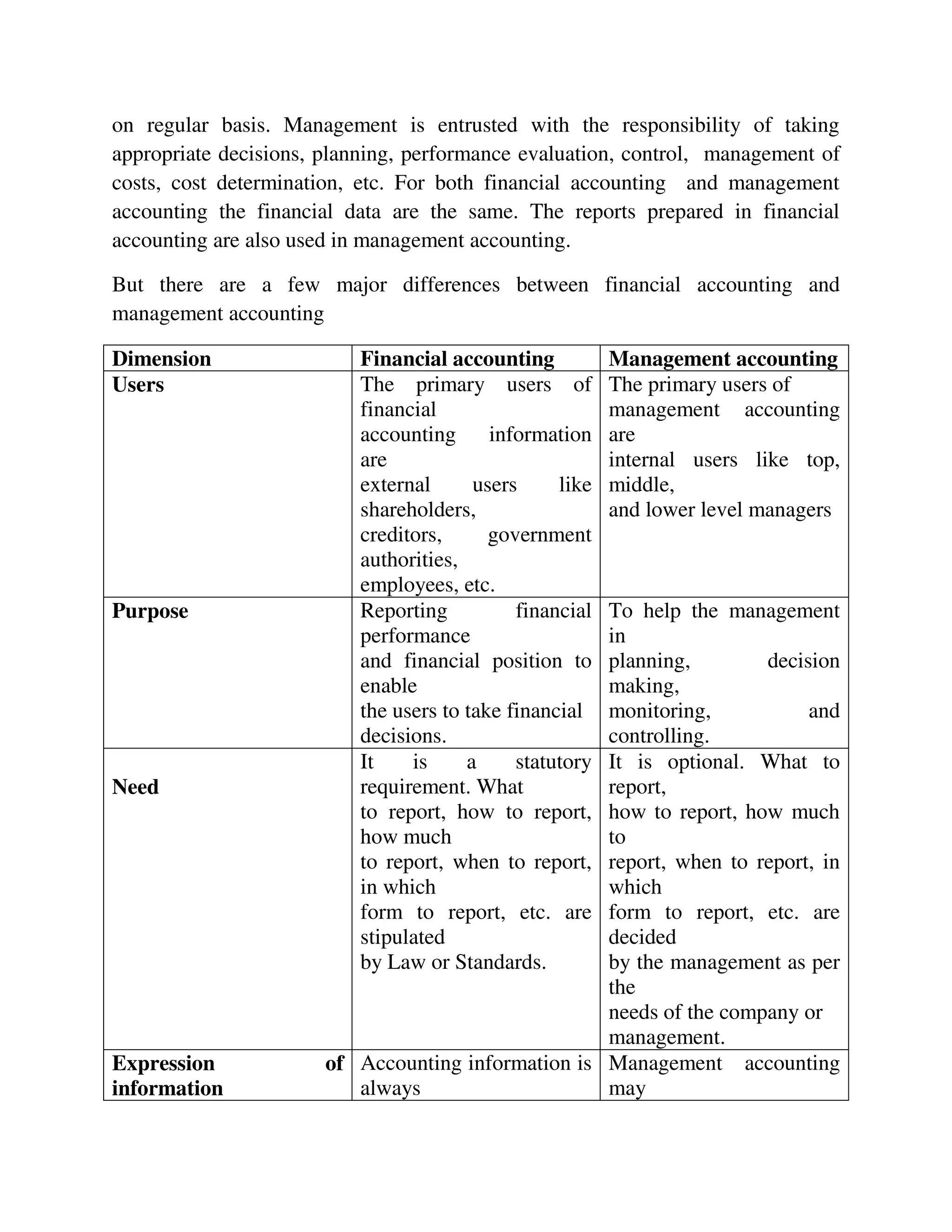

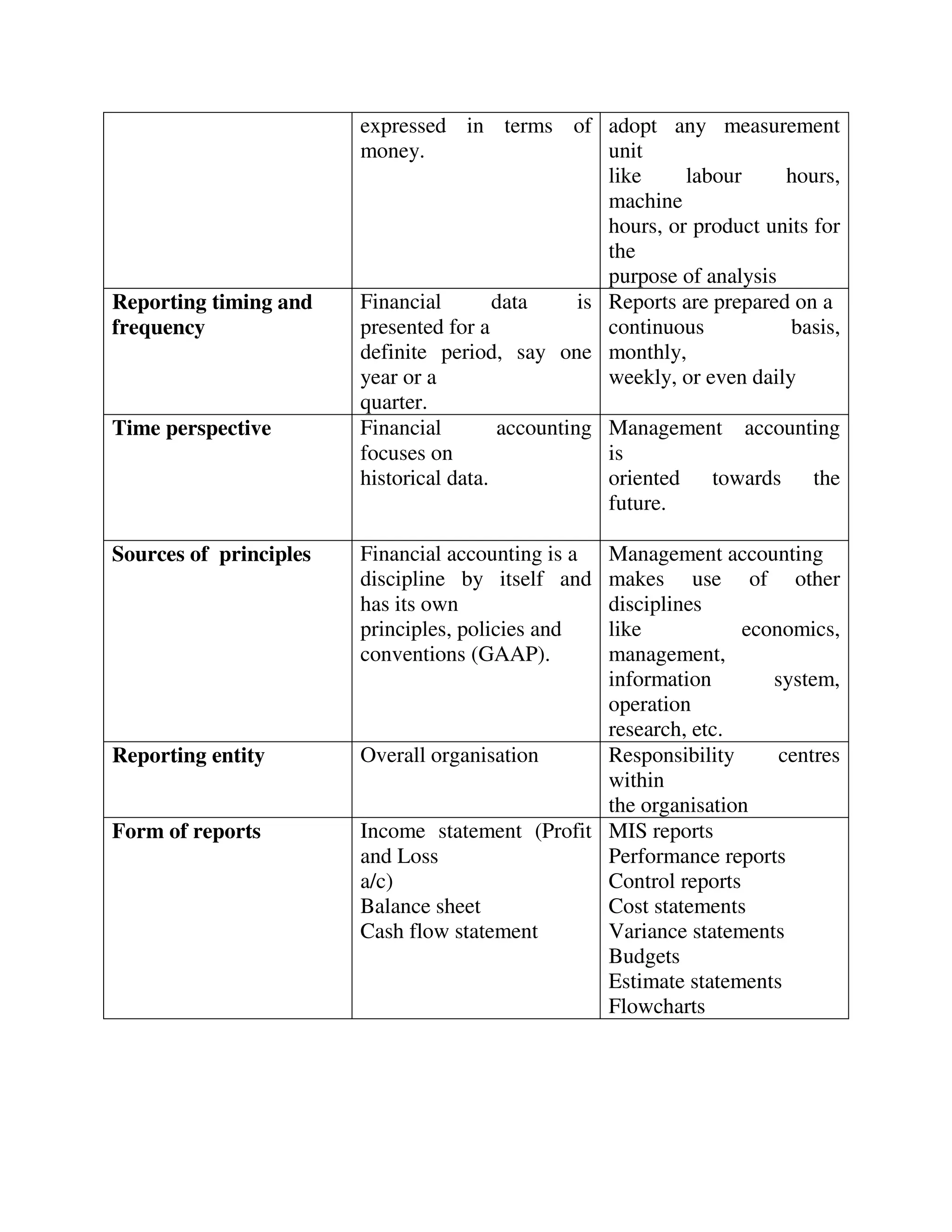

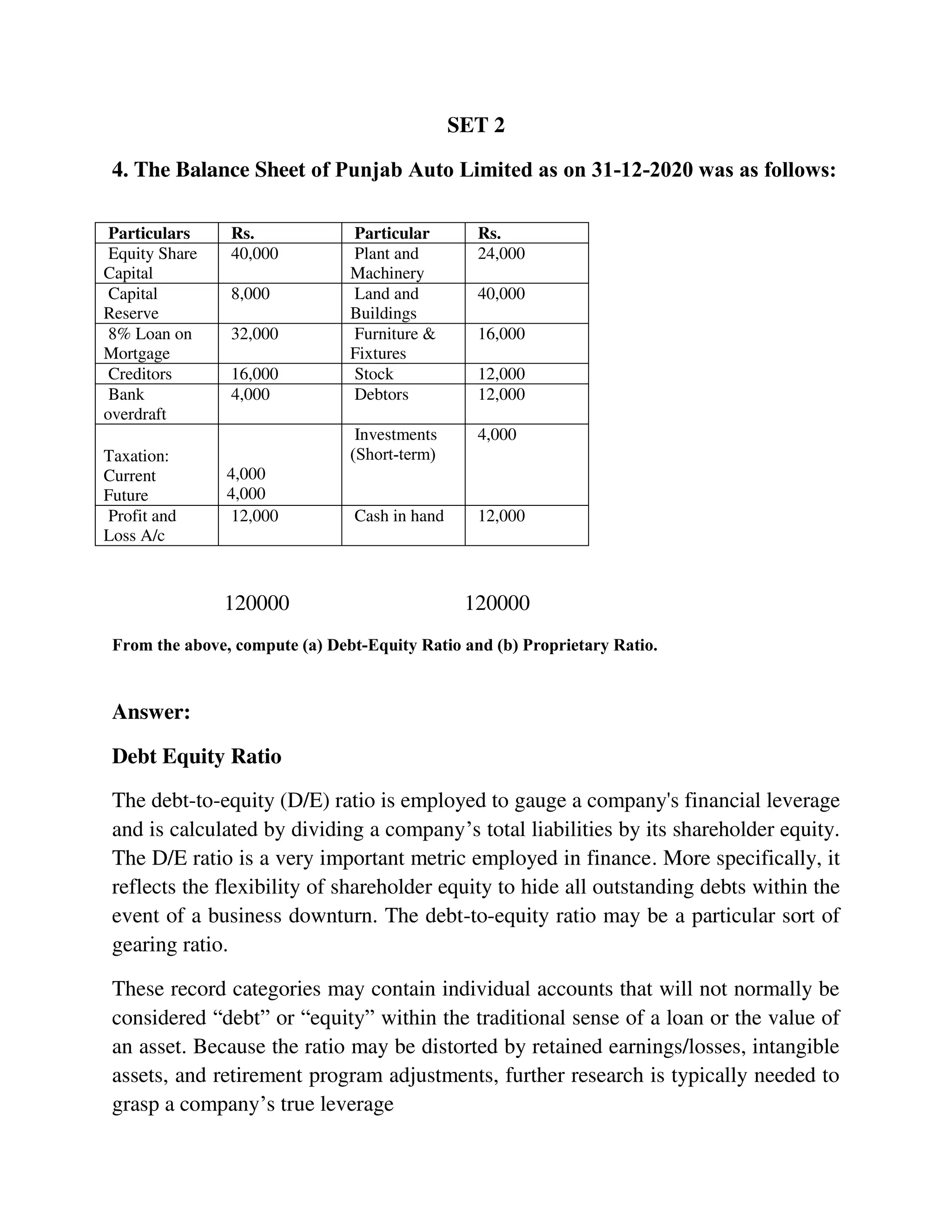

This document contains information about an MBA program session from July/August 2021, including course details and student responses to assignments. The assignments include discussing 5 accounting concepts with examples, preparing a trading account, and distinguishing between management accounting and financial accounting. It also includes the balance sheet of a company and calculations of debt-equity and proprietary ratios based on the information provided. The purpose of a cash flow statement is to analyze changes in a company's cash position and the sources and uses of cash. Examples of cash flows include receipts from customers and payments to suppliers for operating activities.