Localiza Rent a Car reported its 4Q12 and full year 2012 results. Key highlights include:

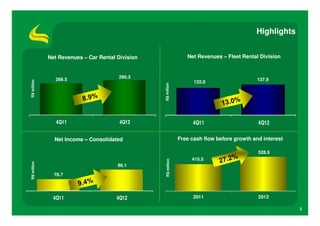

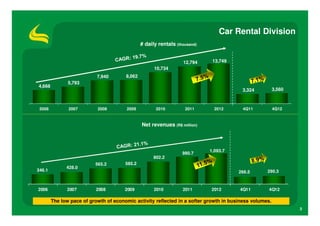

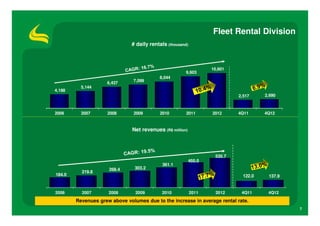

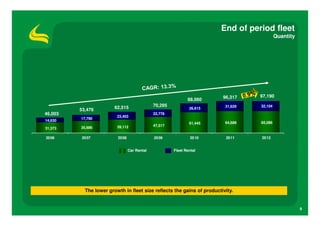

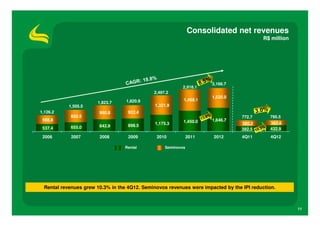

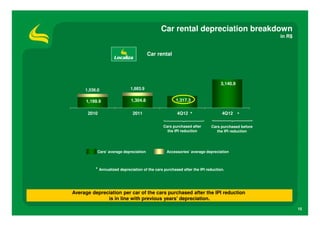

1) Net revenue from car rentals increased 7.9% in 4Q12 and 10.3% for the full year compared to the previous periods.

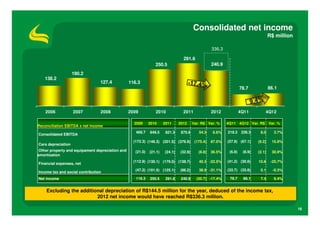

2) Net income increased 10.1% in 4Q12 and 11.1% for the full year.

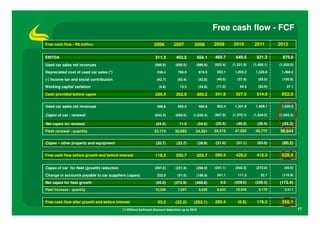

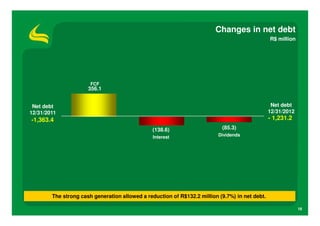

3) Free cash flow before growth and interest increased 27.3% for the full year.

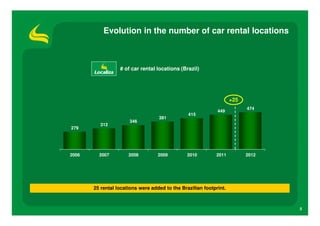

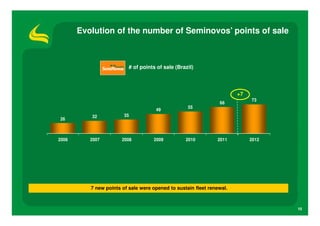

4) The company added 25 new rental locations in Brazil, expanding its footprint.