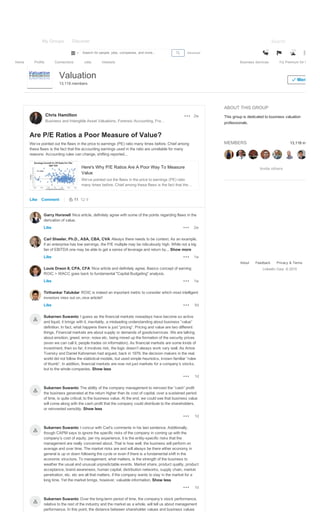

Are P/E Ratios a Poor Measure of Value? Valuation LinkedIn Discussion

•

1 like•793 views

This group is dedicated to business valuation professionals and includes discussions on various topics related to business valuation. Recent discussions include comments on an article about flaws in using price to earnings ratios to measure value, with members agreeing the accounting earnings used can be unreliable. Other discussions focus on returns on invested capital being an important metric, the difference between stock pricing and business value, and the importance of entity-specific risks to management versus market risks.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

John McGonagle • EPI Advisors, LLC

- Understanding the relevance of risk-adjusted returns by Dave Walton

- Strongest jobs gain since 2012 surprises markets

- Building stronger visibility for an advisory firm (Rodger Sprouse, Titan Securities)John McGonagle, CFP, CRPC – Proactive Advisor Magazine – Volume 4, Issue 11

John McGonagle, CFP, CRPC – Proactive Advisor Magazine – Volume 4, Issue 11Proactive Advisor Magazine

More Related Content

What's hot

What's hot (20)

Growth Framework: A tool for analysing growth opportunities in financial and ...

Growth Framework: A tool for analysing growth opportunities in financial and ...

Kimble Johnson – Proactive Advisor Magazine – Volume 3, Issue 1

Kimble Johnson – Proactive Advisor Magazine – Volume 3, Issue 1

EffectivePortfolioDimensionality_StandardLifeInvestments.PDF

EffectivePortfolioDimensionality_StandardLifeInvestments.PDF

Similar to Are P/E Ratios a Poor Measure of Value? Valuation LinkedIn Discussion

John McGonagle • EPI Advisors, LLC

- Understanding the relevance of risk-adjusted returns by Dave Walton

- Strongest jobs gain since 2012 surprises markets

- Building stronger visibility for an advisory firm (Rodger Sprouse, Titan Securities)John McGonagle, CFP, CRPC – Proactive Advisor Magazine – Volume 4, Issue 11

John McGonagle, CFP, CRPC – Proactive Advisor Magazine – Volume 4, Issue 11Proactive Advisor Magazine

Similar to Are P/E Ratios a Poor Measure of Value? Valuation LinkedIn Discussion (20)

John McGonagle, CFP, CRPC – Proactive Advisor Magazine – Volume 4, Issue 11

John McGonagle, CFP, CRPC – Proactive Advisor Magazine – Volume 4, Issue 11

Venture 360 Report Overview For Entrepreneurs 1232000447204805 2

Venture 360 Report Overview For Entrepreneurs 1232000447204805 2

Venture 360 Report Overview For Entrepreneurs 1232000447204805 2

Venture 360 Report Overview For Entrepreneurs 1232000447204805 2

eToro startup & mgnt 2.0 course - Class 03 value systems

eToro startup & mgnt 2.0 course - Class 03 value systems

2016 IVCA Viewpoint - The Art+Science of Investing in Private Companies

2016 IVCA Viewpoint - The Art+Science of Investing in Private Companies

More from Futurum2

More from Futurum2 (20)

Catatan kecil atas Peraturan Menteri Keuangan Nomor 191/PMK.010/2015 tentang ...

Catatan kecil atas Peraturan Menteri Keuangan Nomor 191/PMK.010/2015 tentang ...

Use average internal rate of return (airr), don't use internal rate of return...

Use average internal rate of return (airr), don't use internal rate of return...

A quick comment on pablo fernandez' article capm an absurd model draft

A quick comment on pablo fernandez' article capm an absurd model draft

Menggunakan informasi arus kas dan nilai kini dalam pengukuran akuntansi

Menggunakan informasi arus kas dan nilai kini dalam pengukuran akuntansi

Summing up about growing and non growing perpetuities wacc levered and tax sa...

Summing up about growing and non growing perpetuities wacc levered and tax sa...

Ignacio Velez-Pareja : From the Slide Rule to the Black Berry

Ignacio Velez-Pareja : From the Slide Rule to the Black Berry

REIT “rasa indonesia” kontrak investasi kolektif dana investasi real estat

REIT “rasa indonesia” kontrak investasi kolektif dana investasi real estat

Proyek remodel refresh di sektor ritel kapitalisasi vs dibiayakan psak ias 1...

Proyek remodel refresh di sektor ritel kapitalisasi vs dibiayakan psak ias 1...

Surplus revaluasi atau penilaian kembali aset tetap

Surplus revaluasi atau penilaian kembali aset tetap

Perpetuity and growing pepetuity formula derivation

Perpetuity and growing pepetuity formula derivation

Pentingnya melakukan normalisasi dalam pengerjaan proyeksi dan valuasi - bagi...

Pentingnya melakukan normalisasi dalam pengerjaan proyeksi dan valuasi - bagi...

15 minute lesson formula derivation - reconciling price-to- earnings (pe rati...

15 minute lesson formula derivation - reconciling price-to- earnings (pe rati...

15-minute lesson- watch out the formula that you use for roa (return on assets)

15-minute lesson- watch out the formula that you use for roa (return on assets)

Pentingnya melakukan normalisasi dalam pengerjaan proyeksi dan valuasi - bagi...

Pentingnya melakukan normalisasi dalam pengerjaan proyeksi dan valuasi - bagi...

Apakah perhitungan biaya kapital rata rata tertimbang (wacc) dalam capital bu...

Apakah perhitungan biaya kapital rata rata tertimbang (wacc) dalam capital bu...

PSAK 22 (revisi 2010) - bab 2 biaya terkait akuisisi & biaya transaksi

PSAK 22 (revisi 2010) - bab 2 biaya terkait akuisisi & biaya transaksi

Recently uploaded

Resume

• Real GDP growth slowed down due to problems with access to electricity caused by the destruction of manoeuvrable electricity generation by Russian drones and missiles.

• Exports and imports continued growing due to better logistics through the Ukrainian sea corridor and road. Polish farmers and drivers stopped blocking borders at the end of April.

• In April, both the Tax and Customs Services over-executed the revenue plan. Moreover, the NBU transferred twice the planned profit to the budget.

• The European side approved the Ukraine Plan, which the government adopted to determine indicators for the Ukraine Facility. That approval will allow Ukraine to receive a EUR 1.9 bn loan from the EU in May. At the same time, the EU provided Ukraine with a EUR 1.5 bn loan in April, as the government fulfilled five indicators under the Ukraine Plan.

• The USA has finally approved an aid package for Ukraine, which includes USD 7.8 bn of budget support; however, the conditions and timing of the assistance are still unknown.

• As in March, annual consumer inflation amounted to 3.2% yoy in April.

• At the April monetary policy meeting, the NBU again reduced the key policy rate from 14.5% to 13.5% per annum.

• Over the past four weeks, the hryvnia exchange rate has stabilized in the UAH 39-40 per USD range.

Monthly Economic Monitoring of Ukraine No. 232, May 2024

Monthly Economic Monitoring of Ukraine No. 232, May 2024Інститут економічних досліджень та політичних консультацій

Recently uploaded (20)

how can I sell pi coins after successfully completing KYC

how can I sell pi coins after successfully completing KYC

Monthly Economic Monitoring of Ukraine No. 232, May 2024

Monthly Economic Monitoring of Ukraine No. 232, May 2024

The European Unemployment Puzzle: implications from population aging

The European Unemployment Puzzle: implications from population aging

Industry Insights - Financial Performance & Valuation Trends

Industry Insights - Financial Performance & Valuation Trends

Introduction to Economics II Chapter 28 Unemployment (1).pdf

Introduction to Economics II Chapter 28 Unemployment (1).pdf

Greek trade a pillar of dynamic economic growth - European Business Review

Greek trade a pillar of dynamic economic growth - European Business Review

how can I transfer pi coins to someone in a different country.

how can I transfer pi coins to someone in a different country.

Jio Financial service Multibagger 2024 from India stock Market

Jio Financial service Multibagger 2024 from India stock Market

Webinar Exploring DORA for Fintechs - Simont Braun

Webinar Exploring DORA for Fintechs - Simont Braun

Are P/E Ratios a Poor Measure of Value? Valuation LinkedIn Discussion

- 1. My Groups Discover Search Valuation 13,118 members Member ABOUT THIS GROUP This group is dedicated to business valuation professionals. MEMBERS 13,118 members About Feedback LinkedIn Corp. © 2015 Garry Horsnell Nice article, definitely agree with some of the points regarding flaws in the derivation of value. Like 2w Carl Sheeler, Ph.D., ASA, CBA, CVA Always there needs to be context. As an example, if an enterprise has low earnings, the P/E multiple may be ridiculously high. While not a big fan of EBITDA one may be able to get a sense of leverage and return by... Show more Like 1w Louis Dreon II, CPA, CFA Nice article and definitely agree. Basics concept of earning ROIC > WACC goes back to fundamental "Capital Budgeting" analysis. Like 1w Tirthankar Talukdar ROIC is indeed an important metric to consider which most intelligent investors miss out on..nice article!! Like 5d Sukarnen Suwanto I guess as the financial markets nowadays have become so active and liquid, it brings with it, inevitably, a misleading understanding about business “value” definition. In fact, what happens there is just “pricing”. Pricing and value are two different things. Financial markets are about supply or demands of goods/services. We are talking about emotion, greed, error, noise etc. being mixed up the formation of the security prices (even we can call it, people trades on information). As financial markets are some kinds of investment, then so far, it involves risk, the logic doesn’t always work very well. As Amos Tversky and Daniel Kahneman had argued, back in 1979, the decision makers in the real world did not follow the statistical models, but used simple heuristics, known familiar “rules of thumb”. In addition, financial markets are now not just markets for a company’s stocks, but to the whole companies. Show less 1d Sukarnen Suwanto The ability of the company management to reinvest the “cash” profit the business generated at the return higher than its cost of capital, over a sustained period of time, is quite critical, to the business value. At the end, we could see that business value will come along with the cash profit that the company could distribute to the shareholders, or reinvested sensibly. Show less 1d Sukarnen Suwanto I concur with Carl’s comments in his last sentence. Additionally, though CAPM says to ignore the specific risks of the company in coming up with the company’s cost of equity, per my experience, it is the entityspecific risks that the management are really concerned about. That is how well, the business will perform on average and over time. The market risks are and will always be there either economy in general is up or down following the cycle or even if there is a fundamental shift in the economic structure. To management, what matters, is the strength of the business to weather the usual and unusual unpredictable events. Market share, product quality, product acceptance, brand awareness, human capital, distribution networks, supply chain, market penetration, etc. etc are all that matters, if the company wants to stay in the market for a long time. Yet the market brings, however, valuable information. Show less 1d Sukarnen Suwanto Over the longterm period of time, the company’s stock performance, relative to the rest of the industry and the market as a whole, will tell us about management performance. In this point, the distance between shareholder values and business values Chris Hamilton Business and Intangible Asset Valuations, Forensic Accounting, Fra… Are P/E Ratios a Poor Measure of Value? We’ve pointed out the flaws in the price to earnings (PE) ratio many times before. Chief among these flaws is the fact that the accounting earnings used in the ratio are unreliable for many reasons: Accounting rules can change, shifting reported... Here's Why P/E Ratios Are A Poor Way To Measure Value We’ve pointed out the flaws in the price to earnings (PE) ratio many times before. Chief among these flaws is the fact that the… accounting earnings used in the ratio are unreliable for many Like Comment 11 9 2w Invite others Privacy & Terms Home Profile Connections Jobs Interests Business Services Try Premium for free Advanced Search for people, jobs, companies, and more... 98 332