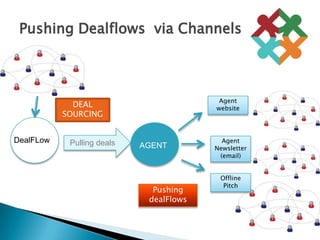

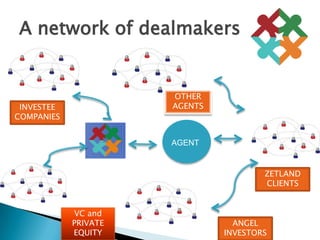

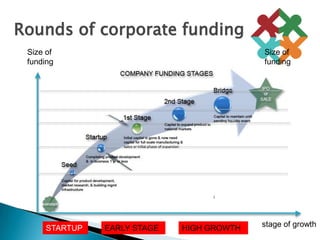

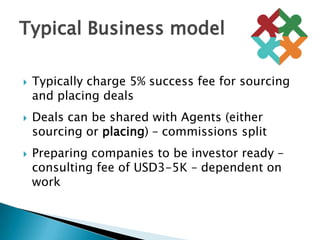

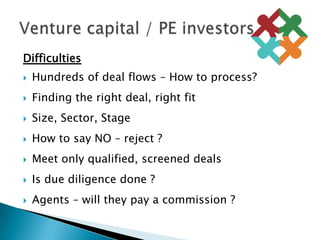

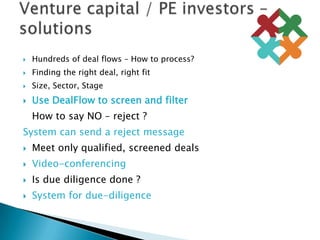

The document discusses an Asia Pacific DealFlow platform that aims to connect companies seeking funding with corporate finance agents and investors. It provides an overview of the objectives of the AP DealFlow platform, how it can source deals and push deal flows to investors, and the typical business models of agents who use the platform. The document also outlines some difficulties faced by companies, agents, angel investors, and venture capital/PE investors, and proposes solutions that the AP DealFlow platform could provide.