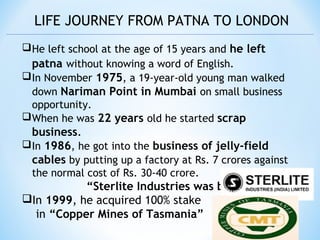

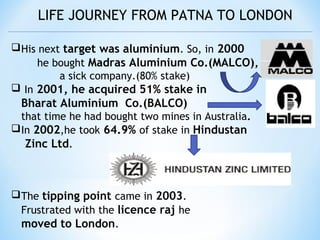

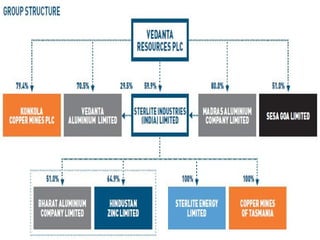

Anil Agarwal was born in Patna, Bihar and left school at age 15 without knowing English. He began as a scrap metal dealer in Mumbai and founded Sterlite Industries in 1986. Through acquisitions of struggling metal companies starting in 2000, he built Vedanta Resources, becoming one of India's most prominent metals entrepreneurs. Frustrated with bureaucracy, he moved operations to London in 2003 and continued expanding Vedanta's global operations through numerous acquisitions over the following decade.