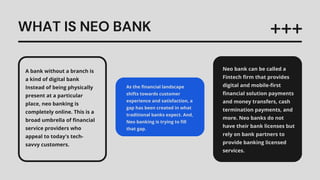

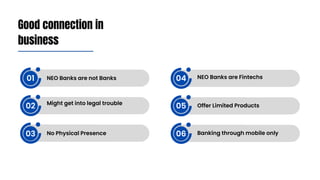

The document discusses neo banks, which are digital-only banks that operate without physical branches. Some key points:

- Neo banks first emerged between 2013-2015 and provide digital and mobile-first financial services like payments, money transfers, and cash management.

- They work by partnering with licensed banks to provide regulated banking services through their digital platforms.

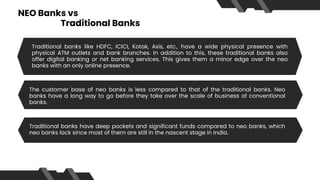

- While neo banks offer a modernized customer experience, traditional banks still have a physical presence advantage.

- The global neo banking market has grown exponentially in recent years and is projected to continue strong growth, though challenges remain around business models, regulations, and trust for some customers.