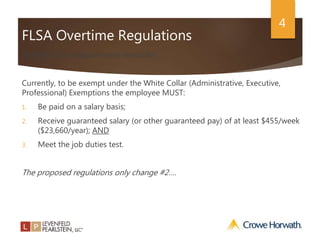

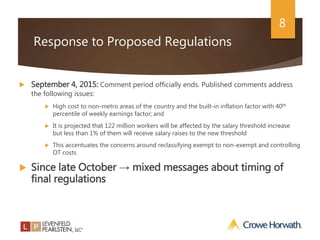

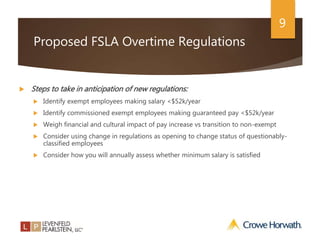

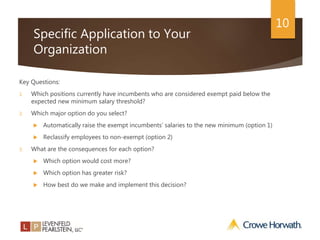

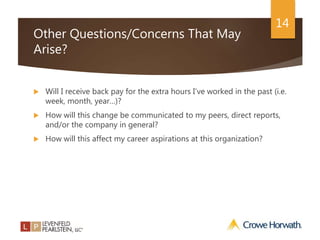

The document discusses proposed changes to the Fair Labor Standards Act regulations that would increase the minimum salary threshold for exempt employees. It is expected that the final regulations will be issued in 2016 and will likely increase the minimum guaranteed pay to $970 per week or $50,440 annually. For organizations, the key steps are to identify employees currently classified as exempt who make less than the new threshold, analyze options to raise salaries or reclassify as non-exempt, and develop a communication and implementation strategy. FAQs and consistent messaging will be important to address employee questions and concerns through the change process.