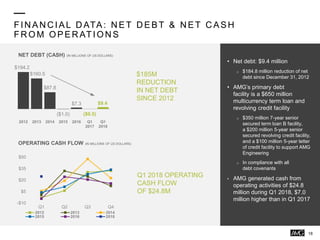

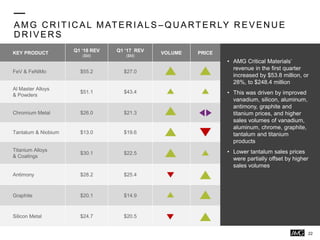

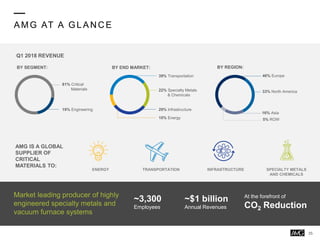

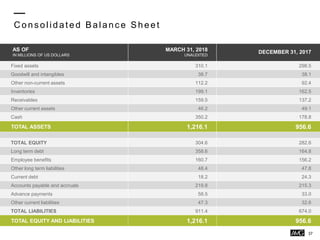

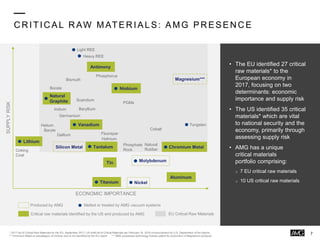

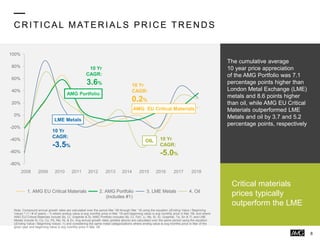

AMG is a global critical materials company focused on CO2 reduction through enabling and mitigating technologies. It has a strong capital structure with no net debt and is positioned for growth through disciplined organic expansion and acquisitions. AMG has presence in 7 EU-designated critical raw materials and 10 US-designated critical materials. Prices for critical materials in AMG's portfolio have historically outperformed benchmark metals and oil indices. AMG operates businesses in vanadium conversion, superalloys, and mining/recycling of critical materials to supply growing demand.

![C R ITIC AL MATER IALS PR IC ES: H ISTOR IC AL PR IC IN G

9

• Metal prices are measured

on a scale of 0 to 10, with 0

and 10 representing the

minimum and maximum

average quarterly prices

occurring since the end of

2005

• The positions demonstrate

the current price level of

each metal with respect to

their various historical price

points since the end of 2005

AMG’s relevant

prices have started

to move out of the

bottom quartiles

6.0

2.8

1.2

7.7

3.6

4.0

8.7

7.9

6.6

8.6

5.1

3.7

3.1

1.4

0.5

1.9

3.2 3.2

0.0

5.4

3.0

6.8

0.7

3.7

0

2.5

5

7.5

10

Scale

Metals

Mar 2018 Position Mar 2017 Position

Highest

Price

Lowest

Price

Note: Metal Positions are measured on a scale of 0 to 10, with 0 being the minimum price and 10 being the maximum price. They are calculated

using the formula [(Dec ‘05 ending value – min. monthly avg) / (max. monthly avg – min. monthly avg) *10] where maximum and minimum

monthly averages are measured over the period 31 Dec ‘05 through 31 Mar ’18; graphite prices are per Benchmark Minerals, showing five year

historical data.

Cr Mo Ni FeV Ti Al C Si Ta SbNbLi

[unchanged]](https://image.slidesharecdn.com/amginvestorpresentationmay2018-180502063630/85/AMG-Investor-Presentation-May-2018-9-320.jpg)