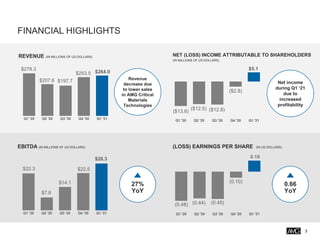

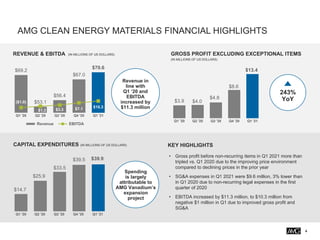

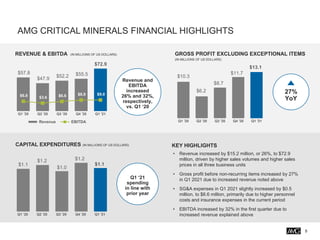

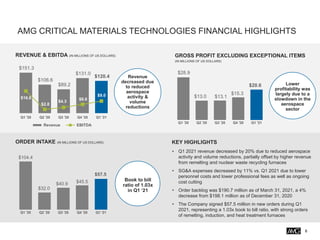

The document provides an investor presentation for AMG Advanced Metallurgical Group N.V. for the first quarter of 2021. It summarizes the company's financial highlights and performance across its business segments. Some key points:

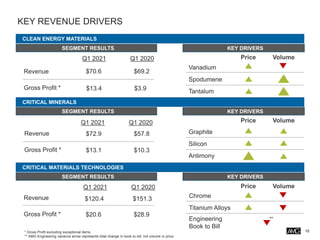

- Revenue decreased year-over-year for AMG Critical Materials Technologies due to reduced aerospace activity, but increased for AMG Clean Energy Materials and AMG Critical Minerals due to higher sales volumes and prices.

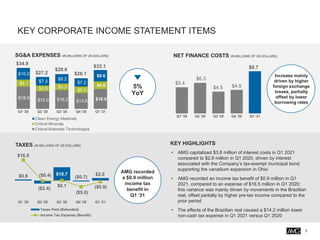

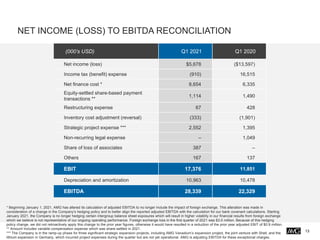

- Net income increased significantly compared to the first quarter of 2020, driven by improved profitability across segments.

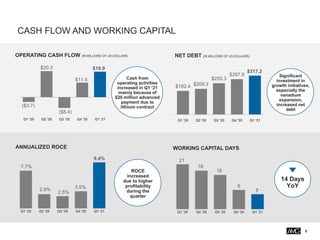

- Capital expenditures were largely attributable to AMG Vanadium's expansion project.

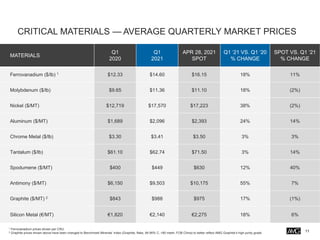

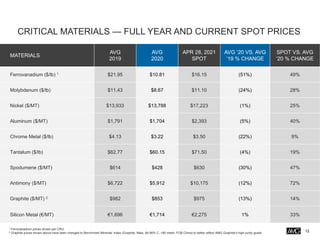

- Average market prices increased year-over-year for many critical materials.