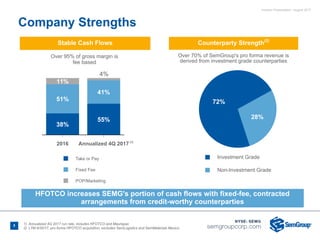

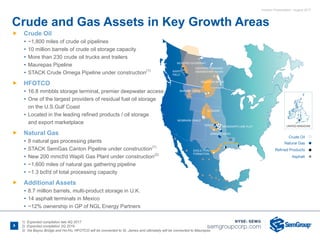

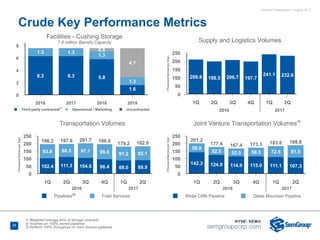

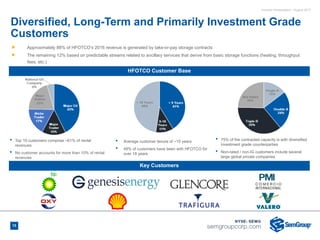

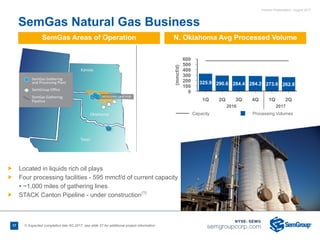

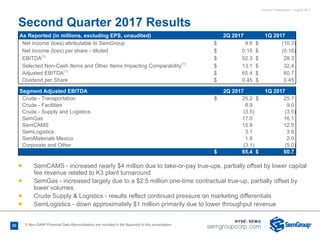

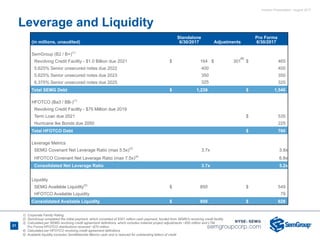

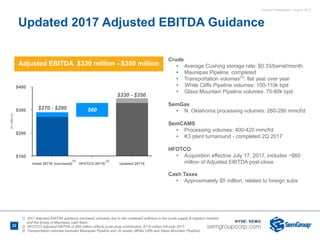

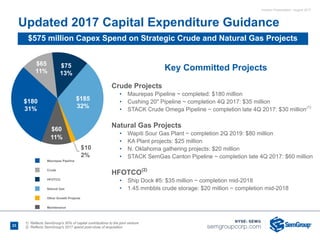

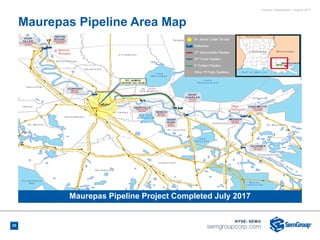

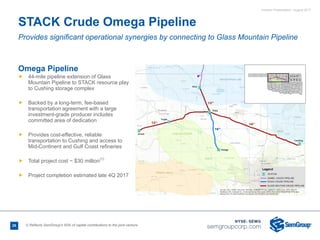

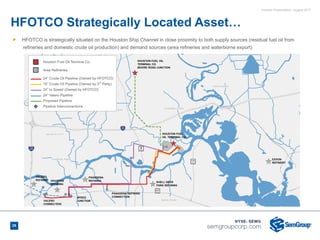

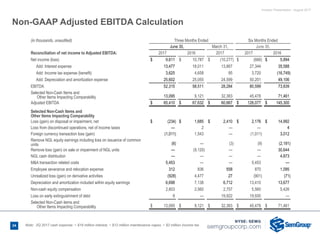

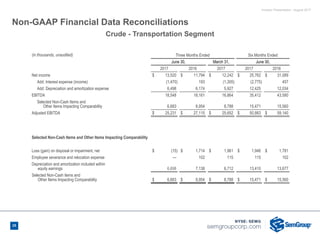

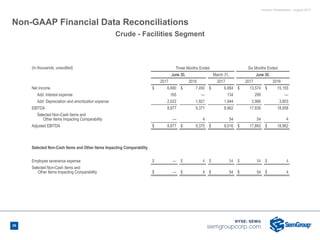

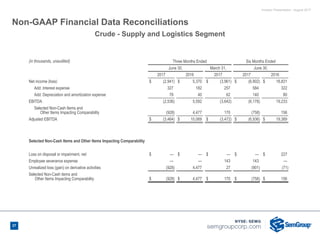

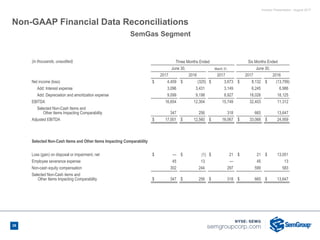

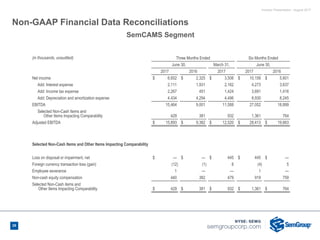

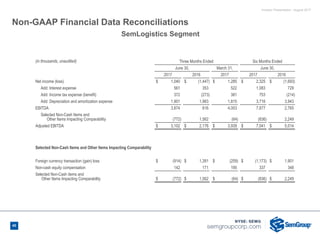

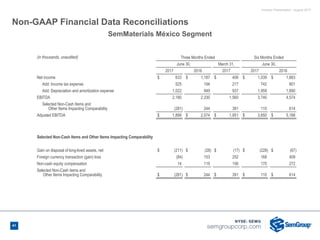

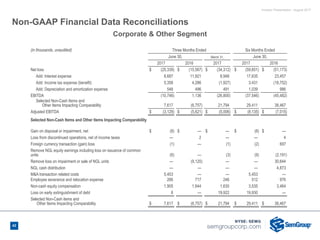

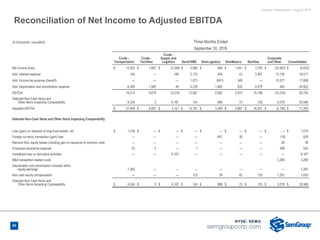

This document provides an investor presentation for SemGroup's second quarter 2017 results. It discusses SemGroup's non-GAAP financial measure of Adjusted EBITDA, noting that it excludes certain items to increase comparability between reporting periods. It also contains forward-looking statements regarding SemGroup's prospects, financial performance, annual dividend growth, and other matters. Finally, it outlines SemGroup's strategy of transforming into a diversified energy infrastructure company through acquisitions in the Gulf Coast, STACK play, and Duvernay/Montney regions to generate stable cash flows under contracts with investment-grade counterparties.