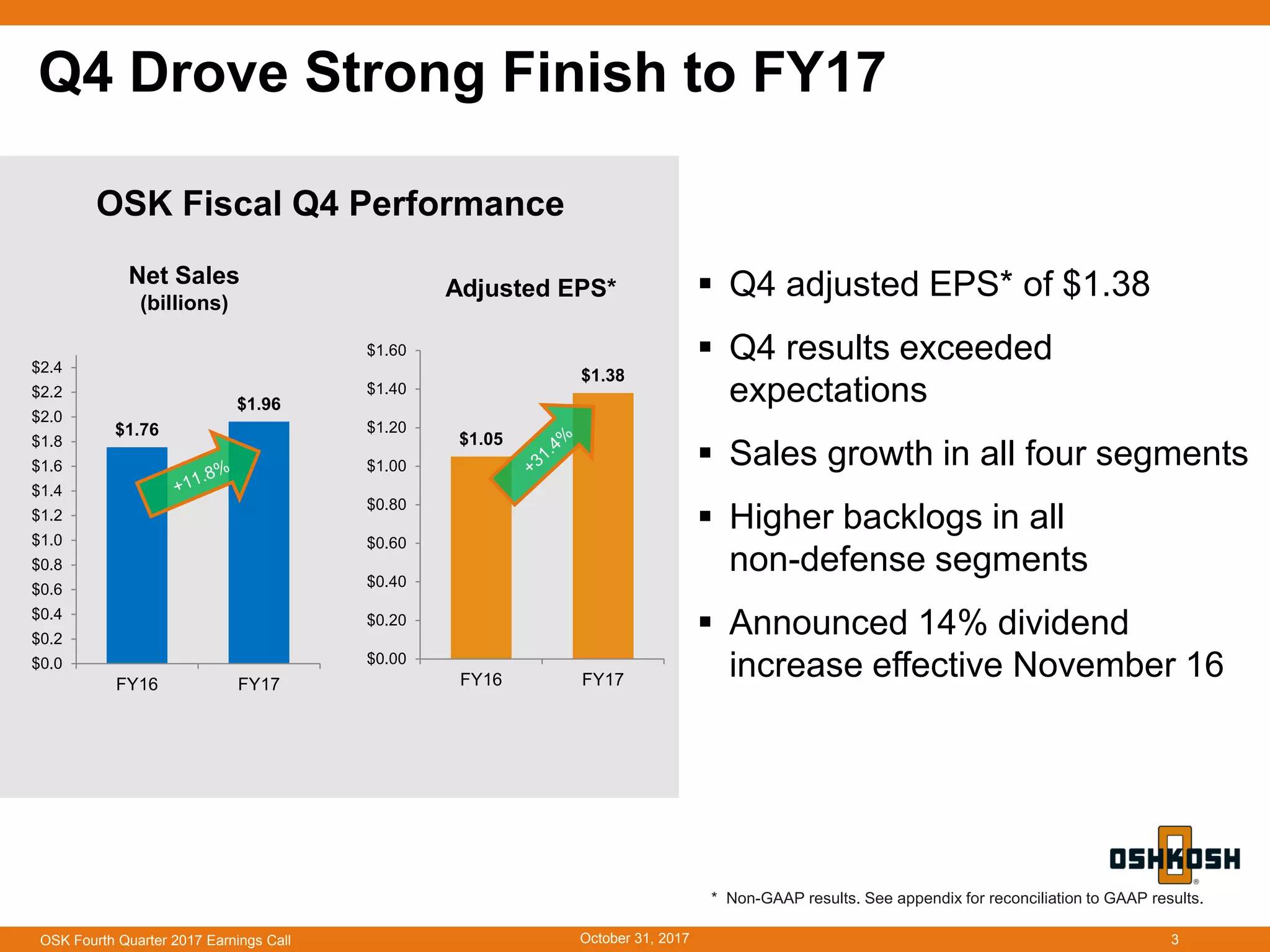

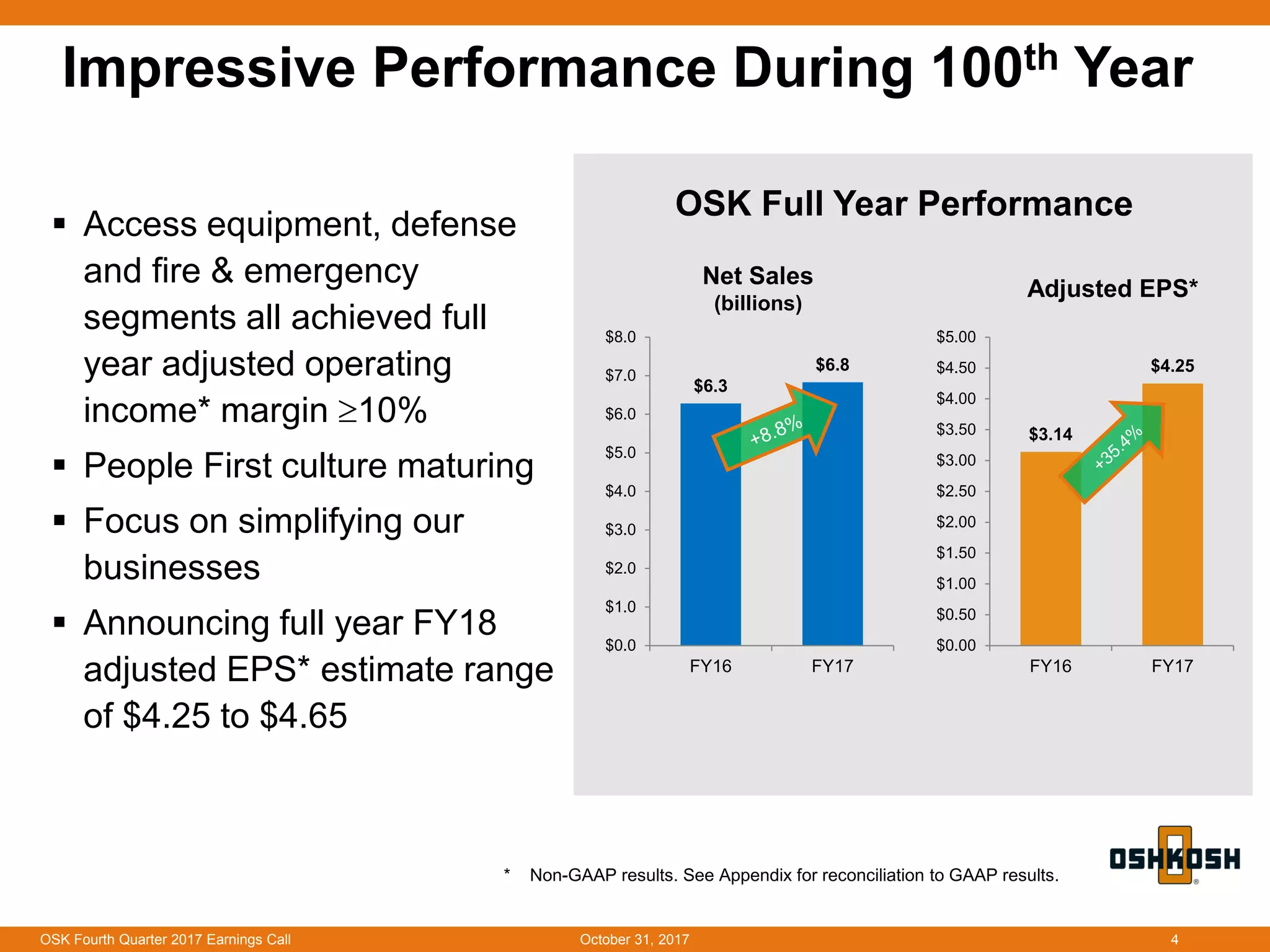

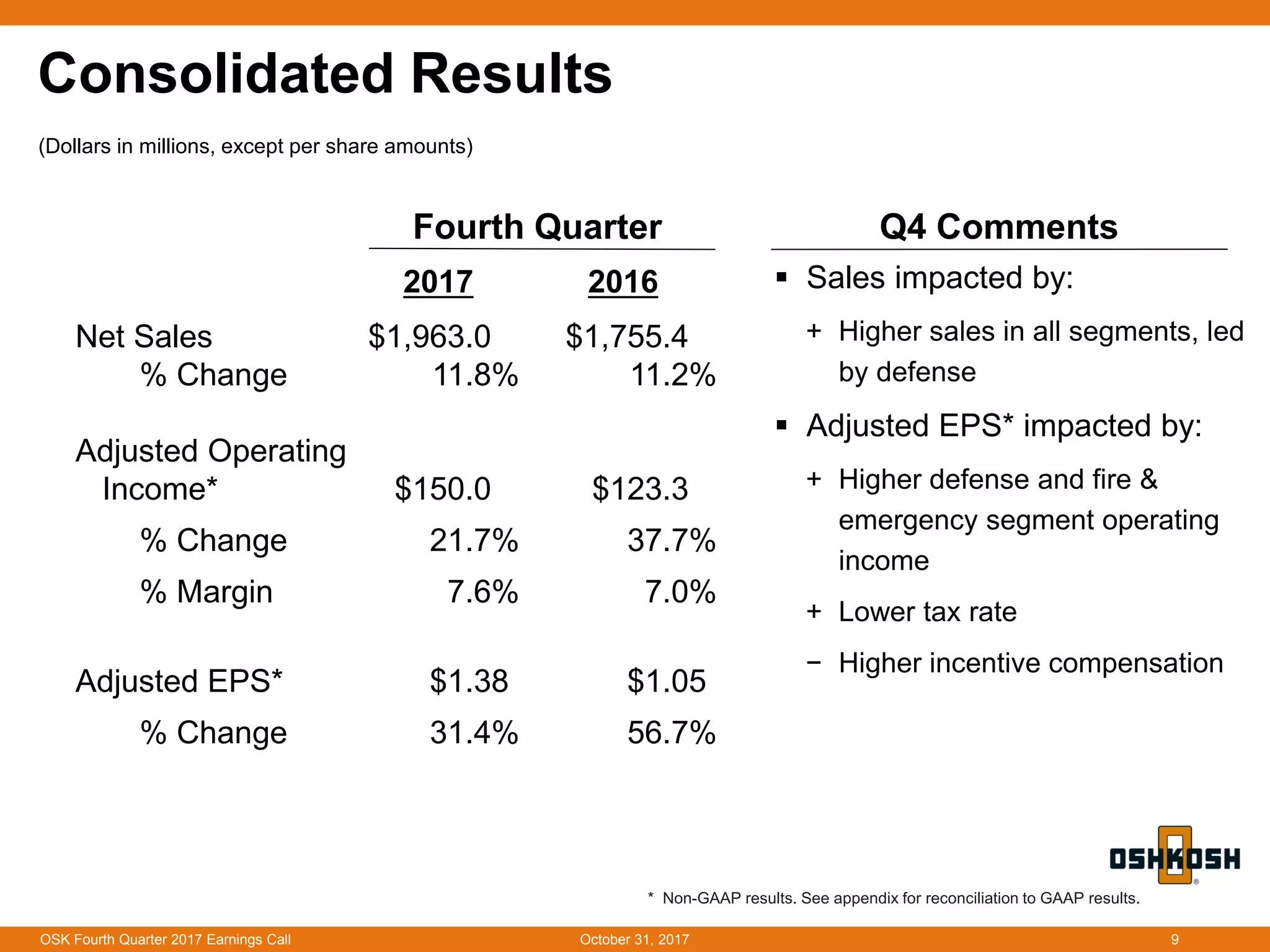

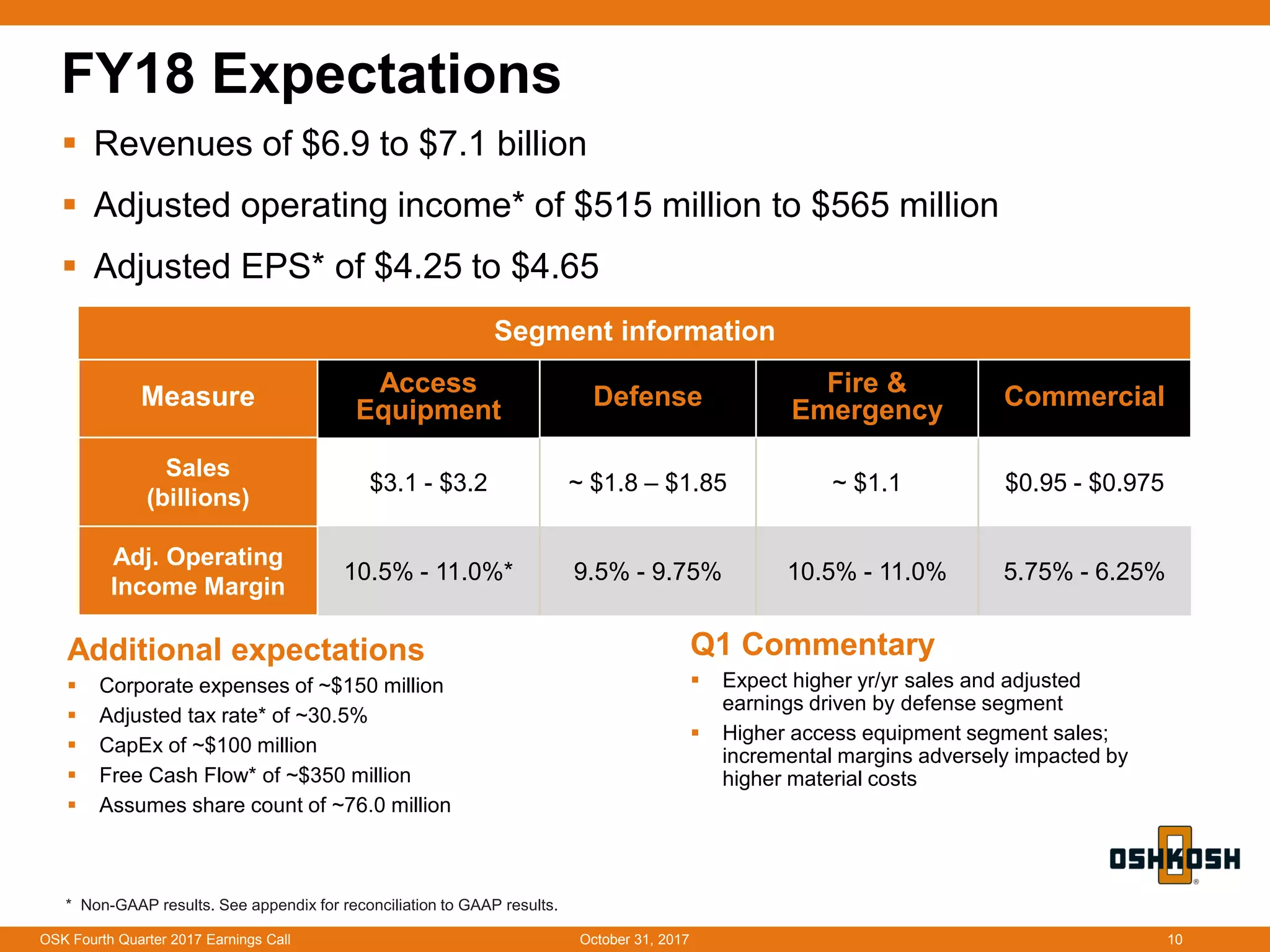

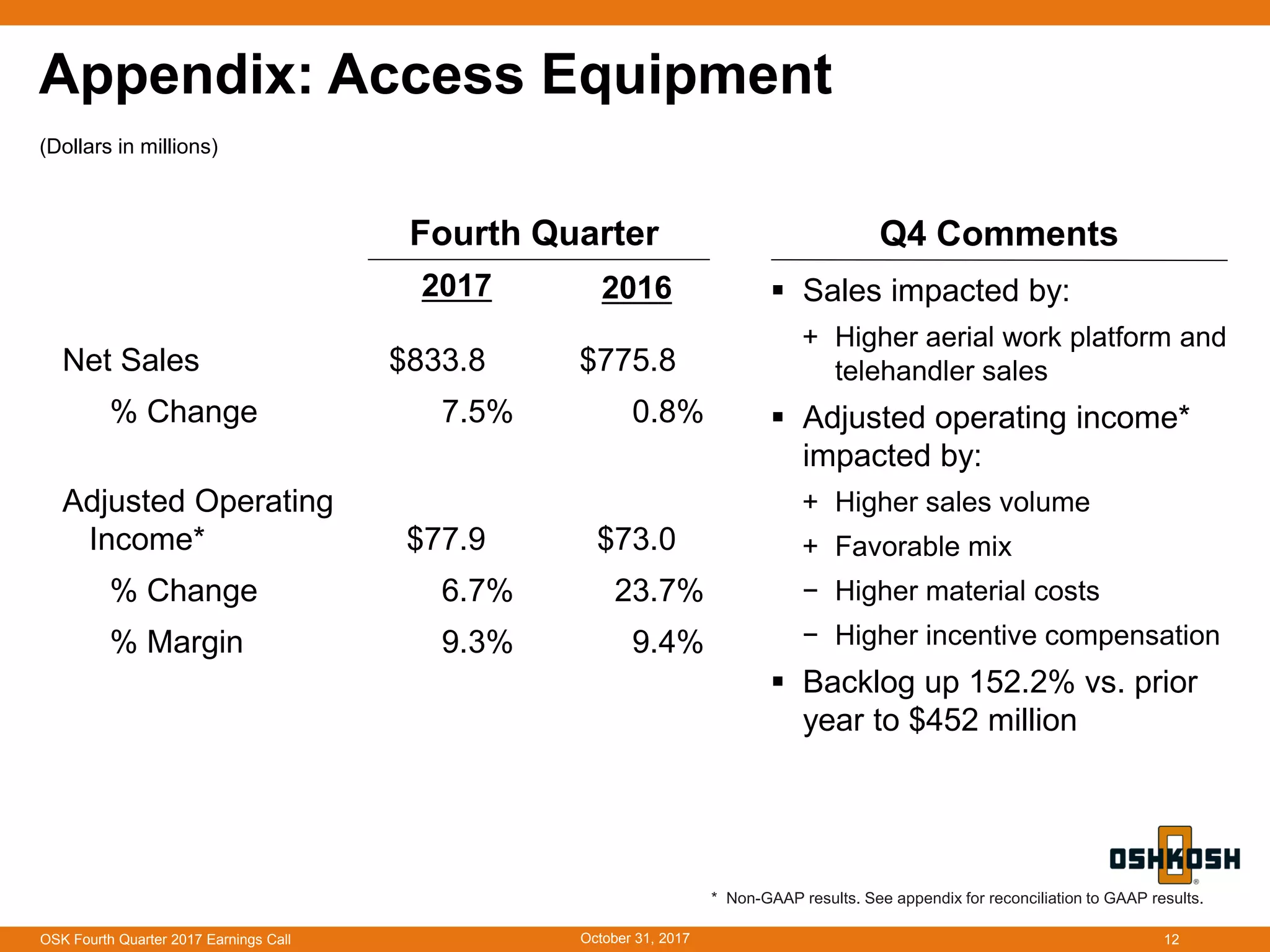

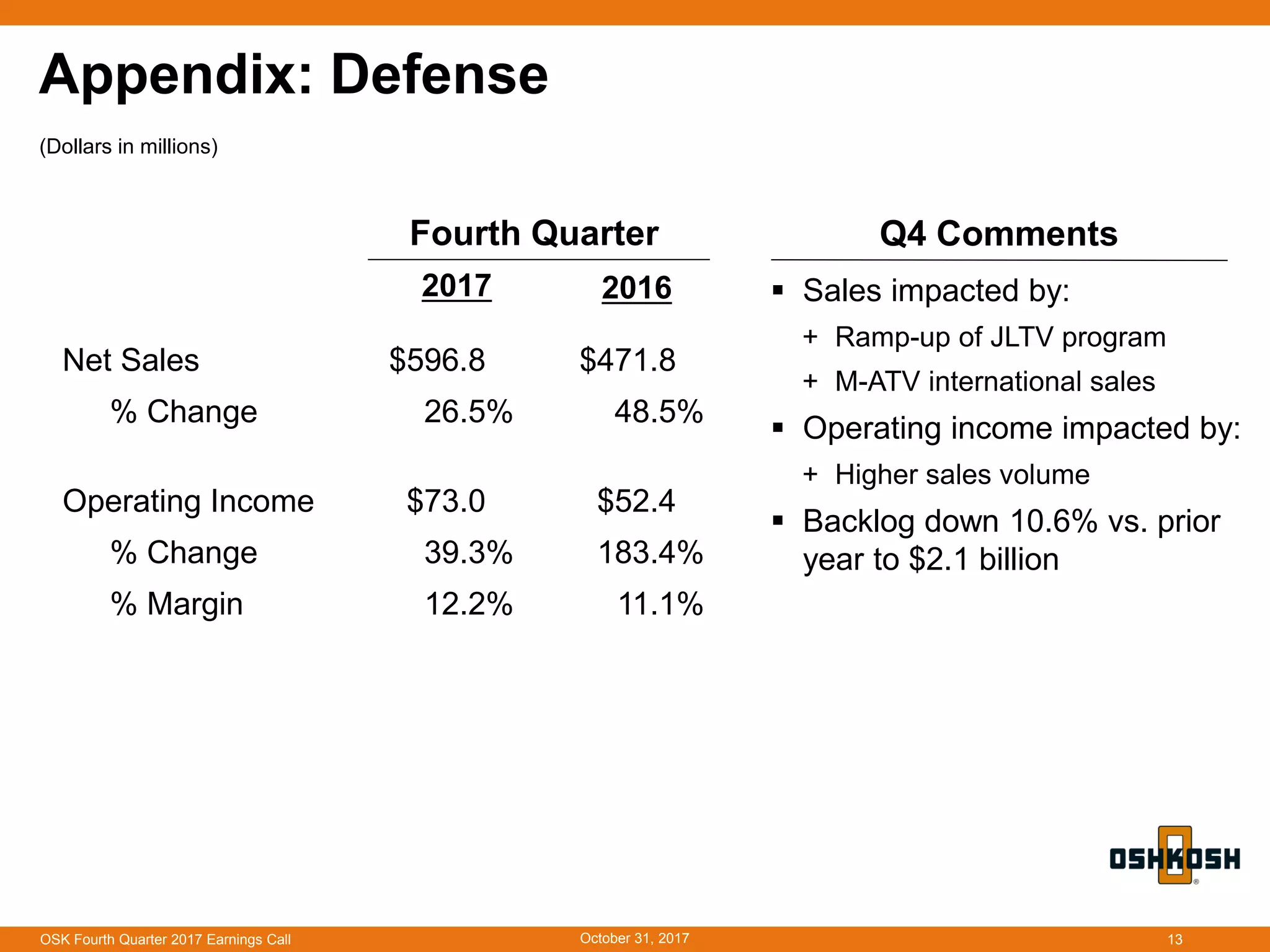

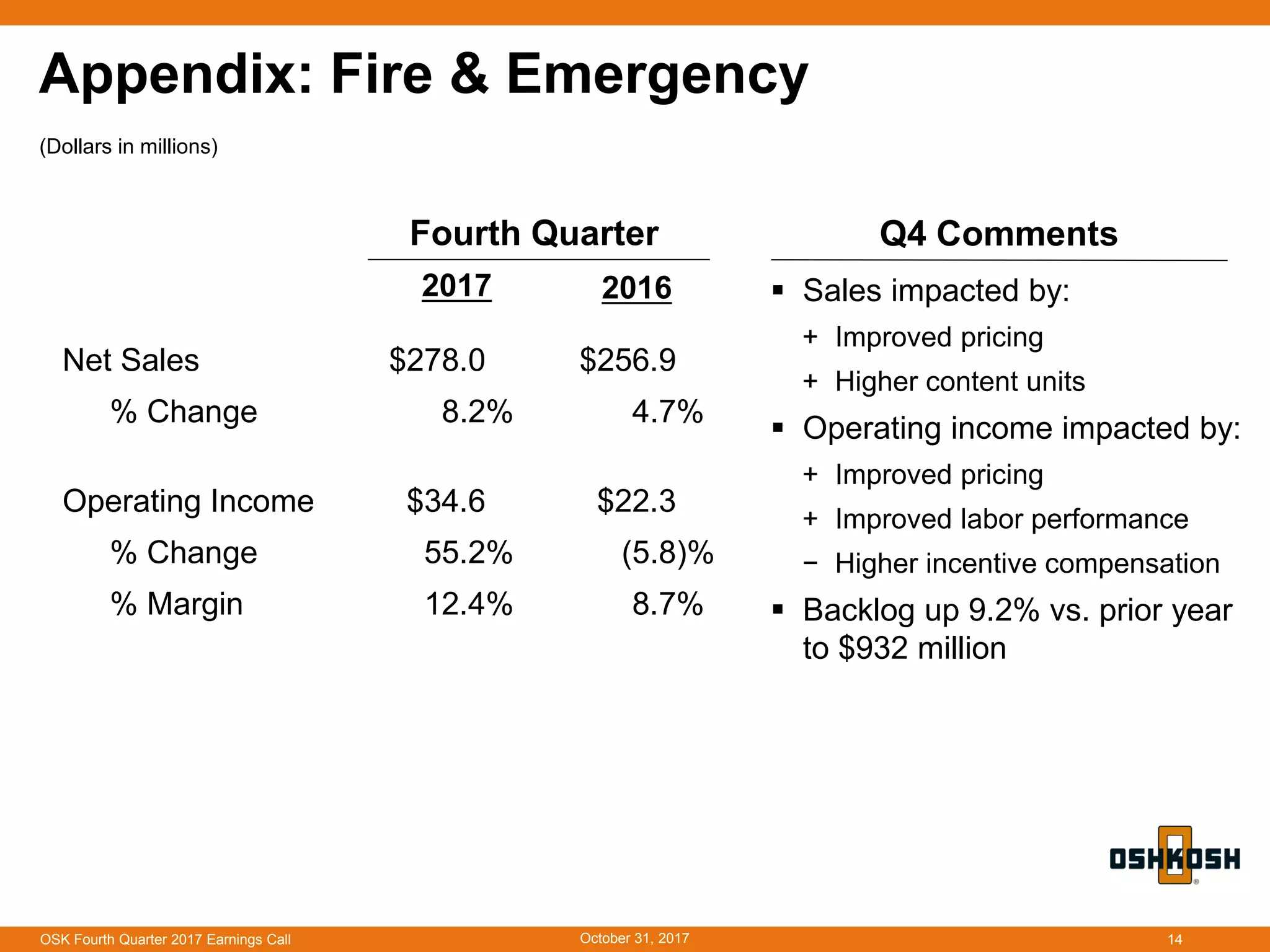

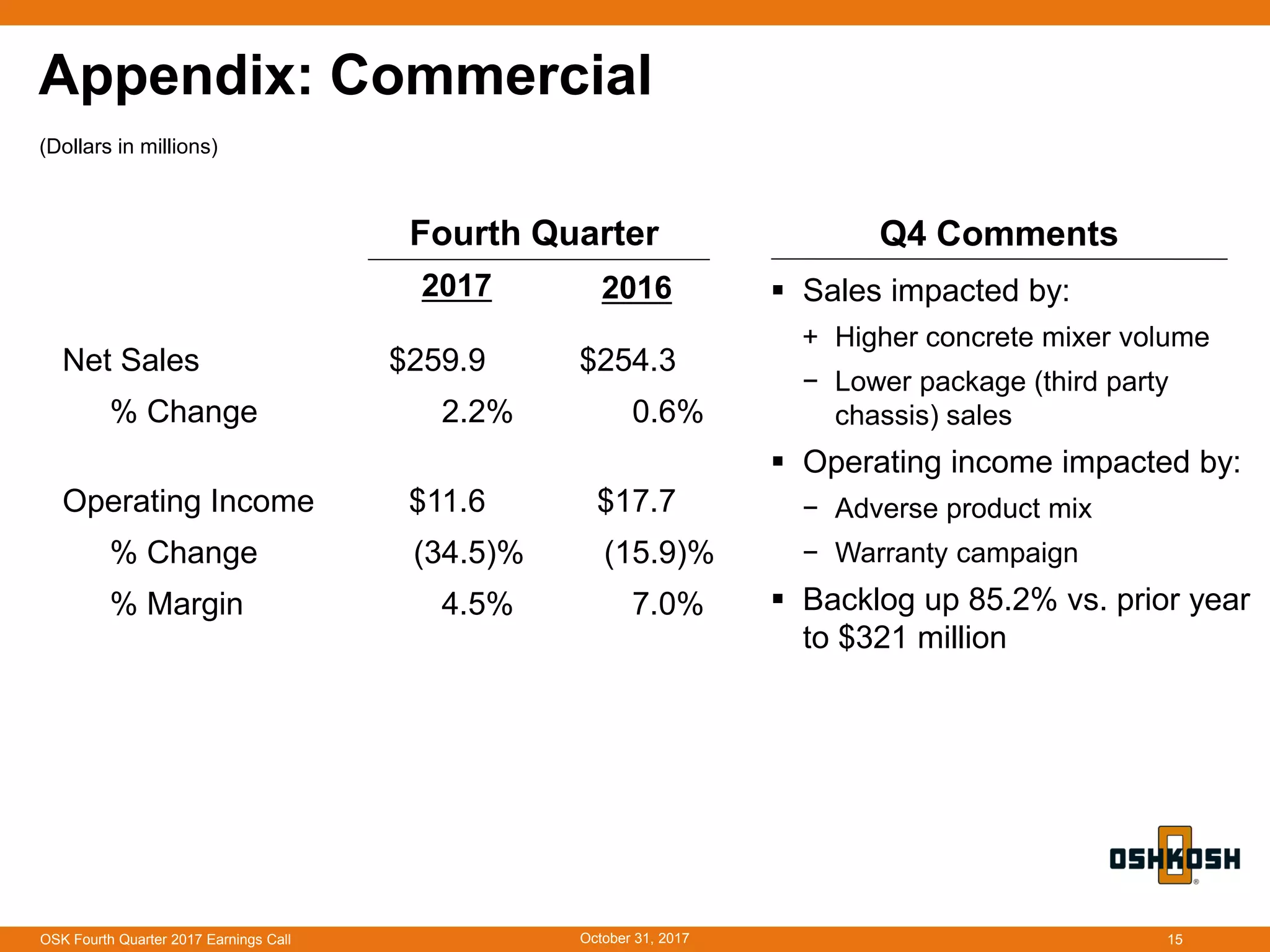

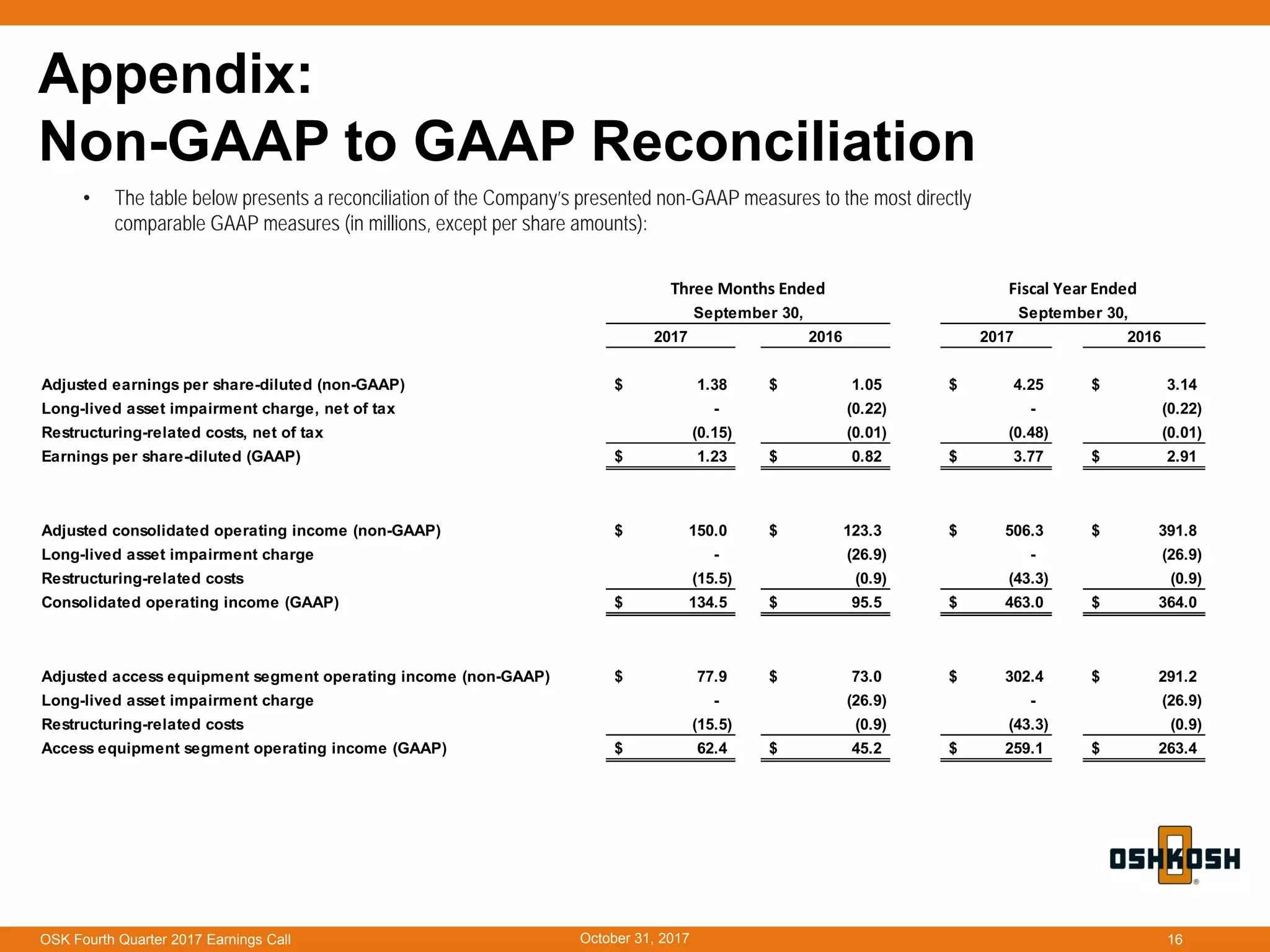

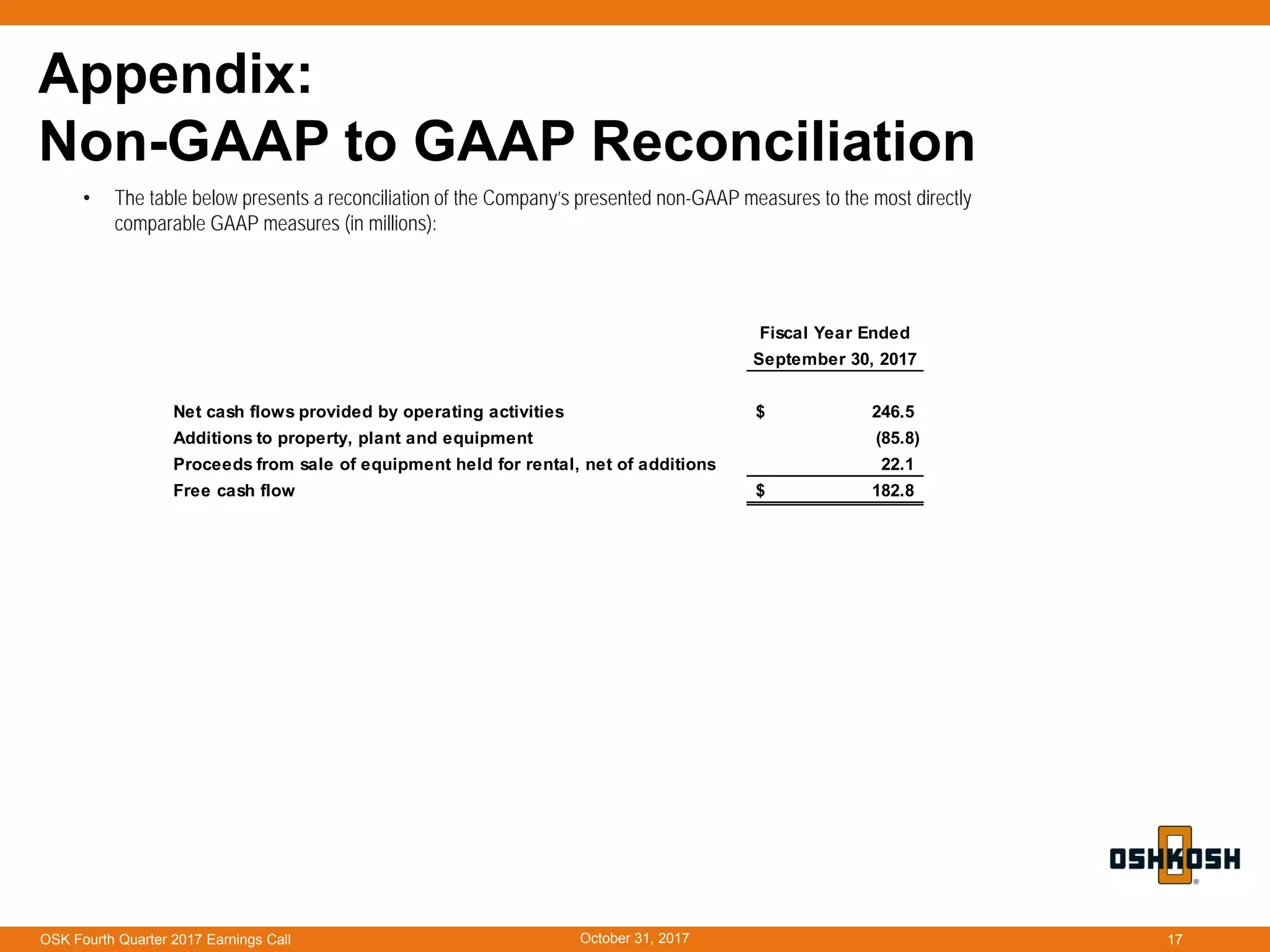

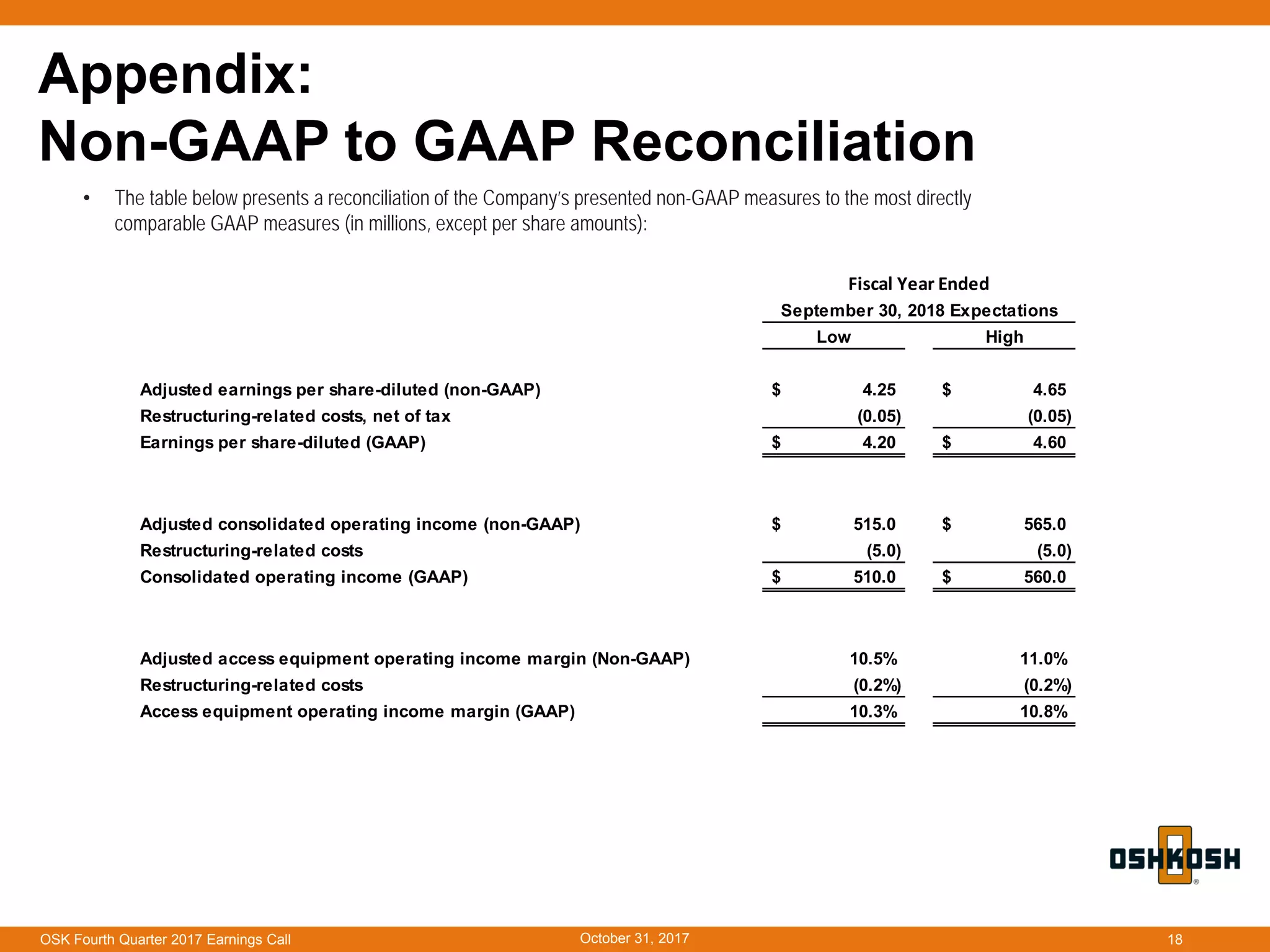

Oshkosh Corporation reported strong financial results for the fourth quarter and full fiscal year 2017. For the quarter, net sales increased 11.8% to $1.96 billion and adjusted EPS rose 31.4% to $1.38. All segments achieved sales growth for the quarter led by the defense segment. For the full fiscal year, the company expects net sales between $6.9-7.1 billion and adjusted EPS of $4.25-$4.65, driven by continued growth in the defense, fire & emergency, and access equipment segments. The company also announced a 14% increase to its quarterly dividend.