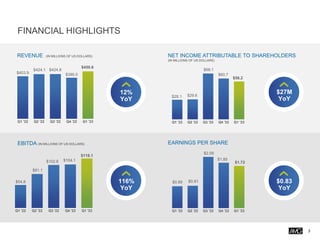

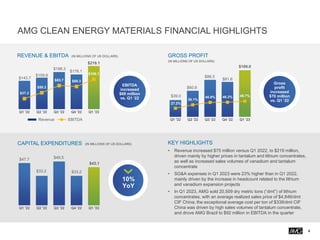

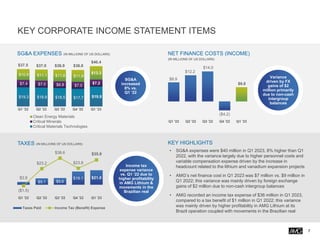

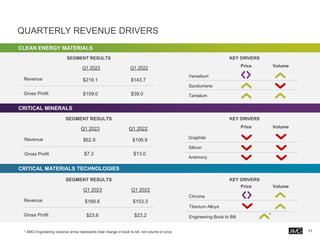

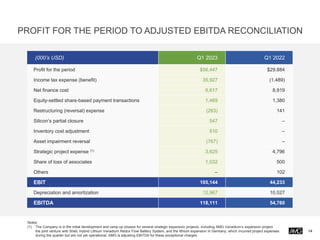

AMG Advanced Metallurgical Group N.V. reported strong financial results for the first quarter of 2023. Revenue increased 12% year-over-year to $450.6 million, driven by higher prices for lithium and tantalum concentrates as well as increased sales volumes of vanadium and tantalum. Net income attributable to shareholders was $68.1 million, up 116% year-over-year. Earnings per share increased 83% to $1.72. EBITDA grew 27% to $118.1 million. The company's clean energy materials segment performed particularly well, with revenue up 52% and EBITDA increasing 81% compared to Q1 2022.