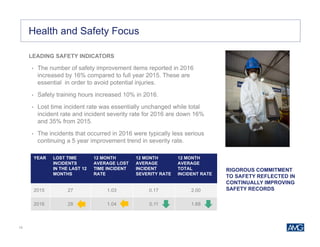

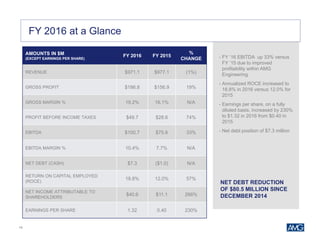

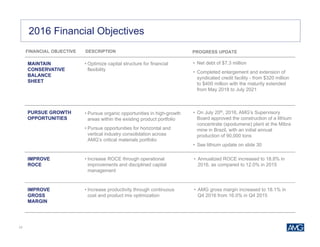

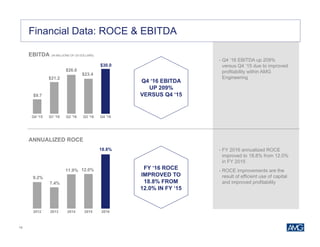

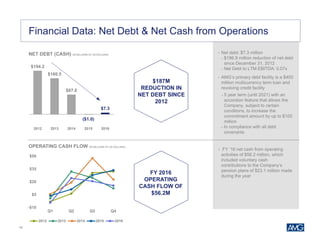

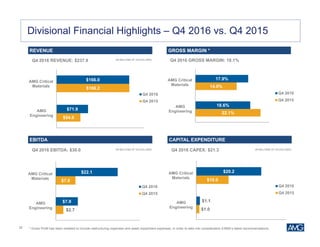

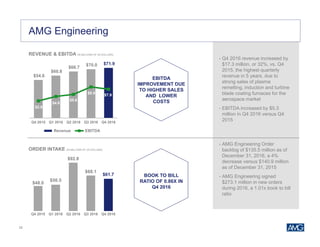

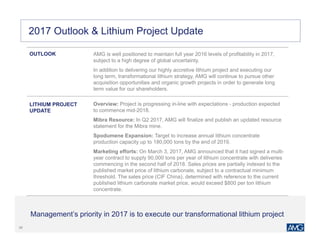

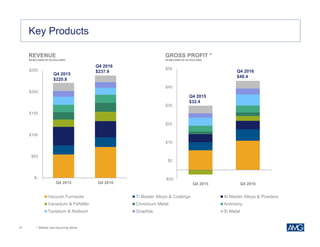

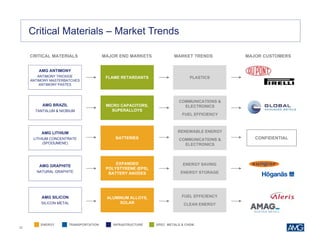

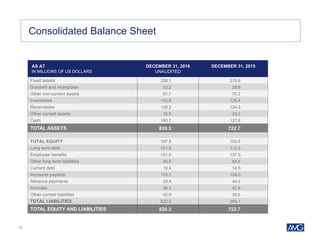

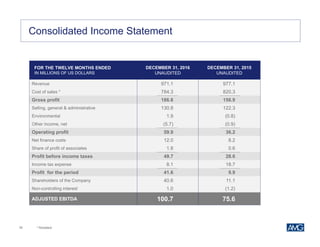

The document is an investor presentation by AMG Advanced Metallurgical Group N.V. It provides an overview of AMG's business segments which involve sourcing, processing, and supplying critical raw materials. It discusses AMG's focus on enabling technologies to reduce CO2 emissions and highlights several critical raw materials in its portfolio. The presentation also provides financial highlights such as revenue, EBITDA, gross profit and net debt figures for fiscal years 2015-2016 showing overall growth. It outlines AMG's strategic goals of improving return on capital employed, gross margins, and pursuing growth opportunities while maintaining a conservative balance sheet.

![9

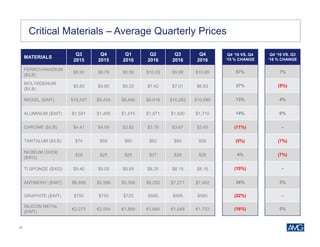

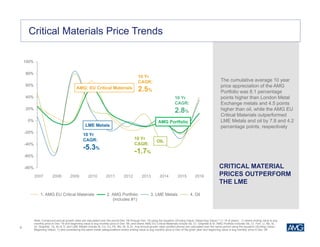

Critical Materials Prices: 10 Year Perspective

AMG has significant

potential upside within

certain critical materials

based on historical price

ranges

Note: Metal Positions are measured on a scale of 0 to 10, with 0 being the minimum price and 10 being the maximum price. They are calculated using the formula [(Dec ‘06 month avg –

min. monthly avg) / (max. monthly avg – min. monthly avg) *10] where maximum and minimum monthly averages are measured over the period 1 Dec ‘06 through 31 Dec ‘16.

1.8

0.8 0.7

1.7

2.5 2.3

0.9

3.6

5.8

0.3

2.62.6

0.2 0.2 0.2

3.8

1.2

2.2

4.7

5.8

0.0

0.8

0

2.5

5

7.5

10

Scale

Metals

Dec 2016 Position Dec 2015 Position

Cr Mo Ni FeV Ti Al C Si Ta Sb

Highest

Price in

10 years

Lowest

Price in

10 years

[unchanged]

• Metal prices are measured on a

scale of 0 to 10, with 0 and 10

representing the minimum and

maximum average quarterly

prices occurring during the past

10 years

• The positions demonstrate the

current price level of each metal

with respect to their various

historical price points over the

past 10 years

Nb](https://image.slidesharecdn.com/amginvestorpresentationmarch2017final-170309135756/85/AMG-Investor-Presentation-March-2017-9-320.jpg)