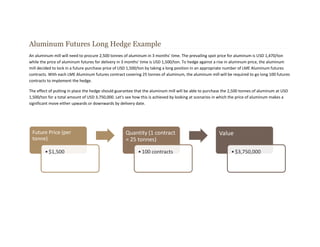

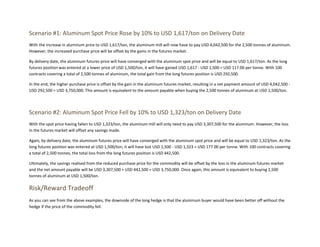

1) Businesses that need large quantities of aluminum in the future can implement a long hedge in the aluminum futures market to lock in a purchase price and protect against rising aluminum prices.

2) To implement a long hedge, a business would buy enough aluminum futures contracts to cover the quantity needed, with each contract representing 25 metric tons.

3) Hedging with futures guarantees the purchase price will be the original contract price, even if the spot price changes, as gains and losses on the futures position will offset changes in the spot market price.