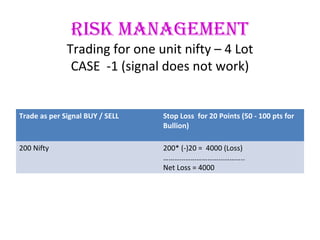

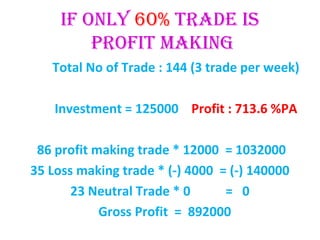

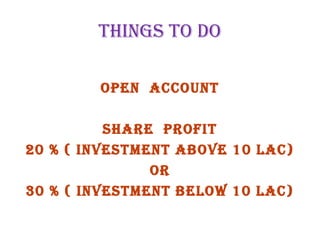

This document provides an overview and summary of MnR Capital Management's wealth management and investment advisory services. They offer services including wealth management, equity and derivatives trading, currencies, bonds, commodities, mutual funds, insurance, and real estate investments. They promote derivative trading as a means to create wealth through disciplined trading based on a complete trading system using technical and fundamental analysis. They claim annual returns ranging from 188-950% are possible depending on the percentage of profitable trades, with risk managed through position sizing and stop losses. They invite readers to open an account and share in the profits.